High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

EURUSD remains in the range. Hourly MAs are holding resistance so far

EURUSD remains within a defined support and resistance range after the FOMC decision, with price action holding key technical levels. The resistance target near 1.0936 – 1.0954 continues to cap gains, while the support target below at the 61.8% at 1.08174 provides a...

Powell opening statement: Recent indications point to a moderation in consumer spending

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Watch live: Powell hosts FOMC press conference March 19, 2025

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US dollar softens after the FOMC decision

The Fed decision emphasized uncertainty in the outlook in light of fights over US tariffs and fiscal policy. Expect Powell to be quizzed about that extensively at the 2:30 pm ET press conference.For now, the market is likely focusing on downgraded growth forecasts...

A look at the changes in the FOMC statements from January to March

January 29March 19, 2025Federal Reserve issues FOMC statementFor release at 2:00 p.m. ESTEDTRecent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate has stabilized at a low level in recent months, and labor market...

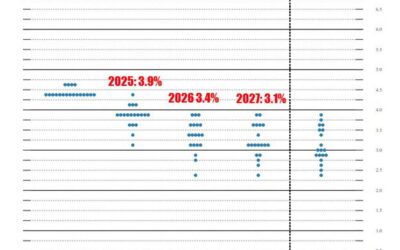

The March 2025 dot plot and estimates for GDP, Unemployment and PCE inflation

The dot plot from December 2024 showed:Dot Plot December 2024The NEW projection for 2025 in March 2025 projects the Fed fund at end of 2025 unchanged at 3.9%. For 2026, they project 3.4% and 3.1 in 2027. Those are unchanged from December.Dot plot from March 20251)...

The full statement from the March 2025 FOMC rate decision

March 19, 2025Federal Reserve issues FOMC statementFor release at 2:00 p.m. EDTRecent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate has stabilized at a low level in recent months, and labor market conditions...

Federal Reserve rate decision: Rates held unchanged, as expected

Prior range was 4.25-4.50%No change to rates was 99% priced inSays "uncertainty around the economic outlook has increased"Removes line in the statement that said 'risks to the outlook roughly in balance' Labor market conditions remain solidInflation remains somewhat...

For reference: The January FOMC statement (and how it changed)

I always find it's good practice to read the prior FOMC statement one last time before the new one is released. Here is what the January 29 statement said:Recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate...

Zelensky said he had a ‘positive, substantial’ call with Trump

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trump gave Iran a two-month deadline to reach a nuclear deal – report

Iran supreme leader Ali KhameneiAxios reports that Trump sent a letter to Iran supreme leader Ali Khamenei with a two-month deadline for reaching a nuclear deal."If Iran rejects Trump's outreach and doesn'tnegotiate, the chances of U.S. or Israeli military action...

What to watch: Initial jobless claims, capex and card spending data

I don't think today's FOMC decision is going to be a big market mover but one of the things I'm hoping that Powell reveals is the data points that he's watching most closely for signs of a turn in the economy.Everyone has seen the soft survey data -- which is...

EURUSD Technical Analysis: Key levels to watch through of FOMC rate decision

EURUSD technicalsThe FOMC rate decision is fast approaching and the traders have set the close support and resistance levels from recent price action ove rhre last week or so of trading. Looking at the 4-hour chart above, the EURUSD has seen sellers lean against the...

Zelenskiy: Supports the proposal to halt energy assets strikes

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDJPY: The price is testing a swing area upside target.

USDJPY technicalsAs the market awaits the FOMC rate decision, USDJPY has climbed above the 150.00 level in the U.S. session, reaching a high of 150.142 before pulling back to 149.92.Technical Outlook: Today's high tested a key swing area between 150.11 and 150.288,...

Will Nvidia return to all-time highs? And Tesla?

Two of the biggest market phenomena of recent years face serious challenges. For Tesla, growing competition from Chinese manufacturers is not the only problem. Elon Musk's growing involvement in politics has also damaged the company's image, especially in Europe and,...

Trump after call with Zelensky: We are very much on track

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Preview: Five numbers to watch from the Federal Reserves’s forecasts and dot plot

The market will undoubtedly move on today's fresh round of forecasts and dot plot from the FOMC. I think that's a mistake in large part due to the uncertainty around these forecasts. Officials aren't married to these forecasts and will advocate for higher or lower...

AUDUSD: Buyers had their shot. They missed.

AUDUSD on the 4-hour chartThe AUDUSD moved above the 100-day MA for the first time since October 2024. The price moved higher on the break, but fell short f the high price for 2025 at 0.6408 and the 38.2% of the move down from the September 2024 high at 0.64136. The...