It's a new week, new month, and new quarter to kick things off today. But the Easter holiday is overshadowing markets and keeping things rather quiet, for now at least. North American traders will be greeted with a more muted mood as such but we are seeing gold stay...

GameStop’s Q4 Results. Traders React to Weak Earnings

GameStop Corp. is facing a whirlwind of challenges. The beloved stock among retail traders took a hit early Wednesday morning, now down over 20% for the year and nearly 50% in the last twelve months. This downturn follows the company's Q4 earnings report and more job...

AUD/USD stays sluggish near the 0.6500 mark for now

AUD/USD daily chartThe pair is now settling down a bit after some rather back and forth action in March trading. It looked like buyers were poised for a strong breakout, only to get their wings clipped following a reversal to the initial reaction to the US jobs report...

1.36 hurdle still a stretch too far for USD/CAD currently

USD/CAD daily chartThe pair has had some decent swings in price action in the last two months. However, they seem largely contained between the lower threshold of 1.3450 and now the ceiling at 1.3600. The latter in particular looks to be a strong resistance point as...

USD/CHF holds on just above 0.9000 as buyers stay poised for now

USD/CHF daily chartThe recent upside momentum has stalled a little but the pair still clocked in three straight weekly gains coming into trading this week. The good news for buyers is that price is consolidating just above the 0.9000 threshold now. It's not entirely...

GBP/USD settles into ping pong range after recent push and pull

GBP/USD daily chartAs will be the case with most dollar pairs this week, the focus will be on the anticipation ahead of the US jobs report on Friday. As such, the dollar itself might not have much to react to. And that could see GBP/USD stay caught inside a ping pong...

EUR/USD leans against next key technical hurdle in thin trading

It is a bit of a bore in trading today as it is an extended weekend in Europe. So, let's try and take stock of the technicals with there being little else to really work with. First one's up is EUR/USD and the daily chart comes into focus.EUR/USD daily chartThe pair...

Strong Chinese Economic Data Prompts Demand for US Stocks!

The Chinese economy and sentiment improve for the first time since September 2023. Chinese Manufacturing PMI rose to 50.8, beating expectations. Higher Chinese data improves the global risk appetite towards stocks. Stocks trade higher, what is more, the SNP500, and...

FX stays more subdued so far on the day

As a reminder, major markets in Europe are closed today amid Easter Monday. That is to keep liquidity conditions thin, with little appetite among traders to chase any big moves. So far, the major currencies space is rather tame with very, very light changes...

Q2 Top Trade – Sell 10 Year UK Gilt Yields

The Bank of England (BoE) turned dovish in the past few days and this means that a UK interest rate cutting cycle is on the way, and perhaps sooner than financial markets originally anticipated.BoE Governor Andrew Bailey recently communicated that UK interest rate...

The Easter bunny is still out to play in trading today

Major currencies are caught in a lull, not much changed to start the new week. It owes in part to a lack of interest as the Easter break is still in effect for some major markets globally. Australia and New Zealand are out today and it is also a holiday for almost the...

ForexLive Asia-Pacific FX news wrap: Gold surges to over US$2260

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Gold above USD 2250 after a strong start to the week

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Ex BOJ official says next rate hike in Japan will be in October at the earliest

Bloomberg (gated) carries an assessment from Tsutomu Watanabe, a former BOJ official (1982-1999), now an economics professor at the University of Tokyo. He is described in the piece as a respected inflation expert. In brief he says the Bank of Japan will follow a...

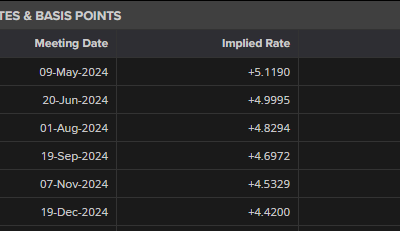

AUD traders heads up – two important events coming from the RBA on Tuesday

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China Caixin Manufacturing PMI for March 51.1 (expected 51.0, prior 50.9)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC sets USD/ CNY reference rate for today at 7.0938 (vs. estimate at 7.2191)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

What to watch in Japanese comments for USD/JPY selling intervention getting closer

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan Final Manufacturing PMI for March 2024 comes in at 48.2 (flash 48.2, prior 47.2)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.2191 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...