High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECBs de Cos: surely expected latte policy impact is a downside risk to euro growth outlook

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

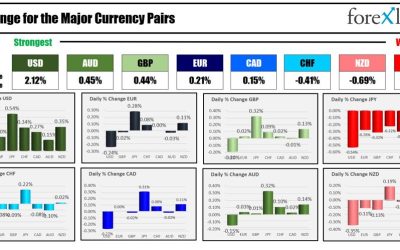

The USD is the strongest an the JPY is the weakest as the NA session begins

As the North American session As the North American session begins, the USD is the strongest of the major currencies. The JPY is the weakest a day after they hiked rates for the first time in 17 years. Yesterday the JPY was also the weakest. The USDJPY has reached a...

ForexLive European FX news wrap: Dollar nudges higher with the Fed in focus

Headlines:Markets:USD leads, JPY lags on the dayEuropean equities mixed; S&P 500 futures up 0.1%US 10-year yields down 0.9 bps to 4.288%Gold down 0.2% to $2,154.03WTI crude down 0.9% to $82.02Bitcoin down 0.8% to $63,199It was a slower session after a busy Tuesday...

US MBA mortgage applications w.e. 15 March -1.6% vs +7.1% prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Market Recap – All eyes on FED

Economic Indicators & Central Banks: Treasury yields are sinking as bonds await the FOMC’s results. The market is recovering slightly from this month’s selloff that has taken rates to the highest levels since late November. Stock markets traded mixed...

USD/JPY eyes potential major breakout going into the Fed later

USD/JPY weekly chartA triple-top formation or a breakout to fresh highs since 1990? That is what awaits USD/JPY as we look towards the FOMC meeting decision later in the day.The dollar is trading firmer across the board in European morning trade, as it seems like...

ECB’s Lagarde says cannot commit to rate path even after first cut

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Dollar holds firmer awaiting the Fed later in the day

The dollar is staying slightly bid on the session as it continues to keep in a decent spot so far this week. The move higher in USD/JPY is arguably a key reason for that. But as Treasury yields are continuing to sit well higher compared to its peers, it is another...

Bitcoin technical analysis, shorts should cover part or exit

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

A more cautious mood greets European stocks with the Fed in focus

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

UK finance minister Hunt says falling inflation opens the door for BOE rate cuts

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

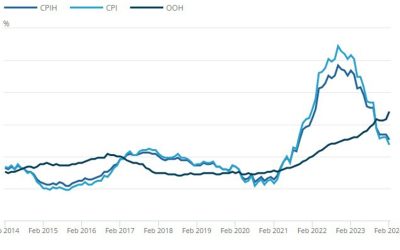

What’s priced in for the BOE now after the UK CPI data?

Well, to be fair, it was more or less already fully priced in even before the data. The odds of that were ~97% previously, so traders have just moved to fully price in a 25 bps rate cut now. Meanwhile, traders are now anticipating roughly 71 bps worth of rate cuts for...

Germany February PPI -0.4% vs -0.1% m/m expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

UK February CPI +3.4% vs +3.5% y/y expected

Prior +4.0%Core CPI +4.5% vs +4.6% y/y expectedPrior +5.1%The softer readings here should rebuff expectations for an August rate cut. Coming into the report, the odds of that were at ~97% while traders were pricing in ~66 bps worth of rate cuts for this year. We'll...

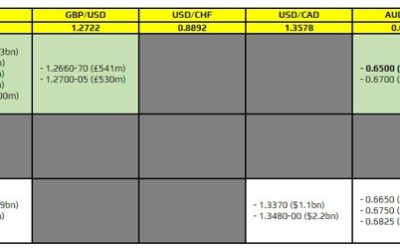

FX option expiries for 20 March 10am New York cut

There are a couple to take note of, as highlighted in bold.The first ones are for EUR/USD as they are layered from 1.0810 through to 1.0910. That is going to help keep price action more muted around the current levels, with the technicals also in play. The 200-day...

UK inflation on the agenda in the session ahead

The Japanese yen is the main mover in the major currencies space so far today. The post-BOJ fallout in the yen continues and we're seeing USD/JPY race higher to above 151.50 currently. Besides that, the dollar remains largely steady as the focus and attention turns...

Bitcoin falls further with another test of $60,000 in sight

It has not been a good last one week for cryptocurrencies and the retracement lower in Bitcoin is a big part to do with that. The price of Bitcoin has now dropped just below $61,000 on the day as the selling pressure intensifies. All eyes are now on the $60,000 mark...

USD/JPY looks to last year’s high as the yen stays under pressure

USD/JPY daily chartIt's not going according to plan for yen bulls to say the least. USD/JPY is now up another 0.5% today to 151.55 now, its highest level since November last year. The pair now looks poised to take a run at the high last year at 151.90 next. The rise...

ForexLive Asia-Pacific FX news wrap: USD/JPY rises to 151.30

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...