High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

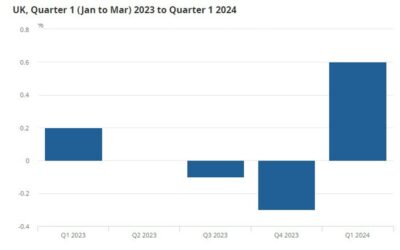

UK March monthly GDP +0.4% vs +0.1% m/m expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

UK Q1 preliminary GDP +0.6% vs +0.4% q/q expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

FX option expiries for 10 May 10am New York cut

There are a couple to take note of on the day, as highlighted in bold.The first one being for EUR/USD at the 1.0825 level. However, this is one that might not factor in too much into play given the technicals. The 200-day moving average at 1.0791 and offers lined up...

Next rate hike could come as early as July, says former BOJ executive

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

UK GDP in focus in the session ahead

The US weekly jobless claims yesterday helped to inject some life into markets, as we look to the final stretch of the week now. The dollar dropped as risk trades jumped, providing a bit of a teaser perhaps to next week. Things are calmer now with the dollar steadying...

We got a teaser yesterday of what to expect in trading next week

It was a quiet one yesterday up until the release of weekly jobless claims in the US. The release here was weaker than estimated and that kicked off more fears about a softening in the labour market, following the non-farm payrolls report on Friday last week. As a...

Chinese media says home purchases restrictions are unlikely to be completely removed

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ForexLive Asia-Pacific FX news wrap: USD higher across the major FX board

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Federal Reserve speakers on Friday include Bowman, Kashkari, Logan, Goolsbee, Barr

The times below are in GMT/US Eastern time format. 1300/0900 Federal Reserve Board Governor Michelle Bowman speaks on "Financial Stability Risks: Resiliency and the Role of Regulators" before the Texas Bankers Association Annual Convention1400/1000 Federal Reserve...

USD/JPY on the rise – earlier jaw boning from Finance Minister Suzuki was just the usual

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BoE Chief Economist Pill speaking Firday, dove Dinghra also speaking

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Ex-BOJ Watanabe says Bank of Japan must avoid raising interest rates to combat a weak yen,

Watanabe points to weaker services inflation, which he says suggests sluggish consumption is discouraging firms from hiking prices:"The BOJ is probably hoping that services inflation will strengthen. But the data coming out so far aren't backing up this view," "None...

PBOC sets USD/ CNY central rate at 7.1011 (vs. estimate at 7.2102)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The US will impose tariffs on EVs from China after review

Bloomberg headline saying Biden’s administration is poised to unveil a sweeping decision on China tariffs as soon as next weektargeting key strategic sectors (including electric vehicles, batteries and solar equipment) with new imposts***The US slapping tariffs on...

[주민센터 신청하고!! 월 41만원 받으세요!! 국회 ‘이것’ 빨리 통과시켜야… ]#3.1경제독립tv

https://www.youtube.com/watch?v=icayRlprJLA [주민센터 신청하고!! 월 41만원 받으세요!! 국회 '이것' 빨리 통과시켜야... ]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

Heads up for the approaching weekend – China releases April inflation data on Saturday

China CPI and PPI data is due on Saturday, 11 May 2024 at 0130 GMT, which is Friday at 2130 US Eastern time.China has barely crawled out of consumer deflation, but producer prices are still falling, they've done so since October 2022. Trade rebounded in April, imports...

PBOC is expected to set the USD/CNY reference rate at 7.2102 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

Japan’s finance minister Suzuki says is closely watching FX moves

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan data – March Household Spending +1.2% m/m (expected -0.3%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[주민센터 신청하고!! 월 41만원 받으세요!! 국회 ‘이것’ 빨리 통과시켜야… ]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/05/eca3bcebafbcec84bced84b0-ec8ba0ecb2aded9598eab3a0-ec9b94-41eba78cec9b90-ebb09bec9cbcec84b8ec9a94-eab5aded9a8c-ec9db4eab283-ebb9a8-400x250.jpg)