High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

European indices closing mixed with Spain and Italy rising

Major European indices are closing the day makes with Spain and Italy rising. Germany, France and UK falling (after each closed at record levels on Friday).The final numbers are showing:German DAX, -0.18%France CAC, -0.14%UK FTSE 100 hundred, -0.22%Spain's Ibex,...

Roaring Kitty posts again….”Fine…I will do it myself”

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDCAD trades higher and lower with shorter term technical levels doing their jobs

The USDCAD traders are using the shorter term technical levels to define the trading range today. On the topside, the high price from Friday and earlier today have done a good job of stalling the upside.On the downside, a swing area between 1.3654 and 1.36678 is...

New York Fed inflation expectations for 1-year rises to 3.3% from 3.0%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Treasury Secretary Yellen: Bidens #1 priority is to bring down inflation

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

AUDUSD moves above the 50% of the move down from the December high.

The AUDUSD fell in the early Asian-Pacific session, and in the process tested a short-term swing area seen over the last few weeks at 0.6585. Points are held, the price reversed and started to extend the upside.The move has now taken the price above the 50% midpoint...

Reuters poll: Federal Reserve to cut fed funds rate by 25 basis points in September

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US stocks are marginally higher in early US trading

The US stocks are marginally higher in early US trading. The major indices are off premarket levels.A snapshot of the market currently shows:Dow Industrial Average average up 109.89 points or 0.28% at 39622.74S&P index up 4.17 points or 0.08% at 5226.86NASDAQ...

USDCHF trades to new session lows. Looks toward 38.2% of the move up from the March low

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Fed Gov. Jefferson: Economy has made a lot of progress, inflation has retreated

Fed's JeffersonFed Gov. Jefferson answering questions at his event this morning says:Economy has made a lot of progress, inflation has retreated.Labor market has been very resilient.I view the economy as in a solid position.The decline in inflation has...

Fed Gov. Jefferson and Cleveland Fed Pres. Mester do not speak on economy/policy

Fed Jefferson and Cleveland Fed Pres. Mester are both scheduled to speak, and both did not speak on the economy/policy in the prepared text.Of note is that Cleveland Fed Pres. Mester is retiring in June. As result, her comments (if she expresses them) are likely to be...

AP: Chinese regulators tell tech firms in China to buy fewer Nvidia chips

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Kickstart the FX trading day on May 13 w/a technical look at the EURUSD, USDJPY and GBPUSD

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Why rent in the CPI report is so hard to figure out

The WSJ's Nick Timiraos wrote on the weekend about the puzzle around rent inflation, which is one-third of the CPI. It's stuck at 5.6% y/y and keeping overall inflation high.That number comes from a survey of 7000 tenants and synthesizes what a homeowner would pay to...

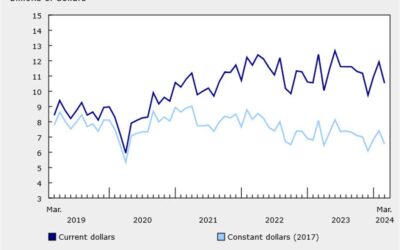

Canada March building permits -11.7% vs -3.3% expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ForexLive European FX news wrap: The calm before the storm

Headlines:Markets:AUD, EUR, and GBP lead, JPY lags on the dayEuropean equities mixed; S&P 500 futures up 0.2%US 10-year yields down 2.3 bps to 4.482%Gold down 0.7% to $2,343.91WTI crude up 0.8% to $78.85Bitcoin up 3.6% to $62,650It was a quiet session and...

Gold futures technical analysis. I am waiting to go Long on Gold at 2337.5 to 2341.5

Gold futures technical analysis and my trade plan - watch the video below, gold traders and investorsAs I delve into the technical analysis of gold futures on the 1-hour time frame, my focus shifts towards identifying the most strategic buying opportunities and...

Forget about the win rate

“It’s not whether you are right or wrong, but how much you make when you are right and how much you lose when you are wrong”. This quote from George Soros sums up perfectly what trading is all about. Beginner traders don’t want to experience the pain of loss, so they...

UK PM Sunak reaffirms that election will be at some point later this year

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...