Late last year, Canada was hit with a bombshell: There were 1 million more people in the country than believed. For a country of 40 million people, that's an incredible mis-count. It helped to explain why Canadian jobs data had been so strong in 2023, despite a...

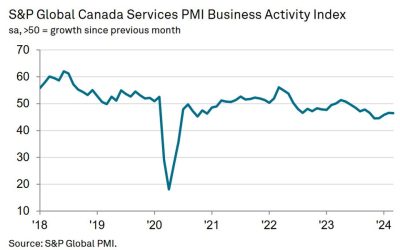

Canadian March S&P Global services PMI 46.4 vs 46.6 prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDCHF hits new highs, bullish momentum strengthens

The USDCHF has pushed to a new 2024 high price today at 0.90943. In the process, the price is moving away from its 38.2% retracement of the longer-term move down from the 2022 high. That retracement level comes in at 0.90252. Recall at the end of last week the price...

ECB’s De Cos: Eurozone inflation is positive news

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Kickstart your FX trading for April 3 w/ a technical look at the EURUSD, USDJPY and GBPUSD

The better-than-expected ADP employment report as pushed the US dollar higher. That rise is being led by the USDJPY which is pushing against the 2022, 2023, and 2024 high prices between 151.91 and 151.967. The high price today has reached 151.905 so far. Breaking...

Fed’s Bostic: Economy is maintaining strong momentum that it’s had. Sees Q4 rate cut

Everyone has been expecting the economy to slow at a faster pace but I'm not hearing that it's picking upIf there's any weakening, it's at a very incremental levelOver the longer run, the economy needs to slow to get to longer-run inflation targetSays he is still...

USD/JPY approaches the 152.00 barrier after strong US jobs data

Keep an eye on USD/JPY.It's up 32 pips to 151.88. That's just a sneeze away from last week's high of 151.97, the November high of 151.91 and the October 2022 high of 151.94.The 152.00 is clearly a line in the sand that Japanese authorities don't want to cross and a...

US markets reacting to the stronger ADP report

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

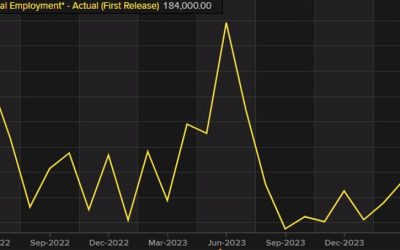

US ADP national employment 184k versus expectations of 148k

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US March ADP employment +184K vs +148K expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Heads up for ISM services PMI coming up at 14:00 GMT

At 14:00 we are expecting the march release of the ISM services PMI.Markets will be paying additional attention to this one following the upside surprise in the manufacturing data on Monday.With the last print, majority of measures stayed in expansion, while...

European Inflation Declines. Will the ECB Cut Rates First?

The Euro has increased in value over the past 24 hours, but inflation is declining and indicates a weaker Euro. Economists now believe the European Central Bank is likely to take earlier action and adjust the Main Refinancing Rate. German monthly inflation increases...

US mortgage applications prints at -0.6% versus expected of -0.7%

US mortgage applications data:MBA mortgage applications: -0.6% (prior -0.7%)Mortgage market index: 195.6 (prior 196.8)MBA purchase index: 145.6 (prior 145.7)MBA refinancing index: 4536.5 (prior 460.9)MBA 30-year mortgage rate: 6.91% (prior 6.93%)Notes on mortgage...

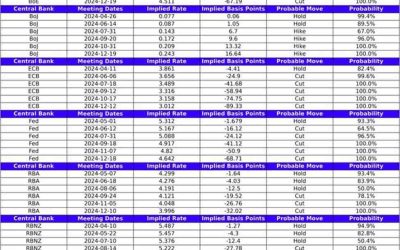

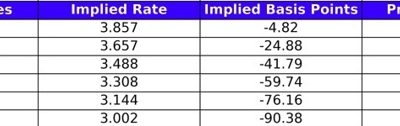

Quick snapshot of what is priced for major central banks

Below is a handy table that shows what type of interest rate changes are expected for the major central banks over their next few policy decisions.Markets have certainly come a long way in pricing out some of the aggressive cuts we saw at the start of the year.Central...

BofA increase their 2024 wti forecast to $81

BofA has raised their 2024 forecasts for both WTI ($81) and Brent ($86).The bank noted that improvement in demand has been enough to create a deficit in the second and third quarter of 2024.They estimate that the deficit is roughly 450k barrels per day.This is the...

Eurozone flash HICP prints at 2.4% vs expected of 2.6%

Today's Eurozone flash HICP data surprises lower across the board for the YY numbers but a beat for the MM:HICP Flash YY: 2.4% (expected 2.6%)HICP Flash Excluding F&E YY: 3.1% (expected 3.2%)HICP Flash Excluding F,E,A & T YY: 2.9% (expected 3.0%)HICP Flash...

Implied volatility levels for today

Below is a list of the implied volatility daily ranges for various assets.These levels are based on 1-month implied volatility and can be used as dynamic and market-based levels of support and resistance.Implied volatility suggests that if prices were normally...

What is driving gold’s rise?

Gold is often seen as a hedge against inflation, but in 2022, despite favorable conditions, the precious metal performed poorly, to say the least. Although the situation improved somewhat in 2023, it still fell short of the S&P 500 index. As the U.S. moves closer...

A risk to be aware of for dollar bulls with this week’s economic data

The dollar saw a solid upside move following Monday's beat in the ISM manufacturing PMI.As a result many are expecting a similar beat in the ISM services or the NFP to see a similar reaction.Even though that might be true in the very short-term, there is a risk dollar...

Credit Agricole sees EURUSD at 1.05 by 4Q24

Credit Agricole expects EURUSD to hit 1.05 by the end of the year.They based their call on a couple of different drivers:Even though they expect both banks to cut rates in 2024, they think the ECB will ease much more aggressive than the FOMCIf the Fed opts to use QT...