High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

More Waller headlines: “Fed’s Waller Says No Rush to Cut Interest Rates”

Federal Reserve Board Governor Christopher Waller spoke earlier. Headlines are focused on his reasons for delaying cuts.Reuters, for example:Fed's Waller still sees 'no rush' to cut rates amid sticky inflation dataBloomberg:Fed's Waller Says No Rush to Cut Interest...

PBOC sets USD/ CNY reference rate for today at 7.0948 (vs. estimate at 7.2259)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China hopes the Netherlands would ensure “normal” trade of lithography machines

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australian Retail Sales for February +0.3% m/m (expected 0.4%, prior +.1%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.2259 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

New Zealand March business confidence 22.9 (prior 34.7)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[4월부터~이 통장 바꾸면..153만원 더 이득!! 은행가지 말고, 여기서 하세요!!]#3.1경제독립tv

https://www.youtube.com/watch?v=-HSu1lfYxXo [4월부터~이 통장 바꾸면..153만원 더 이득!! 은행가지 말고, 여기서 하세요!!]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

BOJ ‘Summary’ of the historic March 2024 meeting

The full text is here: Summary of Opinions at the Monetary Policy Meeting on March 18 and 19, 2024This meeting saw the BoJ raise rates for the rest time in 17 years, and from negative for the first time in 8 years. One member said YCC, negative rate, and other massive...

Check out this headline: “Why the Fed Is Delaying Interest-Rate Cuts: Waller”

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Still more from Fed’s Waller: If unemployment goes up no reason to panic

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

More Fed’s Waller: The economy has supported the cautious approach by the Federal Reserve

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Waller’s remarks have pumped up the US dollar

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Forexlive Americas FX news wrap: Stocks stay hot, FX stays cool

Markets:S&P 500 up 45 points, or 0.9%Gold up $15 to $2194US 10-year yields down 4.6 bps to 4.19%WTI crude oil up 10-cents to $81.72JPY leads, EUR lagsFX closing moves were small today as the market sorts through quarter-end and waits for some meaningful economic...

Fed’s Waller says may need to hold current rate for longer than expected, no rush to cut

Federal Reserve Board Governor Christopher Waller 'Still no rush' to cutting rates in current economyFed may need to maintain current rate target for longer than expectedNeeds to see more inflation progress before supporting rate cutNeeds at least a couple of months...

New Zealand data – March consumer confidence plunges to 86.4 (prior 94.5)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

SNB Vice President Schlegel says the Bank has no target for the franc (CHF) exchange rate

Schlegel is favoured to take the top spot at the bank when current Chair Jordan leaves in September after a decade in the job.He spoke at an event in in St. Gallen, Switzerland:Swiss National Bank has no target for the franc exchange rate“The National Bank monitors...

US Treas Sec Yellen says not ready to discuss potential US retaliation over China

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

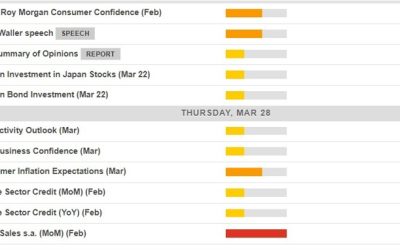

Economic calendar in Asia 28 March 2024 – where’s Waldo?

New Zealand data will kick off the calendar, followed by a speech from Waller. Adam previewed this here:While on central banks the Bank of Japan 'Summary' of its most recent meeting is due today. More on these under the screenshot. The most recent meeting was an...

Trade ideas thread – Thursday, 28 March, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[4월부터~이 통장 바꾸면..153만원 더 이득!! 은행가지 말고, 여기서 하세요!!]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/03/4ec9b94ebb680ed84b0ec9db4-ed86b5ec9ea5-ebb094eabeb8eba9b4-153eba78cec9b90-eb8d94-ec9db4eb939d-ec9d80ed9689eab080eca780-eba790eab3a0-400x250.jpg)