The SNBs Jordan is speaking and says:Lower inflation pressure allowed them to lower interest ratesThe bank looks at the exchange rate closely and intervenes in Forex when necessarySNB has no set goal for Franc rateThe bank has reduced the size of the balance sheet...

EURUSD price action analysis: key levels and targets to watch

EURUSD trades below key MA/50% but above a floor target areaThe EURUSD is trading in a narrow trading range in the US session. The low was reached at 1.08102. The high in the US session reached 1.08251That keeps the pair below the falling 100 hour MA at 1.08314, the...

ANZ: We don’t feel comfortable taking long JPY positions yet; here is why?

USDJPY dailyANZ expresses hesitance in taking long positions on the Japanese Yen despite potential moderation in USD/JPY gains following the Bank of Japan rate hike in March. The bank compares the current BoJ's cautious approach and uncertain outlook for future rate...

XCAD Announces Multiple Governments’ Backing for New Initiative to Expand Web3 Education

XCAD Network - a tokenisation platform for YouTubers to connect and reward their viewers with crypto tokens - today announced it has signed MOUs (Memorandum of Understanding) with multiple governments to expand incentivised Web3 education to millions of people across...

US 10-year yields are in an interesting spot

US 10-year yields are at a two-week low, down 4.6 bps to 4.188% and at the lows of the day. That comes after a strong seven-year auction to follow up on yesterday's firm 5-year result.The auction sizes this week are huge but the demand is there, at least in terms of...

US sells 7-year notes at 4.185% vs 4.193% WI

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Euro Latest – German GDP Seen at Just 0.1% in 2024, EUR/USD Under Pressure

EUR/USD Prices, Charts, and AnalysisThe German economy is struggling according to five leading economic institutes.Two ECB rate cuts before the August holiday break?Learn How to Trade EUR/USD with Our Complimentary Guide Recommended by Nick Cawley How to Trade EUR/USD...

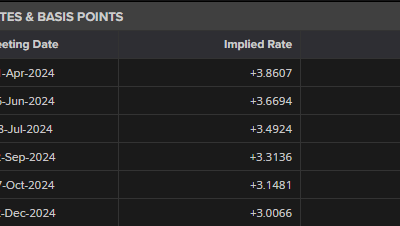

U.S. Treasury to sell $43 billion of seven-year notes at 1 PM ET

As US yields are moving lower today, the US treasury will auction off $43 billion of 7-year notes at 1 PM ET. A snapshot of the treasury market yield curve currently shows:2-year 4.566%, -3.1 basis points5-year 4.191%, -3.5 basis points10 year 4.202%, -3.2 basis...

Bitcoin makes a new high, and them makes a new low for the day. What next?

The price of Bitcoin whipped to a new high in the US morning session and in the process extended above the high price for the week at $71572. The high for the day was reached at $71754, but buyers turned to sellers, and the price rotated lower.The subsequent run to...

Eyes on the fix

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Investors Amend Portfolios in Preparation For The Upcoming Earnings Season!

Analysts see very little potential for Tesla’s stock price to rise in the medium term. Economists also indicate the stock may fall outside of the NASDAQ’s top ten influential stocks. The USA100 continues to trade within a descending triangle with no real bullish...

BofA: USD dynamics post-FOMC: ‘birds of a feather’?

BofA analyzes the short-lived USD selloff following the March FOMC meeting, attributing the initial decline to several perceived dovish indicators from the Fed. However, subsequent dovish actions or communications from other G10 central banks, such as the SNB's...

AUDUSD sellers pushed below trend line support but failed in what is an up and down day

In the video above, I take a look at the AUDUSD from a technical perspective. This week, the price action has been up and down volatile. Today, the low was pressed with the price moving down to test a lower upward sloping trend line. That trend line was broken on 2...

US urges allies to bar companies from servicing certain Chinese chipmaking tools

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

EIA weekly US crude oil inventories +3165K vs -1275K expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US weekly EIA crude oil inventory data coming up next

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDCAD backs off from ceiling area again

The USDCAD moved up to retest the swing area between 1.36049 and 1.36269. The high price today reached near the low of that ranges at 1.36071 before rotating back to the downside. The price is trading near session lows nos at 1.3578. Going forward that ceiling area...

US judge rules that Coinbase failed to register as a securities business

Shares of Coinbase are quickly lower by 2% after a court ruling allowing the SEC to proceed with a lawsuit that Coinbase failed to register as a securities business. However the claim they acted as an unregistered broker via wallet application was dismissed, so it's...

US stocks are trading higher at the open, erasing declines from yesterday

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDCHF continues its run to the upside as the buyers keep the momentum going

The USDCHF is running higher again after basing against its broken 38.2% retracement of the move dale from the 2022 hi. The retracement comes in at 0.90254. The low today was a few pips short of that level before buyers stepped in and pushed the price higher. Staying...