European PMI data for Services and Manufacturing sectors again fall and indicate further pressure within the European markets. The Pound declines as dovish members of the Monetary Policy Committee outnumber the hawks. The Pound is seeing the strongest decline against...

The SNB surprised with a cut today. What are the chart saying for USDCHF and EURCHF now?

The Swiss National Bank surprise the market by cutting rates by 25 basis points. That sent the CHF lower vs both the USD and the EUR. In this video, I take a look at both the USDCHF and the EURCHF from a technical perspective. The USDCHF is running to new 2024 highs...

US existing home sales for February 4.38M vs 3.94M expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

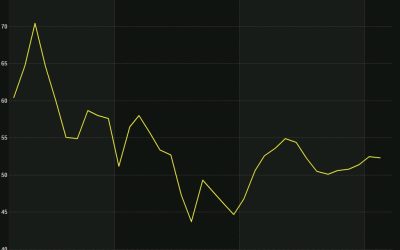

US March flash S&P Global services PMI 51.7 vs 52.0 expected

Three-month lowPrior was 52.3Manufacturing 52.5 vs 51.7 expectedPrior manufacturing was 52.2Composite 52.2 vs 52.5 priorThis is a small miss but the direction is lower, highlighting some subtle weakening in the US economy.Commenting on the data, Chris Williamson,...

BOC’s Gravelle: We will continue process of normalizing balance sheet

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US PMIs from S&P Global coming up next

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

New record highs for the major indices

The major US indices are opening with gains led by the NASDAQ index. Those moves have each of the indices trading at new record levels. Yields are marginally lower in the US. Swiss National Bank surprised with a interest-rate cut which may have other central banks...

US stocks set to surge to a fresh record at the open

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Kickstart your FX trading for March 21 w/a technical look at the EURUSD, USDJPY and GBPUSD

There is a lot of news to digest. The Swiss National Bank surprised the markets with a interest-rate cut, leading the way on the cut side for the major currencies (the Bank of Japan raised rates earlier this week). The Federal Reserve kept the rates unchanged...

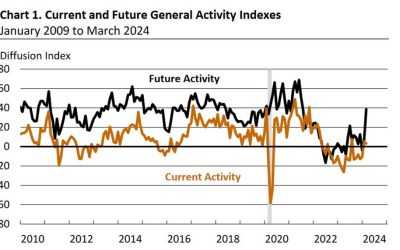

Philly Fed March business index +3.2 vs -2.3 expected

Philly Fed business indexPrior was +5.2Employment: -9.6 vs -10.3 priorNew orders: +5.4 vs -5.2 priorPrices paid: +3.7 vs +16.6 priorPrices received: +4.6 vs +6.2 priorShipments: +11.4 vs +10.7 priorUnfilled orders: +1.0 vs -11.7 priorDelivery times: -16.7 vs -21.1...

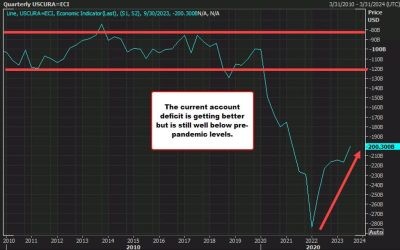

US Q4 current account deficit -194.8B vs -209.0B estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Canada February new housing price index +0.1% m/m vs -0.1% prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

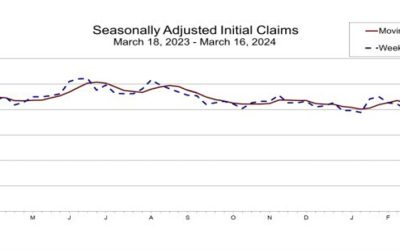

US initial jobless claims 210K vs 215K estimate

Initial jobless claims for the current weekPrior 209K revised to 212K.Initial jobless claims 210K vs 208K estimate.4-week moving average of initial claims 211.25K vs 208.75Klast weekContinuing claims prior week 1.8111M revised to 1.803M.Continuing claims current week...

ForexLive European FX news wrap: Swiss franc falls as SNB surprises with rate cut

SNB:Headlines:Markets:AUD leads, CHF lags on the dayEuropean equities higher; S&P 500 futures up 0.4%US 10-year yields down 3.8 bps to 4.233%Gold up 0.9% to $22,06.43WTI crude down 0.3% to $80.50Bitcoin up 0.1% at $67,170As the window of opportunity is opening up...

German economy likely in recession in Q1 2024 – Bundesbank

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Web3 Base Layer – Mystiko.Network Completed an 18 Million USD Seed Funding Round

Mystiko.Network, the leading Base Layer of Web3, has completed a 18 Million USD seed funding round led by Sequoia Capital India/SEA (now known as Peak XV Partners), with participation from Samsung Next, Hashkey, Mirana, Signum, Coinlist, Naval Ravikant, Sandeep...

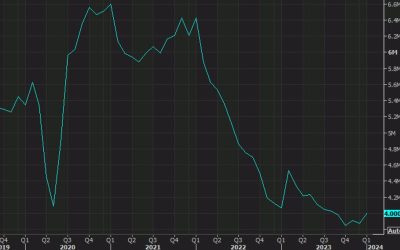

Treasury yields retreat further post-Fed but nears key technical juncture

After nearing the highs for the year earlier this week, 10-year Treasury yields have come down a fair bit. The move lower was helped by a more dovish Fed yesterday, with the rebound last week now resembling a double-top pattern. But as yields retreat, they are nearing...

SNB chairman Thomas Jordan says rate cut is not a parting gift

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

UK March flash services PMI 53.4 vs 53.8 expected

Prior 53.8Manufacturing PMI 49.9 vs 47.8 expectedPrior 47.5Composite PMI 52.9 vs 53.1 expectedPrior 53.0The services print was slightly softer but a stronger manufacturing print is a welcome development, contrasting with what is taking place in the euro area at least....

Market Recap – Gold & Stocks at record highs; Fed maintained rate cut forecast

Economic Indicators & Central Banks: The Fed signalled that rate cuts are still in the cards, stock markets rallied, Treasury yield were lower and the US Dollar was down from earlier highs. DOT PLOT: Fed keeps rates on hold and signals 75 basis points of cuts...