Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have moderated since early last year but remain strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.The Committee...

BOC Minutes: Conditions should materialize for cuts in 2024 but ideas on timing differed

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US dollar softens in the count down to the FOMC decision

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Are the dots the wrong thing to be focused on?

AI imageThe market likes to focus on the dot plot because it's the clearest indication of where the Fed plans to have its policy rate. That said, there's an inherent uncertainty around the dots that doesn't capture the Fed's thinking.Maybe it's better to focus on the...

EURUSD price action ahead of crucial FOMC decision

EURUSD ping-pongs ahead of FOMC rate decisionIn the European session, EURUSD saw a downward trend, notably breaking below its 100-day moving average (MA) at 1.0857. The decline continued until the currency pair reached and tested significant support levels—the 200-day...

The SEC is waging a compaign to classify ethereum as a security – report

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

NZDUSD trades to new 2024 lows today and maintains a bearish bias. What shift the bias?

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Ethereum Foundation under investigation – report

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

AUDUSD traders stall the rise today against a key MA and keep the sellers in control

The AUDUSD moved higher in early Asian trading today but found willing sellers against it to hundred bar moving out on the four hour chart had 0.65399. That moving average is the first of a series of moving averages that would need to be broken on the topside to shift...

March Eurozone consumer confidence -14.9 vs -15.0 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The quick stock market snapshot is mixed. Waiting for Jerome.

Stock market heatmap bu FinViz.com, start of 20 March 2024📈 Sector overview: In today’s trading session, the technology sector is showing resilience, with Microsoft (MSFT) slightly up by 0.07%. The semiconductor space, however, is exhibiting a modest retreat, with...

Introducing Trader Zone at FMAS:24!

The Finance Magnates Africa Summit 2024 (FMAS:24), will be here before you know it, coming this May 20-22 to Sandton City, South Africa. Now in its second year, the premium event will be expanding its content track, introducing the Trader Zone to cater to a growing...

EIA weekly crude oil inventories -1952K vs +13K expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDCAD bounces higher today but finds sellers near swing area resistance. What next?

The USDCAD yesterday moved higher and moved into a swing area on the 4-hour chart between 1.36049 and 1.36269. In between sits the 61.8% retracement of the move down from the November 2023 high to the December 2023 low at 1.3623. That move to the upside failed and the...

Oil lower ahead of US inventory report

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

CFTC Supports the Continuation of Gold’s Trend! Eyes Turn to the Fed!

Gold declines but remains within the descending triangle pattern. Additionally, the correlation with the US Dollar weakens according to statistics. Last week, buyers increased the number of contracts by 25,734, and sellers decreased by 2,766. UK inflation declines...

Gold springs to life ahead of the Fed decision

Gold has quickly risen to a five-day high with a $10 pop in the last few minutes.There doesn't appear to be a catalyst for the sudden buying in a market that's otherwise settled ahead of the 2 pm ET FOMC decision.This might be a bet on a more-dovish-than-expected FOMC...

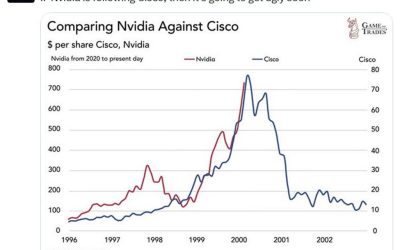

Chart overlays continue to lead people in the wrong direction

Overlaying two charts is the worst form of click-baity engagement farming. It works every time too.Guess what, history does rhyme but no one has ever made money overlaying a chart like this and even then, it's obviously manipulated to match two very-different things.I...

USDCHF extends above key retracement target. Trades at highest since November 14

The price of the USDCHF has followed the US dollar higher and in the process has been able to extend above its 61.8% retracement of the move down from the October 2023 high to the December low. That retracement level comes in 0.88957. In the process, the pair is...

ECB’s Schnabel: We may now be facing a turning point in real interest rates

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...