High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

FMAS:24 – Discover the Benefits of Attending

The Finance Magnates Africa Summit (FMAS:24) will be here in a few weeks, with the countdown officially underway to the biggest event of the year in Africa in 2024. FMAS:24 returns for its second year in Sandton City, South Africa on May 20-22, 2024, at the luxurious...

Riksbank’s Jansson saying a cut was very likely at their March decision

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

NZD is the strongest and EUR is the weakest

The NZD is leading the pack to the upside and the EUR is the underperformer as US traders get to their desks.For the EUR, the downside does not have any specific catalyst. However, it could be due to USD strength as well as some possible pre-positioning ahead of...

Wells Fargo joins the club and now sees the Fed cutting rates in September

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Russia says their forces targeted energy facilities in Ukraine

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

UK lenders expect supply and demand for mortgages to pick up

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BNP Paribas joins other banks to amend Fed cuts to two this year

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Morgan Stanley upgraded Chinese GDP to 4.8% vs 4.2% prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Meet The Winners of the UF AWARDS LATAM 2024!

Shining a spotlight on the success of the best B2C and B2B brands in the online trading and fintech space across the globe, the UF AWARDS represent the crowning achievement of high performance and enterprise.Organised by Ultimate Fintech, the UF AWARDS LATAM are a...

China took countermeasures against two US enterprises for arms sales to Taiwan

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

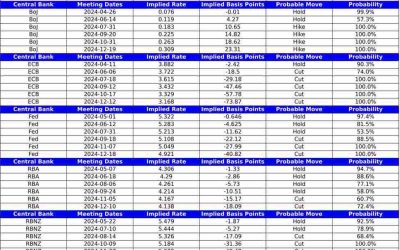

What’s priced in for major central banks

Below is a quick snapshot of what is priced for major central banks after yesterday's US CPI.A few notable changes:BoC: after yesterday's policy decision, markets now see about a 50/50 chance between a cut and hold for June.BoE: Markets have pushed back their...

JPMorgan downgrades view of emerging market currencies

JPMorgan has downgraded their view of EM FX after yesterday upside surprise in US CPI sparked a reassessment of the Fed's rate path.The surprise led markets to reprice their expectations towards September as the first possible cut for the Fed.In response to this,...

GBPUSD Technical Analysis – Will it finally break out of the range?

USDThe Fed left interest rates unchanged as expected at the last meeting with basically no change to the statement. The Dot Plot still showed three rate cuts for 2024 and the economic projections were upgraded with growth and inflation higher and the unemployment rate...

(장볼 때)10% + 30% 혜택 더 보려면! 꼭 이렇게 하세요!!

https://www.youtube.com/watch?v=G4ysFTwUqK4 요즘에는 식당 음식값도 많이 올랐고 장을 보러 가면 조금만 사도 5만 원, 10만 원이 훌쩍 넘어가서 장 볼 때 가격을 보고 망설일 때가 많은데요. 더 싸게 식재료를 구입할 수 있는 꿀팁을 소개해 드리겠습니다. 도움이 되셨으면 좋겠습니다. ^^ MoneyMaker FX EA Trading...

USD/JPY Outlook: Hot US Inflation Propels USD/JPY to Worrying Levels

Japanese Yen (USD/JPY) AnalysisDollar response to hot CPI data sends USD/JPY higherUSD/JPY enters a danger zone as the FX intervention threat loomsDollar yen breaks 152.00 and enters overbought territoryElevate your trading skills and gain a competitive edge. Get your...

Italian industrial output YY (Feb) -3.1% vs -3.4% prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Israeli war council meets tonight amid anticipation of Hamas’ response to proposals

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

UBS expects the Fed to start cutting in September

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Inflation Pushes Stocks Down, But How Does US Inflation Affect The ECB?

US inflation again climbs at a faster pace than previously thought. The inflation rate rises to 3.5%, a 6-month high, and core inflation remains unchanged. The CME’s FedWatch Tool reduces the possibility of a rate hike from 56% to 18% for June 2024. The highest...