High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Walmart toy supplier warns on higher prices due to tariffs

California-based MGA Entertainment is in a tough spot.The company supplies a large number toys to Walmart but suddenly finds itself facing tariffs as it largely makes its goods in China. Executives are pushing for price hikes at Walmart to compensate."It's going to...

Gold makes a fresh push to $3000

gold dailyGold is wrapping up a day for the history books as it climbed $57 and finished at the highs of the day at $2989. That's a record high and just a shade under $3000, a number that's going to be in focus in Asia-Pacific trade.The only thing I can see stopping...

[스타 애널리스트가 증권사 때려치고 커피회사 차린 충격이유! 카페 창업 이렇게 하면 100%망해요-박창선 블르빅센대표 인터뷰]#3.1경제독립tv

https://www.youtube.com/watch?v=jPpyQaT7Z-g [스타 애널리스트가 증권사 때려치고 커피회사 차린 충격이유! 카페 창업 이렇게 하면 100%망해요-박창선 블르빅센대표 인터뷰]#3.1경제독립tv [박창선 블루빅센대표] 02-498-7236 010-6275-0105 커피숍창업상담, 원두구입문의, 커피관련무료상담 환영 (문자 먼저 주셔요~) 서울시 동대문구 홍릉로54(1,2층)청량리동367-1) [3년뒤 10억부자 3.1경제독립tv필독 추천영상]...

Forexlive Americas FX news wrap 13 Mar: Tariff worries continue to dominate sentiment.

The day started with Pres. Trump saying that if Europe goes ahead with a tariff on whiskey, he would retaliate with a 200% tariff on wine, champagne, and alcohol. That got the markets attention as tariffs continue to be a feared item for traders. So although US PPI...

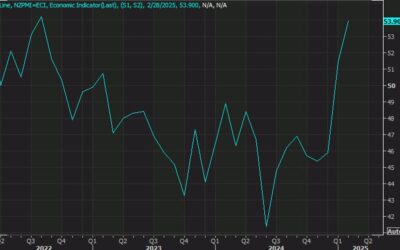

Coming up on the Asia-Pacific calendar: New Zealand PMI and food price data

The Asia-Pacific economic calendar is light today but features a pair of releases from New Zealand:5:30 pm ET (2130 GMT) February manufacturing PMI, prior 51.45:45 pm ET (2145 GMT) February food price index +1.9%Those aren't likely to be market movers -- even for the...

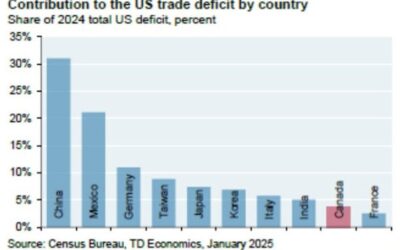

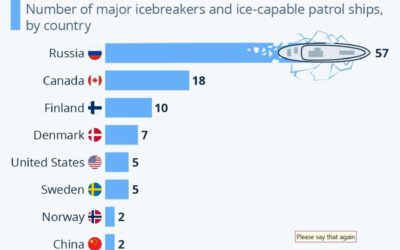

JPMorgan eviscerates US tariff policy on Canada as key meeting gets underway

Officials from the US Commerce Department and Canadian Finance Ministry are scheduled to speak right now. As that meeting gets underway, JPMorgan is out with a scathing note, calling the US talking points " economically, politically and geologically illiterate."They...

US major indices tumble led by the NASDAQ index

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US Commerce Sec. Lutnick: During Trump’s term we will try to balance budget

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Ukraine’s Zelenskiy: Putin is preparing a rejection of cease-fire proposal

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Range-bound NZDUSD eyes key technical levels for breakout signals

NZDUSD technicalsNZDUSD is currently trading at 0.5704, consolidating between key technical levels. On the upside, the 100-day moving average at 0.57527 continues to trend lower and is approaching the current price. For buyers to gain control, the price needs to break...

ECB’s Villeroy: Current US policy is a tragedy for the American economy

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US crude oil futures settled $66.55

Crude oil futures settled down $-1.13 or -1.67% at $66.55. The low price reached $66.40. The high price reached $67.91.IEA forecasts global oil demand to rise by 1 million bpd in 2025, up from 0.83 million bpd in 2024.Supply expected to outpace demand by 0.6 million...

Ontario Premier Ford: Wants to have constructive meeting with US Commerce Sec. Lutnick

Ontario Premier Ford who announced and then backtracked on electricity surcharges to the US which led to Pres Trump saying that tariffs on steel and aluminum would increase to 50% from 25% and then backtracking to 25%, is now on the wires saying he Wants to have...

Ukraine Chief of Staff: Ukraine will never agree to a frozen conflict

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDJPY falls to new lows and approaches swing area between 147.20 and 147.338

USDJPY is extending its decline, approaching a key swing area between 147.20 and 147.338. This zone has been a significant technical level since August to October 2024 (see red circles on the four-hour chart). Last week, the pair stalled near this area before briefly...

Former US Treas Sec Mnuchin: 5-10% correction in stocks makes sense. It’s natural.

Former Treasury Secretary Mnuchin is on the wire saying that 5% – 10% correction in stocks makes sense. It natural.From the high: S&P index is now down -10.37%NASDAQ index is down -14.69%Dow is down -9.5%The NASDAQ index is testing its 38.2% retracement of the...

More Trump: Does not think Russia will attack US allies

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

U.S. Treasury sales $22 billion of 30 year bonds are a high yield of 4.623%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trump: Getting word things are going ok with Russia

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[스타 애널리스트가 증권사 때려치고 커피회사 차린 충격이유! 카페 창업 이렇게 하면 100%망해요-박창선 블르빅센대표 인터뷰]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2025/03/ec8aa4ed8380-ec95a0eb8490eba6acec8aa4ed8ab8eab080-eca69deab68cec82ac-eb958ceba0a4ecb998eab3a0-ecbba4ed94bced9a8cec82ac-ecb0a8eba6b0-400x250.jpg)