High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ForexLive Asia-Pacific FX news wrap: RBNZ to hold rates higher for longer, NZD rises

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Fitch affirms China A+ rating but lowers its outlook to negative

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China vehicle sales rose in March, bouncing back from February

Wall Street Journal with the info, citing data from the China Passenger Car Association:Retail sales of passenger cars surged 53% m/m Retail sales of passenger cars in China rose 6.0% y/y to 1.687 million unitsChina Passenger Car Association said consumer demand...

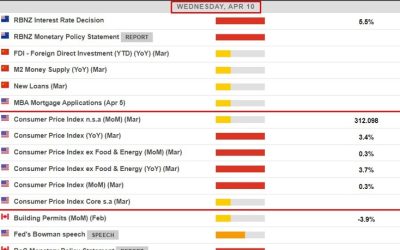

Big Federal Reserve day coming up – CPI, then Bowman, Barkin, Goolsbee, & March minutes

The US CPI report is due at 1230 GMT / 0830 US Eastern time:Following this we have plenty to come from the Federal Reserve.Times are in GMT / US Eastern time format:1245 / 0845 Federal Reserve Board Governor Michelle Bowman participates virtually in discussion on...

NZD/USD trading higher after the RBNZ statement (TL;DR on rates is ‘higher for longer’)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

NZD/USD traded higher on the inflation-fighting RBNZ statement

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

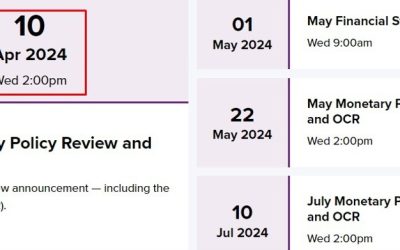

Reserve Bank of New Zealand leaves it cash rate at 5.5%, as widely expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BoJ Gov Ueda comments on challenges of prolonged deflation, low inflation

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ICYMI – What to watch in Japanese comments for USD/JPY selling intervention getting closer

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC sets USD/ CNY central rate at 7.0959 (vs. estimate at 7.2300)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BoJ Governor Ueda says won’t change monetary policy just to deal directly with FX moves

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

“Putin and Xi’s Unholy Alliance”

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

More from BOJ’s Ueda – wanted to move before trend inflation hit 2%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.2300 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

BoJ Ueda anticipates accommodative financial conditions will be maintained for time being

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan data: March PPI +0.2% m/m (expected +0.3%)

The m/m is lower than expected while the y/y is in line. Yen FX barely moved on the data release. Traders are awaiting the US CPI later, of course:---The Producer Price Index (PPI) in Japan is also known as the Corporate Goods Price Index (CGPI)its a measure of the...

Preview of the RBNZ monetary policy decision due today, on hold expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US CPI data due Wednesday, the ranges of estimates (& why they’re crucial to know)

Later today, Wednesday, 10 April 2024, we get the US consumer inflation data.for March 2024 due at 1230 GMT, which is 0830 US Eastern timeThis is one of those reports that is critical to the outlook ahead. For example:the Federal Reserve will be eyeing it for the...

Goldman Sachs on the largest selling of stocks by hedge funds in 3 months – short sales

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...