High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Kickstart the FX trading day on Sept 11 w/a technical look at the EURUSD, USDJPY & GBPUSD

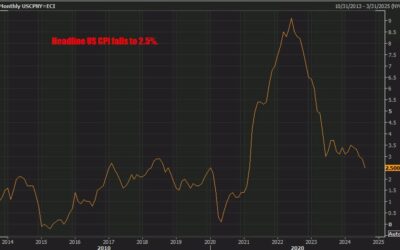

The US CPI data came in a little bit stronger-than-expected especially from the core inflation perspective. Shelter was to blame for most of the upside. Energy prices fell and are expected to fall further in the current month.US yields moved up by are coming off the...

Remembering those who died on September 11, 2001

I moved from New Jersey in August 2001 to Arizona. My work in NY at the time of the move took me to the WTC each day on my commute. My work office was 2 blocks north of the WTC complex. Part of the WTC complex fell into the buildings just south of our building. A jet...

US August CPI 2.5% YoY versus 2.6% expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US CPI to be released at 8:30 AM. Expectations are 0.2% for MoM and 2.6% YoY

For August, US Consumer Price Index (CPI) expectations are for a Headlined CPI 0.2% month-over-month (M/M) change (previously 0.2%), Annual headline CPI rate expected to ease to 2.6% year-over-year (Y/Y) from 2.9%. The core CPI, which excludes food and energy prices,...

ForexLive European FX news wrap: Yen firms as yields fall, US CPI up next

Headlines:Markets:JPY leads, USD lag on the dayEuropean equities a touch higher; S&P 500 futures down 0.1%US 10-year yields down 2.6 bps to 3.618%Gold up 0.3% to $2,522.42WTI crude up 2.6% to $67.49Bitcoin down 1.4% to $56,770The most interesting part of the...

US MBA mortgage applications w.e. 6 September +1.4% vs +1.6% prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Feeding the gold beast

The bulls have been huffing and puffing over the last three weeks but they haven't blown open the door for a stronger technical breakout yet. Gold price action has been consolidating in a bit of a range recently and the next trade is to arguably go with the break that...

Russell 2000 Technical Analysis – The market has become sensitive to soft data

Fundamental OverviewLast Friday, the Russell 2000 sold off following the weaker than expected NFP report even though the details were better than the prior month. The technical break below the key support around the 2120 level eventually increased the bearish...

GBPUSD Technical Analysis – The pair bounces on a key support

Fundamental OverviewThe bullish momentum in the USD is starting to fade as Treasury yields continue to fall. We had two possible catalysts yesterday. The first one was the much weaker than expected US NFIB Index which dropped to a 3 month low. There wasn’t an...

What inflation? That is what the bond market is continuing to say so far this week

Treasuries are keeping strongly bid so far this week and we're seeing some key levels being challenged. 10-year yields are down to their lowest since June last year, down to 3.61% currently. Meanwhile, 2-year yields are down to their lowest in almost two years as it...

EURUSD Technical Analysis – The US CPI and ECB decision in focus

Fundamental OverviewThe bullish momentum in the USD is starting to fade as Treasury yields continue to fall. We had two possible catalysts yesterday. The first one was the much weaker than expected US NFIB Index which dropped to a 3 month low. There wasn’t an...

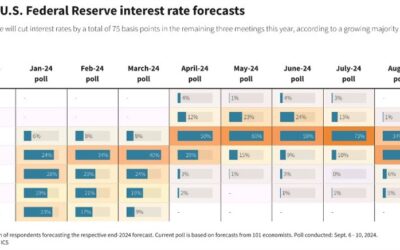

Fed to cut rates by 25 bps at each of the remaining three policy meetings this year – poll

92 of 101 economists expect a 25 bps rate cut next week65 of 95 economists expect three 25 bps rate cuts for the remainder of the year54 of 71 economists believe that the Fed cutting by 50 bps at any of the meetings as 'unlikely'On the final point, five other...

What is the distribution of forecasts for the US CPI?

Why it's important?The ranges of estimates are important in terms of market reaction because when the actual data deviates from the expectations, it creates a surprise effect. Another important input in market's reaction is the distribution of forecasts. In fact,...

USDJPY Technical Analysis – Expectations for a 50 bps cut remain alive

Fundamental OverviewThe Yen is having another good week as the USDJPY pair dropped to new lows as Treasury yields continue to fall. We had two possible catalysts yesterday. The first one was the much weaker than expected US NFIB Index which dropped to a 3 month low....

European equities nudge up at the open to start the day with slight gains

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

UK July monthly GDP 0.0% vs +0.2% m/m expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BOJ’s Nakagawa: Hard to comment on timing of next rate hike

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Fed rate cut pricing continues to bounce around

The pricing there is reflected in the fall in bond yields this week, with 10-year Treasury yields now hitting its lowest since June last year. The odds of a 50 bps rate cut next week now stands at ~35%, up from around ~25% early Monday. It's still down from the near...

Yields fall reverberates to broader markets to start the day

We're already starting to see some notable market moves on the day ahead of European trading. I would argue the main culprit to be the bond market, after the move there yesterday. 10-year Treasury yields fell below the threshold of what might've resembled a short-term...