High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

People’s Bank of China projected to deliver two more RRR cuts this year – Bloomberg survey

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Senior Deputy Governor of Bank of Canada Rogers speaks on Tuesday

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

RBA speaker due at 0220 GMT (2220 US Eastern time)- unlikely to be mon pol comments

There is a speech from the RBA coming up soon, at 0220 GMT. Its from Ellis Connolly, Head of Payments Policy. Its very unlikely there will be anything said about monetary policy but there may be a comment or two on the economy.Its around 24 C (75 F) in Sydney so I...

Chinese assaults on Philippines shipping intensifying – US military could be drawn in

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

New Zealand accuses China of hacking parliament

A statement from New Zealand's Foreign Minister Winston Peters regarding a state-sponsored cyber hack on New Zealand's parliament in 2021:“Foreign interference of this nature is unacceptable, and we have urged China to refrain from such activity in future,” The hack...

AUD and NZD pop again right around PBoC fixing time

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC sets USD/ CNY mid-point today at 7.0943 (vs. estimate at 7.2037)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[실업급여 싹 바뀐다!! 최고 많이 받는 방법?? 구직, 취업, 교육..한번에 다 된다!! ]#3.1경제독립tv

https://www.youtube.com/watch?v=RoL34k3wRBw [실업급여 싹 바뀐다!! 최고 많이 받는 방법?? 구직, 취업, 교육..한번에 다 된다!! ]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

China-run tanker shipping Russian oil hit by Houthis

Houthi terrorists were said to have had an agreement with Russia and China to allow their vessels safe passage. 'US officials, however, reported that a Chinese oil tanker hauling Russian oil appears to have been hit. The attack occurred over the weekend. Via Lloyds:US...

Morgan Stanley is forecasting 4 Federal Open Market Committee (FOMC) rate cuts in 2024

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.2037 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

UBS forecasts the S&P 500 will end 2024 around current levels

UBS is not looking for the S&P 500 to end up any higher by the end of 2024.Analysts at the bank say a 'soft landing' is their base case for the US economy, including a moderation of economic growth, further falls for the inflation rate, and lower interest rates....

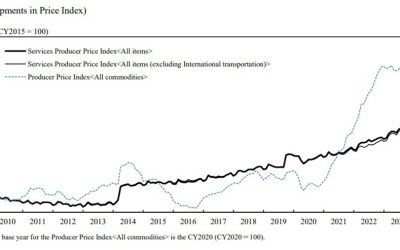

Japan data: February Services PPI 2.1% (prior 2.1% also)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan fin min Suzuki says won’t rule out steps to address disorderly FX moves

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australian monthly consumer confidence falls to 84.4 in March vs. 86.0 in February

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Authorities in Hunan, Liaoning, Xi’an, Chongqing to close local financial asset exchanges

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is “alarmed” by the weakness of the yen (concerned over yuan implications)

Via Saxo Bank on the yen and yuan:Says the People's Bank of China is concerned ('alarmed' according to Saxo analysts) by the weakness of the JPY given how competitive Japanese exports areAnd that if the yen weakens past 152 per dollar, “we could likely see the PB0C...

Australian weekly consumer confidence 83.1 (prior 81.7)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Adam Neumann submitted a bid to buy WeWork, bankrupt co-working firm, for more than $500mn

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[실업급여 싹 바뀐다!! 최고 많이 받는 방법?? 구직, 취업, 교육..한번에 다 된다!! ]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/03/ec8ba4ec9785eab889ec97ac-ec8bb9-ebb094eb8090eb8ba4-ecb59ceab3a0-eba78eec9db4-ebb09beb8a94-ebb0a9ebb295-eab5aceca781-ecb7a8ec9785-400x250.jpg)