High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

What does the US GDP report say about the consumer?

CIBC writes about today's GDP and the US consumer going forward. Personal consumption rose at a 2.8% annualized pace in the report, a deceleration from 3.1% in Q3 but still at a healthy clip, including an increase in services consumption to 2.4% from 2.2%.The slight...

Intel earnings after the close. What is expected .

Intel will report its earnings after the close. According to analysts:Expected Adjusted EPS: $0.45, a significant improvement from last year's Q4 earnings of $0.10 per share.Expected Revenue: $15.2 billion, higher than the $14 billion reported in the same quarter last...

What is on the after-hours US earnings calendar today

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

AUDUSD stuck in a narrow trading range for the week as trader await the next shove

The AUDUSD is mired in a narrow 70-pip trading range this week. The low was reached at the high of a swing area at 0.65504 (swing area down to 0.65417). The high reached up to the high of a swing area between 0.6612 to 0.66215. In between is the 200 day MA and the 50%...

Tesla shares fall 13% to the worst since May 2023. What’s next

The Magnificent Seven is now the Super Six.Shares of Tesla are now down 32% from the December 27 high of $265, including a 13% post-earnings drop today. The fall to $180 is the lowest since May 2023.Shares are wildly oversold with the daily RSI at 16.8 but the chart...

Oil rises to a seven-week high

WTI crude oil dailyOil is having itself a strong day on worries that Iran may be pulled into a Middle Eastern war and with the Red Sea closure looking like a real quagmire.In addition, oil is getting a tailwind from strong US GDP data and hopes for better Chinese...

ECB policymakers open to start discussing cuts in March if inflation data improves

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US sells 7-year notes at 4.109% vs 4.106% WI

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Putin said to signal that he’s open to talks on Ukraine – report

AI imageEarlier this month, Ukraine called for talks but it turned out those talks didn't include Russia and were pre-conditioned on the return of all Ukrainian territory and prosecution for war crimes. That's a bit of a non-starter.So we'll wait on where this goes...

EURUSD moves lower after ECB rate decision and in the process falls below the 200 day MA

The EURUSD moved lower on the back of the ECB rate decision and the press conference from ECBs Lagarde. In the process, the pair moved below the 200-day MA at 1.08432 and toward a key swing between 1.08038 to 1.08243. Move below that level and traders will be looking...

USDCAD corrects lower today but does find support buyers at the 200 day MA. What next?

The USDCAD moved sharply higher yesterday after the Bank of Canada interest rate decision. The price moved up toward the high price of last week at 1.35411, but fell short of that target. The subsequent move to the downside today took the price back down toward its...

European equity close: Can’t keep pace with the US

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

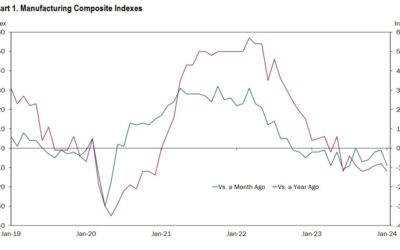

KC Fed composite index -9 vs -1 prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDCHF buyers try to take more control. 100 hour MA and 38.2% the next key targets.

The USDCHF has moved higher in trading today and in the process technicals have improved:The low yesterday held against it to her poor moving average on 4-hour chart (currently at 0.8608)Today, the price low stalled against a rising trend lineThe price is currently...

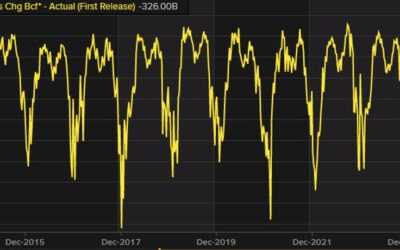

US posts largest weekly natural gas drawdown since 2021

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

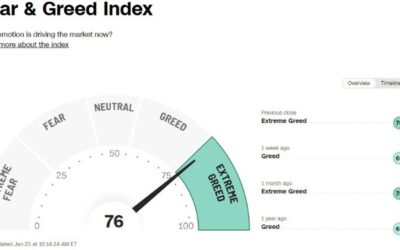

It’s getting a bit frothy

I think you can officially downgrade the Magnificent 7 to the Super 6 today with Tesla down another 10.4%.What's more impressive is that despite a 10% decline in one of the world's biggest companies, the Nasdaq is up 0.5% today and on track for a fifth consecutive...

Lif3 Accelerates DeFi Adoption and Innovation with BitFinex Listing

Today, $LIF3 (pronounced Life), a ground-breaking and complete omni-chain DeFi Layer-1 Curated Blockchain ecosystem, announces its recent listing on Bitfinex, a premier digital asset trading platform, after recently migrating to the Ethereum Network from Fantom. This...

US December new homre sales 664K vs 645K expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Lagarde major comments during press conference bucketed by topic. EURUSD lower.

ECBs Christine Lagarde's comments can be grouped into several key topics:Economic Outlook and Recovery Indicators:PMI a small signal that recovery conditions are coming into place.Some surveys point to growth further ahead.Incoming data signal weakness in near...