High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.1967 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

USD/JPY above 151.00

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Federal Open Market Committee (FOMC) preview: the clear risk is it defers cuts

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

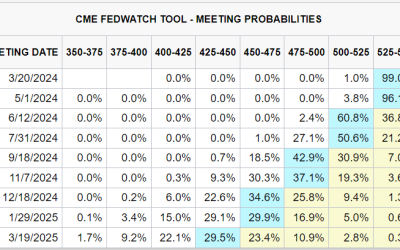

FOMC preview – we’ll get hints on 3 or 2 cuts ahead this year

In Deutsche Bank's preview of today Federal Open Market Committee (FOMC) meeting analysts at the bank say they are expecting "only minor revisions to the meeting statement that saw an overhaul last meeting."With regards to the SEP, the growth and unemployment...

China and Australia foreign ministers met – China says the two economies are complementary

Chinese Foreign Minister Wang Yi met with Australia's Foreign Affairs Minister Penny Wong. Comments from the Chinese side: The economies of China and Australia are highly complementary and have great potentialStressed that since China-Australia relations are on the...

Fed Seen Holding Rates Steady; Policy Outlook to Drive Markets, US Dollar

Most Read: Japanese Yen Outlook & Market Sentiment: USD/JPY, EUR/JPY, GBP/JPYThe Federal Reserve will release its March monetary policy announcement on Wednesday. Consensus estimates overwhelmingly suggest that the institution led by Jerome Powell will hold its...

Goldman Sachs on two reasons the broader US equity market will catch up, not catch down

A Goldman Sachs analyst on US equities - not looking for a pullback despite the high market concentration. Goldman Sachs expects a resilient economy and softening inflation will continue to be supportive of stocks. “As our US strategists have shown, periods of high...

BOJ policy pivot over 4 now: “We expect no more policy tightening in the next few months”

Comments via analysts at Julius Baer:The end of the negative interest rate policy, together with the end of the yield curve control policy and the end of exchange-traded fund purchases, looks like hawkish monetary policy action. At the same time, the outlook for...

Reminder ICYMI – Japanese markets are closed for a holiday today,Wednesday, 20 March 2024

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

New Zealand Q4 current account deficit rises slightly larger than expected

Not impacting NZD/USD upon release.The current account represents the most comprehensive gauge of a nation's international financial interactions. It encapsulates not just the exchange of goods and services, but also earnings from foreign investments and payments made...

Warnings of BOJ yen intervention as USD/JPY rises higher

JPY weakened after the (most-telegraphed ever?) Bank of Japan tightening on Tuesday:I've seen notes now warning that the Bank of Japan may have to intervene. UBS, for example, says that now the tightening is out of the way, and there are no further moves expected on...

Goldman Sachs like oil prices higher on both supply and demand factors

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Forexlive Americas FX news wrap: Canadian CPI surprises to the downside, risk trades pop

Markets:Gold down $2 to $2157US 10-year yields down 4.8 bps to 4.29%WTI crude up 53-cents to $83.25S&P 500 up 0.6%USD leads, JPY lagsThe Bank of Japan decision continued to reverberate in a strong 'sell the fact' reaction for the yen. Perhaps the market was...

Oil – private survey of inventory shows headline crude oil draw

more to come--Expectations I had seen centred on:Headline crude 0 mn barrels (ie no change, which seems peculiar, and do note there are other surveys of expectations)Distillates -0.1 mn bblsGasoline -1.4 mn---This data point is from a privately-conducted survey by the...

US stocks close higher in an volatile day with the price moving above and below unchanged

The major US stock indices are closing the day higher in what was a volatile day, with the price moving above and below unchanged. After all the volatility, the S&P indexes closing at a new record high of 5178.52. The old highways at 5175 pointsThe initial moves...

Economic calendar in Asia Wednesday, 20 March – Japan holiday, PBoC interest rate setting

Japanese markets are closed for a holiday today.---The People's Bank of China sets its Loan Prime Rate (LPR) for the one- and five-years on Monday January 21.Due at 0115 GMT, which is 9.15 pm US Eastern time.The LPR plays a vital role in determining interest rates for...

New Zealand data: Q1 Consumer confidence rose to 93.2 from 88.9 in the previous quarter

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trade ideas thread – Wednesday, 20 March, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The Fed cutting rates won’t end the dollar cycle, it will take more than that

A topical question at the moment is around the big US dollar cycle, given that we're headed towards Fed easing. Deutche Bank today makes a compelling case that it won't be initial Fed cuts that end the USD cycle as it usually only turns well after Fed cuts begin and...