High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US stocks open mixed as traders digest the US employment data

The major indices are trading mixed with the S&P and NASDAQ indices higher and trading at new intraday highs. The Dow Industrial Average is trading above and below unchanged.A snapshot of the market currently shows:Dow Industrial Average is trading down -1.5...

Kickstart the trading day for March 8 w/a technical look at the EURUSD, USDJPY and GBPUSD

The above video kickstarts the trading day for March 8 with the technical look at the EURUSD, USDJPY and GBPUSD after the US jobs report. That report was more mixed with stronger job gains this month, but large revisions to prior months. The unemployment rate also...

US dollar slumps on rising unemployment and weaker wage growth

The US dollar is at the lows of the week following the February non-farm payrolls report. The headline number was strong at +275K compared to +200K but underneath were some soft details. For starters, the prior two reports were revised collectively lower by 167,000...

Canada Q4 capacity utilization rate 78.7% versus 79.7% last quarter

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

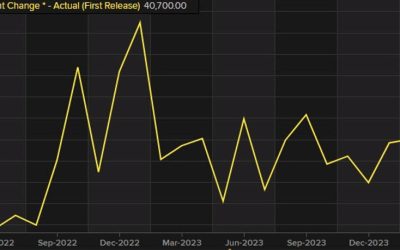

Canada February employment change 40.7K versus 20.0K estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US February non-farm payrolls +275K vs +200K expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Locked and loaded for another edition of non-farm payrolls. Watch the wage numbers

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ForexLive European FX news wrap: Yen strengthens on BOJ anticipation, NFP up next

Headlines:Markets:JPY leads, EUR lags on the dayEuropean equities mixed; S&P 500 futures down 0.2%US 10-year yields down 2.3 bps to 4.069%Gold up 0.3% to $2,166.54WTI crude down 0.7% to $77.73Bitcoin up 0.4% to $67,620The yen is once again the big mover today as...

Fed’s Williams: Inflation expectations have come down quite a bit

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[2024 새로운 부업] 7분 만에 초간단 무료 AI로 자동 부수입 만들기 (집에서 0원으로 누구나 가능! 지금 바로 따라해보세요)

https://www.youtube.com/watch?v=ElJYABgl2AQ 재택 부업을 비롯해, 그동안 다양한 돈버는 직장인 부업과 투잡을 소개해드렸는데요, 오늘은 초간단 AI 사용해, 자동으로 돈버는 새로운 방법을 소개하려고 합니다. 하루 7분이면 충분하고요! 나이 학력 무관한데다 컴퓨터, 노트북, 휴대폰 등만 있으면 주부, 학생들도 누구나 쉽게 도전해볼 수 있는 부업인데요, 0원으로 시작할 수 있고, 가이드를 1번만 따라해 보면, 무척 간단해서 쉽게 하실 수...

Market Recap – NFP day post ECB & FOMC signalling possible June cuts!

Economic Indicators & Central Banks: Global stocks rallied on dovish signals from the ECB and FOMC, while focus turns to today’s NFP. Lagarde signalled rates are likely to remain unchanged in April but that in the central scenario there will likely be...

The countdown continues ahead of the US jobs report

The Japanese yen has been the big mover in European trading, as USD/JPY briefly dipped below 147.00 amid more hawkish BOJ murmurs during the session. Outside of that, the market moves so far today have been relatively contained for the most part.The dollar remains...

Eurozone Q4 final GDP 0.0% vs 0.0% q/q second estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

IC Markets Now Live on TradingView

IC Markets, a global leader in online trading and investing, has integrated with TradingView to enhance the way traders navigate the financial markets. With a thriving community of over 50 million traders worldwide, coupled with superior charting tools, real-time...

Japanese yen extends run higher as hawkish BOJ murmurs continue to grow

USD/JPY daily chartIt looks like we've broken through the first key technical hurdle for USD/JPY on the way down, as sellers are firmly pushing price below the 100-day moving average (red line) of 147.70 today. The hawkish murmurs surrounding the BOJ continue to grow,...

BOJ might not wait until April to exit negative rates – report

It is being reported that a growing number of BOJ policymakers are coming around to the idea of putting an end to negative rates later this month. And they might choose to do so on expectations of stronger results at this year's spring wage negotiations. One of the...

Nominations Now Open for the UF AWARDS LATAM 2024!

Standing out in any competitive industry is a noteworthy accomplishment, especially in the online trading and fintech spheres. The UF AWARDS LATAM 2024 represent the best chance to achieve this feat and gain notoriety, solidifying oneself as a brand authority and...

BOJ reportedly to review YCC as it considers new quantitative policy framework

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Holzmann: A rate change may be in preparation

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[2024 새로운 부업] 7분 만에 초간단 무료 AI로 자동 부수입 만들기 (집에서 0원으로 누구나 가능! 지금 바로 따라해보세요)](https://my.blogtop10.com/wp-content/uploads/2024/03/2024-ec8388eba19cec9ab4-ebb680ec9785-7ebb684-eba78cec9790-ecb488eab084eb8ba8-ebacb4eba38c-aieba19c-ec9e90eb8f99-ebb680ec8898ec9e85-eba78c-400x250.jpg)