High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

NY Fed researchers say says manufacturing growth In China could boost US Inflation

A New York Federal Reserve research paper considers the impact of a scenario in which a credit-fueled boom in manufacturing activity produces higher-than-expected economic growth in China. "A key finding is that such a boom would put meaningful upward pressure on U.S....

ICYMI: Fed’s Bostic spoke again on Monday, repeated his forecast for just 1 cut this year

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Forexlive Americas FX news wrap: US dollar drifts lower, bitcoin jumps

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

It’s a quiet economic calendar in Asia onTuesday, 26 March 2024

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trade ideas thread – Tuesday, 26 March, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US seeks $2 billion in penalties against Ripple Labs

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

WTI crude breaks a three-day losing streak

Oil struggled late last week but is back on the upswing today, rising $1.49.A report confirmed Russian planned production curbs and that's helping but I think this is more of a technical move and a bounce from the old range top.WTI crude oil dailyHere's a chart from...

New Zealand dollar struggles to get off the floor

NZDUSD daily chartThe US dollar is retracing on most fronts today but the New Zealand dollar is an exception. NZD/USD remains within striking distance of a four-month low and below recent support.Two days of heavy selling on Thursday and Friday broke through the 2024...

Putin says Moscow attack committed by radical Islamists

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Credit Agricole: Finger on the JPY intervention trigger

USDJPY dailyCredit Agricole highlights Japan's readiness for currency intervention as the JPY faces downward pressure, quoting Masato Kanda, Japan’s Vice Minister of Finance for International Affairs. Kanda's recent statements signal a strong inclination towards...

US sells 2-year notes at 4.595% vs 4.590% WI

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US set to sell 2-year notes

I invariably do a double-take when auction sizes come up. Today it's $66 billion in two-year notes in what I initially thought was a typo.Bill Gross warned last week about too much supply, though he did advocate for buying 2s (vs 10s).This is the first coupon auction...

European equity close: Modest gains to kick off a holiday-shortened week

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BOE’s Mann: The last time I spoke I said my vote was finely balanced

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trump bond in New York case reduced to $175 million from $454 million

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Fed’s Cook Q&A: We’ll only know if neutral rate is higher after-the-fact

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Russia tells oil companies to cut output to meet OPEC+ target

Crude OilRussia isn't bluffing.Reuters reports that Russia's government has ordered companies to reduce oil output in the second quarter to ensure they meet a production target of 9 million barrels per day by the end of June. That would match OPEC+ pledges.The report...

Gold Price Steadies After Sharp Sell-Off, New All Time High Remains Possible

Gold Price and AnalysisGold’s backdrop remains positive and may lead to further gains.Retail trader positioning is 50/50. Recommended by Nick Cawley How to Trade Gold Get My Guide Last week’s rally saw gold post a fresh record high before a sharp sell-off left the...

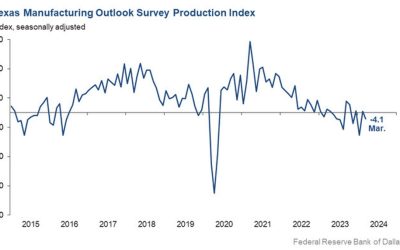

Dallas Fed manufacturing index -14.4 vs -11.3 prior

Prior was -11.3Output index -4.1 vs +1.0 priorComments in the report:Food manufacturingWill the consumer continue to spend enough to promote growth? This is the question I cannot answer confidently. As a food manufacturer, I need consumers to maintain their...