High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ICYMI – BOJ reportedly considering March rate hike, but outcome is still too close to call

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ICYMI – ECB’s Holzmann says a June rate cut is more likely than in April

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

New Zealand data – February Food Price Inflation Index -0.6% m/m (prior +1.2%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

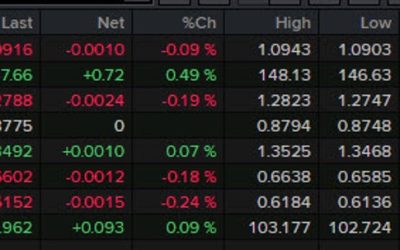

Forexlive Americas FX news wrap: Dollar climbs as US CPI stays hot

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Grayscale has filed to launch a lower-fee Bitcoin ETF

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Citadel founder and CEO Griffin says Fed should cut only slowly – warns of devastation

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

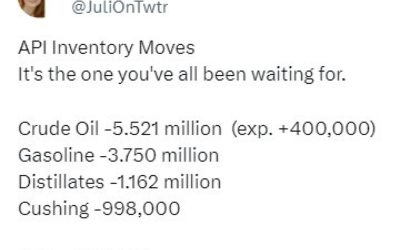

Private survey of oil inventories shows a huge headline crude draw vs the build expected

The inventory data from the private survey is out now, official data follows Wednesday morning at 10.30 am US Eastern time.Via Twitter:--Expectations I had seen centred on:Headline crude +1.3 mn barrelsDistillates -0.2 mn bblsGasoline -1.9 mn--This data point is from...

S&P closes at a new record

The S&P index is closing at a new record level the whole record level reached last Friday was at 5157.35. Though there was no problem in closing will be available 5175.25.The NASDAQ index ticked just above its high record closing level at 16274.94. The high price...

European Central Bank’s Villeroy says the Bank can cut rates independent of the Fed

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Economic calendar in Asia 13 March 2024 – nearly empty

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trade ideas thread – Wednesday, 13 March, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The light US economic calendar will continue on Wednesday

If it feels quiet, that's because the Fed is in the blackout window ahead of the March 20 FOMC decision. That's shaping up to be an important one, not because of a potential rate move, but because the new dot plot could show less than 75 basis points in easing.Until...

USDJPY & EURJPY: Ech of the JPY pairs are trading above and below key MA targets.

Both the USDJPY and the EURJPY are moving higher. The run to the upside in each was started in the Asian session after comments from Japanese finance minister Suzuki and later by BOJs Ueda. Technically, the price of each moved up to a moving average technical target...

US dollar softens as the Nasdaq stretches gain to 1.4%

It's a feeding frenzy in the Nasdaq today despite a worrisome US inflation report and rising Treasury yields. All the elements are in place for equity market selling but we're getting the opposite. Chipmakers and some other high-flying stocks are leading the way...

US broader indices move back toward session highs. S&P on pace for a record close.

The major US indices are pushing back toward at session highs. The S&P is up about 53.5 points or 1.05% at 5171.51. The high price for the day is at 5174.04. The NASDAQ index is up 221 points or 1.39% at 16241. It's high price reached 16252.78.The S&P index is...

주유소에서 나도 모르게 결제된 ‘이돈’ 찾아가세요!

https://www.youtube.com/watch?v=T5aaZ-86ygo 셀프주유소에서 카드로 결제하시는 분들이라면 넣지도 않은 주유비가 결제되는 일이 없도록 조심하셔야 할 것 같습니다. #셀프주유소 #환급 #초과결제 #결제오류 MoneyMaker FX EA Trading...

US February federal budget deficit -296.0B vs -299.0B expected

Deficits and spending all work in cycles. There was something of a blow-off top in spending during the pandemic and now the cycle is slowly turning. I wouldn't count on politicians rushing towards austerity but it will come slowly, then quickly as the bills mount. The...

US EIA now sees stronger oil production growth in 2024

Everyone in the oil market wants discipline in US shale but at $78/barrel there is still plenty of money to be made that is keeping the taps running.The EIA now sees US crude production up 260k bpd in 2024 compared to a rise of 170k bpd in the previous forecast. That...

US treasury sells $39 billion of 10 year note at a high yield of 4.166%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...