High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

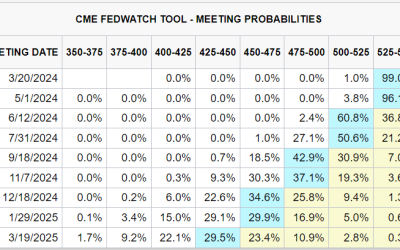

FOMC preview – a 25% to 30% chance of the Fed signaling only two rate cuts in 2024

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BOJ Policy Doesn’t Bring Positive Impact to Yen

Although the BOJ ended negative interest rates, this did not indicate a hawkish stance, but rather a dovish rate hike. USDJPY on Tuesday [19th Mar] was up +1.17%. The yen fell to a 4-month low against the dollar based on dovish comments from BOJ Governor Ueda, who...

China sets 1 and 5 year LPR rates unchanged, as expected

1-year Loan Prime Rate 3.45%expected and prior of 3.45%5-year Loan Prime Rate 3.95%expected and prior 3.95%the 5-year was cut in February: PBoC’s largest 5 year LPR rate cut ever. The 5-year is a benchmark for mortgage rates in China and a big part of the reasoning...

PBOC sets USD/ CNY mid-point today at 7.0968 (vs. estimate at .71967)

The People's Bank of China set the onshore yuan (CNY) reference rate for the trading session ahead.USD/CNY is the onshore yuan. Its permitted to trade plus or minus 2% from this daily reference rate.CNH is the offshore yuan. USD /CNH has no restrictions on its trading...

Morgan Stanley Wealth Management cite BOJ tightening pivot as a risk to US equites

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[3월, 전국민 5만원!! 최대 50% 지원.. 이렇게 받으세요!! ]#3.1경제독립tv

https://www.youtube.com/watch?v=rEmt5jx2SZA [3월, 전국민 5만원!! 최대 50% 지원.. 이렇게 받으세요!! ]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

Estimates are that drone strikes have taken out 900,000 bpd Russian oil refining capacity

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.1967 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

USD/JPY above 151.00

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Federal Open Market Committee (FOMC) preview: the clear risk is it defers cuts

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

FOMC preview – we’ll get hints on 3 or 2 cuts ahead this year

In Deutsche Bank's preview of today Federal Open Market Committee (FOMC) meeting analysts at the bank say they are expecting "only minor revisions to the meeting statement that saw an overhaul last meeting."With regards to the SEP, the growth and unemployment...

China and Australia foreign ministers met – China says the two economies are complementary

Chinese Foreign Minister Wang Yi met with Australia's Foreign Affairs Minister Penny Wong. Comments from the Chinese side: The economies of China and Australia are highly complementary and have great potentialStressed that since China-Australia relations are on the...

Fed Seen Holding Rates Steady; Policy Outlook to Drive Markets, US Dollar

Most Read: Japanese Yen Outlook & Market Sentiment: USD/JPY, EUR/JPY, GBP/JPYThe Federal Reserve will release its March monetary policy announcement on Wednesday. Consensus estimates overwhelmingly suggest that the institution led by Jerome Powell will hold its...

Goldman Sachs on two reasons the broader US equity market will catch up, not catch down

A Goldman Sachs analyst on US equities - not looking for a pullback despite the high market concentration. Goldman Sachs expects a resilient economy and softening inflation will continue to be supportive of stocks. “As our US strategists have shown, periods of high...

BOJ policy pivot over 4 now: “We expect no more policy tightening in the next few months”

Comments via analysts at Julius Baer:The end of the negative interest rate policy, together with the end of the yield curve control policy and the end of exchange-traded fund purchases, looks like hawkish monetary policy action. At the same time, the outlook for...

Reminder ICYMI – Japanese markets are closed for a holiday today,Wednesday, 20 March 2024

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

New Zealand Q4 current account deficit rises slightly larger than expected

Not impacting NZD/USD upon release.The current account represents the most comprehensive gauge of a nation's international financial interactions. It encapsulates not just the exchange of goods and services, but also earnings from foreign investments and payments made...

Warnings of BOJ yen intervention as USD/JPY rises higher

JPY weakened after the (most-telegraphed ever?) Bank of Japan tightening on Tuesday:I've seen notes now warning that the Bank of Japan may have to intervene. UBS, for example, says that now the tightening is out of the way, and there are no further moves expected on...

Goldman Sachs like oil prices higher on both supply and demand factors

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[3월, 전국민 5만원!! 최대 50% 지원.. 이렇게 받으세요!! ]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/03/3ec9b94-eca084eab5adebafbc-5eba78cec9b90-ecb59ceb8c80-50-eca780ec9b90-ec9db4eba087eab28c-ebb09bec9cbcec84b8ec9a94-3-1eab2bdeca09c-400x250.jpg)