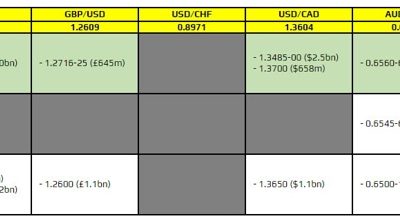

There aren't any significant expiries in play for the day ahead. As such, trading sentiment will continue to revolve around the mix of the technicals, risk mood, and broader market sentiment. So far today, there isn't much to really work with as most markets remain...

Little on the data docket coming up in the session ahead

Major currencies are not up to much for now as the dollar keeps steadier so far on the day. The key areas to watch for markets remain the same as last week, as traders are grappling with the aftermath of key central bank decisions. Looking to the sessions ahead, the...

Dollar steady ahead of European morning trade

The dollar managed a solid rebound towards the end of last week and is holding on to that coming into this week. Things are fairly calmer today, with light changes overall seen in the major currencies space. The dollar remains steady, as it looks to procure the next...

A less hectic week beckons after last week’s central bank bonanza

And that is not to mention that it will also be a holiday-shortened week for some key markets. Australia, New Zealand, Canada, and Europe in general will be observing holidays on Friday as the Easter bunny comes to visit. That will make for lesser flows towards the...

ForexLive Asia-Pacific FX news wrap: Verbal JPY intervention, & China state banks buy CNY

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Fed speakers Monday include Bostic, Goolsbee and Cook

1225 GMT / 0825 US Eastern time: Federal Reserve Bank of Atlanta President Raphael Bostic participates in moderated conversation on "Equitable Economic Development" before the University of Cincinnati Real Estate Center's March Roundtable, in Cincinnati, OhioBostic...

Bank of England Monetary Policy Committee member Mann speaks Monday

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

AUD getting another boost from the China intervention to support CNY

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

FX intervention – China major state banks seen selling USD/CNY

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China’s Industry Minister with very upbeat comments

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Goldman Sachs raised EUR/CHF targets

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

AUD spikes on firm CNY setting

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC sets USD/ CNY reference rate for today at 7.0996 (vs. estimate at 7.2267)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China vice Commerce minister says will expand opening up to outside world

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[전국 1인당 10만원!! 지자체 추가 5만원 지원!! 28일부터~신청 접수!!]#3.1경제독립tv

https://www.youtube.com/watch?v=fGOzrE5r6KE [전국 1인당 10만원!! 지자체 추가 5만원 지원!! 28일부터~신청 접수!!]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

Monetary Authority of Singapore seen loosening policy soon as April, weaker SGD forecast

Bloomberg (gated) have collated some remarks from analysts looking for Singapore's central bank, the Monetary Authority of Singapore, to begin loosening policy perhaps as soon as its April meeting. Inflation cooled in January, February data will ve eyed for clues this...

BOJ not under pressure to accelerate rate hikes at pace that is seen in western countries

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.2267 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

Bank of Japan January meeting minutes – rising likelihood of hitting inflation target

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USD/JPY (not quite) round trip after Kanda’s threatening (intervention) comments

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[전국 1인당 10만원!! 지자체 추가 5만원 지원!! 28일부터~신청 접수!!]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/03/eca084eab5ad-1ec9db8eb8bb9-10eba78cec9b90-eca780ec9e90ecb2b4-ecb694eab080-5eba78cec9b90-eca780ec9b90-28ec9dbcebb680ed84b0ec8ba0ecb2ad-400x250.jpg)