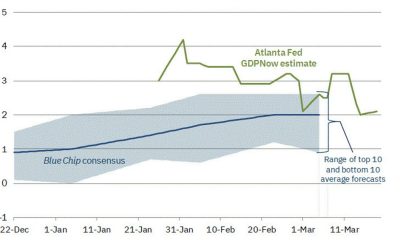

The tracker from the Atlanta Fed is falling to levels that are more consistent with the path of a slowing economy and rate cuts in H2.The releases said:After recent releases from the US Bureau of Labor Statistics, the US Census Bureau, and the Federal Reserve Board of...

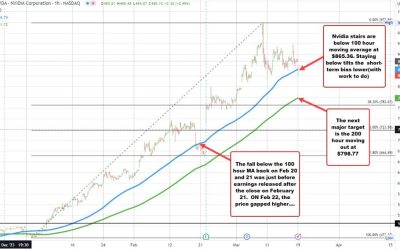

Jansen Huang interview on CNBC fails to kickstart the stock. Technicals tilt lower in ST.

CNBCs James Kramer interviewed and videos Jansen Huang. Shares of Nvidia when trading at $863.23 as the interview got going. Shares are trading at $856.17 down $28 38 or -3.18%.Looking at the hourly chart below, the prices currently trading below its 100 hour moving...

New Zealand GDT price index -2.8%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The US stock indices are mixed with NASDAQ under pressure

Major US stock indices are opening the day lower led by the NASDAQ index. That index is currently down -0.83% on the back of Nvidia shares down over 3% after their Nvidia developers conference yesterday failed to push the price higher.A snapshot of the market...

USDCAD runs higher with the USD and also helped by weaker CPI data out of Canada today.

The USDCAD has moved higher with the US dollar today, and was goosed even higher after Canadian CPI data came out weaker than expected 0.3% versus 0.6% expected. The year-on-year fell to 2.8% from an expected 3.1%.The move to the upside has extended up to a swing era...

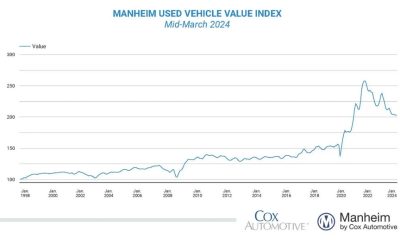

US used vehicle prices continue to slide, led by EVs

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

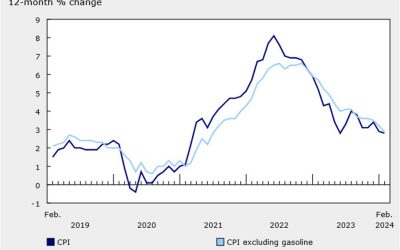

Canadian dollar falls to the lows of the year as inflation slows faster than forecast

For much of the pandemic-era, the Canadian and US economies were mirror images of each other but cracks are beginning to show. Canadian CPI today highlighted differing inflation dynamics as the first two months of 2024 have shown Canadian pricing falling faster than...

Kickstart your FX trading for March 19 w/a technical look at the EURUSD, USDJPY and GBPUSD

The USD is higher in early US trading. For the EURUSD, USDJPY and GBPUSD, the moves have taken the price to target levels. For the EURUSD it is the 200-day MA, for the USDJPY is a key swing area ceiling from February and March, and for the GBPUSD it is its 200-bar MA...

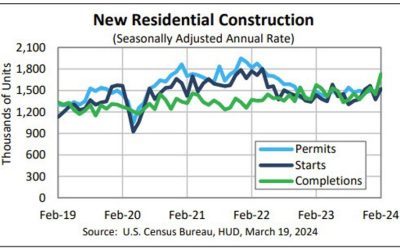

US housing starts for February 1.521M vs 1.425M estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Canada February CPI 2.8% y/y vs 3.1% expected

Prior was 2.9% y/yCPI m/m +0.3% vs +0.6% expectedCore measuresCPI Bank of Canada core y/y +2.1% vs 2.4% priorCPI Bank of Canada core m/m +0.1% versus +0.1% priorCore CPI MoM SA -0.1% vs -0.1% prior (revised to 0.0%)Trim 3.2% versus 3.4% priorMedian 3.1% versus 3.3%...

Canadian CPI and US housing starts top the economic calendar today

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trader Zone – The Art of Market Analysis: Finding the Right Direction

The Finance Magnates Africa Summit 2024 (FMAS:24) will be coming to Sandton City, South Africa for the second year, showcasing a growing continent full of potential. This year’s event will be scaling up, featuring Trader Zone, an entirely new stage to cater to a B2C...

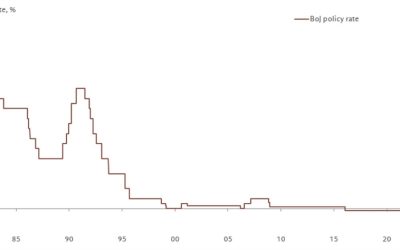

ForexLive European FX news wrap: Yen slides after historic BOJ move

BOJ:RBA:Headlines:Markets:CHF leads, JPY lags on the dayEuropean equities mixed; S&P 500 futures down 0.4%US 10-year yields down 2 bps to 4.320%Gold down 0.2% to $2,155.38WTI crude flat at $82.13Bitcoin down 6.0% to $63,303This is one for the history books as the...

The bond market remains one to watch ahead of the Fed tomorrow

10-year yields may be down slightly on the day but at 4.31%, they are over 25 bps higher from the lows seen on Monday last week. Traders are more wary amid the slew of US data in the week before, as the rates market also no longer prices in a full Fed rate cut for...

Bitcoin technical analysis and price forecast for today

Bitcoin technical analysis: I'm eyeing a possible bounce up at $61k-$62k double supportIn the dynamic landscape of cryptocurrency, observing and interpreting market trends is paramount for anyone engaged in trading or investing. In my latest analysis of Bitcoin...

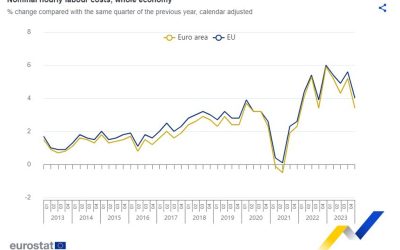

Eurozone Q4 hourly cost of wages +3.1% y/y

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Germany March ZEW survey current conditions -80.5 vs -82.0 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

AUDUSD Market Analysis – Will The Fed Change Their Forward Guidance?

The US Dollar Index rises close to a 2-week high as the Federal Open Market Committee’s meeting approaches. US inflation struggles to drop below 3.00% for nine consecutive months. Investors are keen to hear whether the Fed is considering 3 interest rate cuts or less....

3월 31일까지 1차 신청! 건강지원금 15만 6천원 받으세요!

https://www.youtube.com/watch?v=qpqaN25peLs 정부에서 힘들게 일하는 국민들을 위해서 건강진단비용으로 15만 6천원을 지원한다고 합니다. #건강지원금 #건강진단비용 #소득무관 #나이무관 MoneyMaker FX EA Trading Robot

ECB’s de Cos: We could start cutting rates in June but it is conditional on the data

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...