High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

European major indices rebound higher in trading today

A day after sharp declines of 1.4% or more, the major European indices have rebounded in trading today. A summary of the closing levels shows:German DAX, +0.12%France CAC, +0.62%UK FTSE 100, +0.35%Spain's Ibex, +1.05%Italy's FTSE MIB, +0.72%As UK/ European traders...

NZDUSD corrects modestly higher with more work to do to give buyers more confidence

The NZDUSD is higher on the day, but the move is still modest and there is work to do, to give the buyers more confidence after the recent move lower. IN this video, I outline the technical levels in play and explain what needs to be done, to give the dip buyers more...

US major stock indices giving up their gains

The gains in the major US stock indices have been whittled away. The NASDAQ index is now in negative territory. The Dow Industrial Average S&P index are holding onto small gains.Dow Industrial Average is up 30 points or 0.08%S&P is up 6.5 points or 0.13%NASDAQ...

ECBs Nagel: Price pressure in the euro zone could continue for some time

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Weekly crude oil inventories rise 2.735M vs 1.373M build estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDCAD moves lower w/ the modest USD weakness today. Moves toward support target at 1.3765

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Report of an earthquake in Japan’s Bungo region

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

High Volatility Amidst Upcoming Earnings Data And A Hawkish Fed

The SNP500 declines for three consecutive days despite the market entering earnings season. The Federal Reserve Chairman indicates less confidence and higher for longer for interest rates. This week Tesla and Apple continue to witness the largest declines within the...

USDCHF battles at key moving averages, hinting at short-term bias

The USDCHF as it drifted lower in trading today. Yields are down. The market digested the Fed comments yesterday. Nevertheless, the Swiss National Bank did cut rates at their last meeting. The Federal Reserve comments from Fed's Powell and Fed Gov. Jefferson yesterday...

US stocks are opening modestly higher

Major US stock indices are opening modestly higher. Geopolitical risks out of Israel are on hold at least for now. The economic calendar is void of releases today. Yields are lower and helping the sentiment a bit as well.A snapshot market four minutes into the opening...

ECBs Cipollone: Sees some signs of an economic recovery citing PMI data

ECB's CipolloneECB Cipollone is speaking and says:We see some signs of economic recovery citing PMI data.Expects for rest of year inflation at this level more or less.Base effects are due to unwinding of cost-of-living measures.We expect inflation resuming path to 2%...

Kickstart the FX trading day for April 17 w/ at technical look at EURUSD, USDJPY, GBPUSD

In the kickstart video for April 17, 2024, I take a look at the three major currency pairs - the EURUSD , USDJPY and GBPUSD - from a technical perspective and outline the bias, risks, targets, and stories for each. EURUSD: The EURUSD is trading up and down this week,...

FMAS:24 – Build Relationships with Brokers and Traders

Traders, brokers, and industry enthusiasts from across Africa and the global trading community are gearing up for the highly anticipated Finance Magnates Africa Summit (FMAS:24). The premium event will be taking place on May 20-22 in Sandton City, South Africa,...

Canada house prices climbed 5.6% in the past year – Teranet

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BOE’s Greeene: We’re closer to target than just a few months ago

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

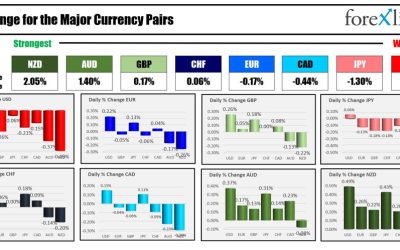

The NZD is the strongest, and the USD is the reduced as the NA session begins

The NZD is the strongest and the USD is the weakest as the North Ameican session begins. Yesterday, Chair Powell (and Fed Gov. Jefferson) declined to state that rate cuts were likely to be appropriate this year (omitting is just as good as saying it), which was a...

ForexLive European FX news wrap: Dollar run pauses, UK inflation slows less than expected

Headlines:Markets:NZD leads, USD lags on the dayEuropean equities higher; S&P 500 futures up 0.3%US 10-year yields flat at 4.655%Gold up 0.3% to $2,388.80WTI crude down 0.7% to $84.77Bitcoin flat at $63,053The dollar is taking a bit of a breather today as it...

US MBA mortgage applications w.e. 12 April +3.3% vs +0.1% prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

When there’s fear in the market..

Iran-Israel tensions are casting a dark shadow over the market, providing what can be argued as a timely retracement in equities and risk trades. But whenever geopolitics tend to get involved, the first thing that always comes to mind for me is the saying buy value,...