USD/JPY has lost a few bids on the remarks from Kanda.Kanda's comments are more forceful than what we have been hearing last week, mentioning speculation, taking steps ... Have been closely watching fx moves with high sense of urgencyWill take appropriate steps to...

Financial Times reports that China blocks use of Intel & AMD chips in government computers

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Post-Bostic headline: “Why a Fed rate cut in June is not yet a done deal”

ICYMI, Bostic spoke late on Friday, after RTH:Its not like Bostic is an outlier with this view, his FOMC colleague Kashkari has been forthright also:That link is to comments from Federal Reserve Bank of Minneapolis President Neel Kashkari speaking in an interview with...

China’s Finance Minister said will allocate more fiscal resources

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

More on China’s Premier Li weekend comments – “room for further macro policy steps”

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

France has raised its terror alert to its highest level

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China’s Li: low inflation, low central government debt means ample room for macro policy

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ICYMI: Late Friday Fed’s Bostic shifted his 2024 forecast to only 1 rate cut 2024 (from 2)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trade ideas thread – Monday, 25 March, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Economic calendar in AsiaMonday, 25 March 2024

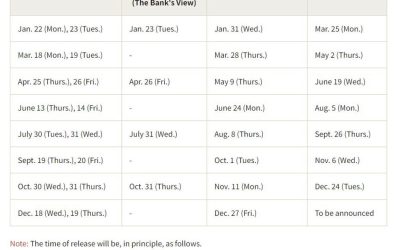

We have minutes of a Bank of Japan meeting due today. These are for the meeting on January 22 and 23. That was a nothing meeting, but in hindsight was the one before the historic changes made at the March meeting (the first BOJ interest rate rise in 17 years and the...

Monday morning open levels – indicative forex prices – 25 March 2024

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Markets Week Ahead: Gold Overreacts, Sterling Sinks and USD Advances

Gold Whipsaws and Signals a Potential Momentum ShiftThe precious metal rose phenomenally in the wake of the FOMC meeting and updated summary if economic projections. The US dollar acted as the release valve for all the hawkish sentiment that had been priced into the...

Bitcoin fails to sustain breakout, traders brace for potential support retest

BTCUSD 4 hourly chart shows a failed breakoutBitcoin's recent price action on the 4-hour chart presents a fascinating narrative of a failed breakout, highlighting the constant battle between bulls and bears in the cryptocurrency market. Here's an in-depth look at the...

Reddit stock IPO technical analysis: Bears take control after initial optimism

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Week Ahead Preview – highlights include US PCE, Aus CPI, Riksbank

MON: US Building Permits (Feb), UK GDP (Q4).TUE: US Durable Goods (Feb), US Richmond Fed (Mar).WED: Riksbank Announcement (MPR), SARB Policy Decision; Australian CPI (Feb), Spanish Flash CPI (Mar), EZ Sentiment Survey (Mar).THU: BoJ SOO (Mar), Scandinavian Holiday...

Weekly Market Outlook (25-29 March)

UPCOMING EVENTS:Tuesday: US Durable Goods Orders, US Consumer Confidence.Wednesday: Australia Monthly CPI, Fed’s Waller.Thursday: BoJ Summary of Opinions, Australia Retail Sales, Canada GDP, US Final Q4 GDP, US Jobless Claims.Friday: US Good Friday Holiday, Japan Jobs...

삼성폰 쓰신다면, 딱 3분만 해보세요! 앞으로 정말 편해집니다.

https://www.youtube.com/watch?v=VBovr6vxy2A 오늘 영상은 삼성 갤럭시폰 사용하시는 분들에게만 해당하는 내용입니다. 3분만 투자하면 앞으로 생활이 굉장히 편해집니다. 이번 주부터 사용이 가능해졌는데요. 앞으로는 대부분 국민들이 사용하게 될 것 같습니다. #삼성폰 #갤럭시 #3분 #꿀팁 MoneyMaker FX EA Trading...

Goldman Sachs has raised its forecast for USD/JPY to 155 (from 145) (3 month horizon)

Goldman Sachs forecasts for USD/JPY:3 months 155 (the prior forecast for 3 months out was 145)6 months 150 (prior 142)12 months 145 (prior 140)These are from a GS note sent to client on Friday. GS cite a “benign macro risk environment" for its bearish view on yen. GS...

US Dollar Forecast: PCE Data to Steal Show; EUR/USD, USD/JPY, GBP/USD Setups

Most Read: U.S. Dollar Outlook & Market Sentiment: USD/JPY, USD/CAD, USD/CHFThe U.S. dollar, as measured by the DXY index, strengthened this past week, closing at its best level since mid-February on Friday. Despite initial losses following the Fed’s dismissal of...

[잠자는 내통장 공돈! 안 찾으면 없어진다! 세금환급148만원까지~이통장 없다면 나만 손해!]#3.1경제독립tv

https://www.youtube.com/watch?v=nCzhWkDySDU [잠자는 내통장 공돈! 안 찾으면 없어진다! 세금환급148만원까지~ 이통장 없다면 나만 손해!]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

![[잠자는 내통장 공돈! 안 찾으면 없어진다! 세금환급148만원까지~이통장 없다면 나만 손해!]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/03/ec9ea0ec9e90eb8a94-eb82b4ed86b5ec9ea5-eab3b5eb8f88-ec9588-ecb0beec9cbceba9b4-ec9786ec96b4eca784eb8ba4-ec84b8eab888ed9998eab889148-400x250.jpg)