USDJPY trades to a new session high. Targets 149.196 next.The USDJPY is moving to a new session high and in the process is now moving further away from the 50% midpoint of the move down from teh February high at 148.676, and a swing area between 148.82 and 148.888....

Weekly Market Recap (11-15 March)

Over the weekend, the Chinese Inflation data beat expectations by a big margin:CPI Y/Y 0.7% vs. 0.3% expected and -0.8% prior. CPI M/M 1.0% vs. 0.7% expected and 0.3% prior. Core CPI Y/Y 1.2% vs. 0.4% prior.Core CPI M/M 0.5% vs. 0.3% prior. China National Bureau of...

USDCAD corrects lower today after failing on a key break earlier today. What next?

The USDCAD moved higher this week, helped by a sharp rise yesterday after stronger than expected US CPI data and weekly initial and continuing claims. The price extended above a number of moving averages with the 100-day moving average at 1.3527 the final in the MA...

ECB’s Makhlouf: Picture should be sufficiently clear in June

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US 10-year yields near the highs of the year

US 10 year yields dailyYields have risen this week as CPI numbers stayed hot but that doesn't tell the whole story. Many in the bond market watching the Bank of Japan and that's why yesterday's weaker retail sales report didn't have much of an effect.The leaks from...

USDCHF backs off to support swing area between 0.8818 to 0.8825. Hold and buyer control.

The USDCHF has moved higher this week, peaking earlier today before moving lower. The subsequent move lower has taken the pair back to a swing area between 0.8818 and 0.8825 and its 200 day moving out at 0.8823. That area has so far held support. If it can continue,...

[부업/수익 인증] 퇴근 후 ‘이렇게’ 하니, 월 200만원 이상 추가 수익 들어옵니다! 이건 꼭 하세요! (나이 학력 무관! 0원으로 가능한 투잡) ft.정민제

https://www.youtube.com/watch?v=JvzfDXIOBnQ 그동안 다양한 직장인 부업과 투잡을 소개해 드렸는데요, 오늘은 집에서 재택부업으로 시작해 월 200만원 이상 돈버는 새로운 방법을 소개합니다. 이번에 만난 인터뷰이는 정민제 님인데요, 정민제 님은 월수익이 적어 고민하던 차에, 부수입을 만들 수 있는 새로운 방법을 알게 되었고, 꾸준히 노력한 결과 현재 매달 200만원 이상의 돈을 꾸준히 벌고 있는데요, 이번에 나그네님들을 위해 자신이 실제로 무료...

ECB’s Lane: Labor market is softening in many ways

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

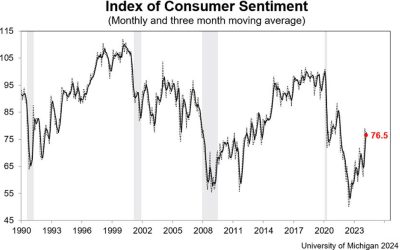

UMich March prelim consumer sentiment 76.5 vs 76.9 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Lane: Services inflation is receding more slowly than historical norm

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US stocks trading lower with the Nasdaq index the weakest

The major US stock indices are trading lower to start the final trading day of the week. The declines are led by the Nasdaq index. The declines have erased the modest gains for the week for the broader indices. The Dow Industrial Average is still marginally higher.The...

ECB’s Vujcic says prefers 25 bps pace of cuts but weaker economy could speed the pace

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US equity futures sink in sharp move ahead of the open

S&P 500 futures are down 24 points, or 0.5% ahead of the open. Futures were flat an hour ago but the selling has picked up in the past 30 minutes.There are two worries:1) Adobe shares are down 12% in the pre-market. This is the first real earnings crack in a...

Kickstart your FX trading for March 15 w/a technical look at the EURUSD, USDJPY and GBPUSD

The kickstart video above for Friday, March 15 takes a technical look at the EURUSD, USDJPY and GBPUSD and outlines what levels are in play, what is the bias, the risks and the targets? Those levels are meant to pave a roadmap for your trading where you can see where...

US February industrial production +0.1% vs 0.0% expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

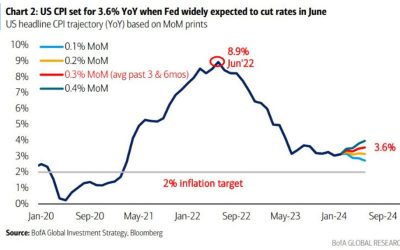

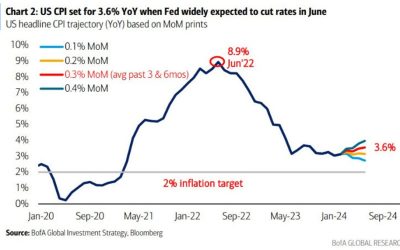

Where will US inflation be when the Fed meets in June

Market pricing for a Fed cut at the June 12 meeting has fallen to 62% and there are only 74 bps of cuts priced in. There's a rising chance that next week's Fed dots will show just 50 bps in cuts as the median.Here's a good chart from Bank of America showing why. It...

Canada January wholesale trade +0.1% vs -0.6% expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

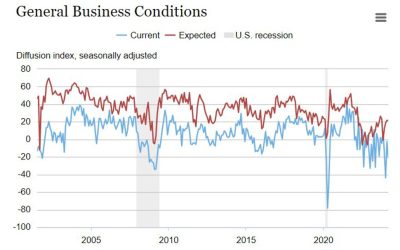

NY Fed empire manufacturing survey for March -20.90 vs -7.00 estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US February import prices +0.3% vs +0.3% expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Canada February housing starts 253K vs 230K expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[부업/수익 인증] 퇴근 후 ‘이렇게’ 하니, 월 200만원 이상 추가 수익 들어옵니다! 이건 꼭 하세요! (나이 학력 무관! 0원으로 가능한 투잡) ft.정민제](https://my.blogtop10.com/wp-content/uploads/2024/03/ebb680ec9785-ec8898ec9db5-ec9db8eca69d-ed87b4eab7bc-ed9b84-ec9db4eba087eab28c-ed9598eb8b88-ec9b94-200eba78cec9b90-ec9db4-400x250.jpg)