High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Investing Education: A Beginner’s Guide to Investing in Gold

A clear, beginner-friendly guide to help young investors understand why gold is still relevant and how to invest in it."Gold has been a store of value for thousands of years — and it still plays a role in modern investing."Investing in goldWhy Gold Still Matters in...

EU trade commissioner says will talk to US counterparts tomorrow

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Learn to Invest: Who cares about currencies in investing?

A simple, practical guide for young investors to understand how currencies can impact their investing returns."When you invest globally, you’re not just betting on stocks — you’re betting on currencies too."Who cares about currencies in investing?What Is Currency Risk...

EU to vote on countermeasures to US steel, aluminum tariffs on 9 April

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The dollar hemorrhage continues in European trading

The moves on the session are turning rather outsized now but they're all in one direction. And that is the dollar falling out of favour as it continues to be pummeled across the board. EUR/USD is now up 1.9% to 1.1060 and USD/JPY down 1.9% as well to 146.43 on the...

Investing Education: Why Global Investors Care About the US Dollar

A beginner-friendly guide on why the US dollar matters in investing — and what could happen if trust in it starts to crumble."The US dollar isn’t just America’s currency — it’s the world’s financial backbone."Why Global Investors Care About the US DollarWhy the US...

VSee Health Highlights: AI-Powered Telehealth Redefining $787b Digital Healthcare Market

The healthcare industry is undergoing a significant transformation, and VSee Health, Inc. (Nasdaq: VSEE) is at the forefront, pioneering AI-driven telehealth solutions that are revolutionizing patient care. As a leader in digital health technology, VSEE is redefining...

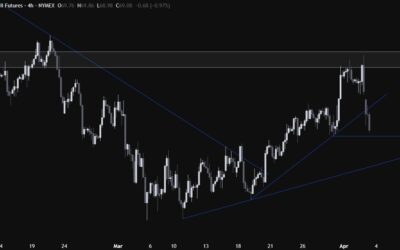

USDCHF breaks out of the range and collapses amid risk-off flows

The CHF as well as the JPY are generally considered as safe havens in the FX space. They appreciate in times of risk-off sentiment and depreciate when the mood is positive. Trump yesterday surprised with worse than expected reciprocal tariffs that triggered a wave of...

Deutsche Bank warns of a dollar confidence crisis

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Barclays warns of strong possibility of a US recession this year

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

OPEC+ reportedly not expected to change oil output policy today

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Crude oil feeling the pinch from global growth fears

The Trump's announcement yesterday was without a doubt worse than expected. There were some positive caveats like reciprocal tariffs not coming into effect immediately and so on, but there's a limit to optimism and hopefulness. Right now, the market is pricing a...

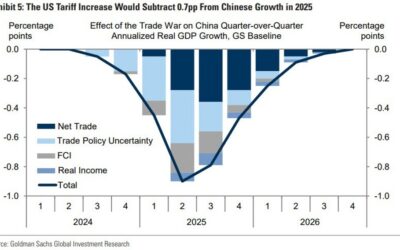

Goldman Sachs estimates latest tariffs to weigh on China’s GDP growth by a further 1%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Eurozone February PPI +0.2% vs +0.1% m/m expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

2025년! 온누리상품권 통합되면서 10%이상 다양한 혜택을 편하게 받으세요!

https://www.youtube.com/watch?v=sG84WUPTlh0 혹시 여러분, 시장에서 물건을 구매할 때 “온누리상품권” 이용해 본 적 있으신가요? 이게 생각했던 것 보다 할인혜택도 많고 더 편리해졌는데요. 어떻게 사용하면 혜택이 좋은지 알려드리겠습니다. #뉴스 #온누리상품권 #혜택 MoneyMaker FX EA Trading...

How have interest rates expectations changed after the tariffs announcement?

Rate cuts by year-endFed: 82 bps (76% probability of no change at the upcoming meeting) ECB: 70 bps (90% probability of rate cut at the upcoming meeting) BoE: 60 bps (76% probability of rate cut at the upcoming meeting) BoC: 57 bps (71% probability of no change at the...

Dollar slumps further across the board as tariff angst weighs

The dollar is falling further in European trading as it fails to find any shelter in the first wave of the market reaction towards Trump's tariffs. Worries about the tariffs driving the US economy to the brink of a recession are outweighing everything else, with...

SNB’s Tschudin: US tariffs on Switzerland surprisingly high

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

German Chancellor Scholz: Europe will respond appropriately and proportionately

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...