The USDCHF has moved higher in trading today and in the process technicals have improved:The low yesterday held against it to her poor moving average on 4-hour chart (currently at 0.8608)Today, the price low stalled against a rising trend lineThe price is currently...

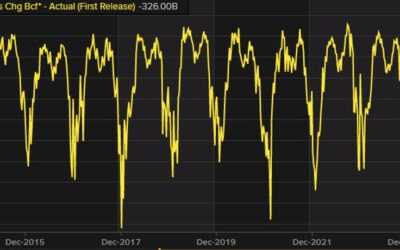

US posts largest weekly natural gas drawdown since 2021

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

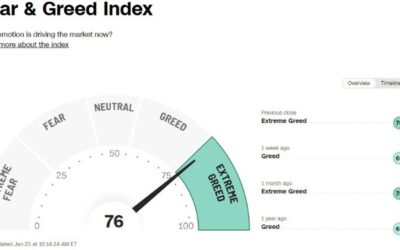

It’s getting a bit frothy

I think you can officially downgrade the Magnificent 7 to the Super 6 today with Tesla down another 10.4%.What's more impressive is that despite a 10% decline in one of the world's biggest companies, the Nasdaq is up 0.5% today and on track for a fifth consecutive...

Lif3 Accelerates DeFi Adoption and Innovation with BitFinex Listing

Today, $LIF3 (pronounced Life), a ground-breaking and complete omni-chain DeFi Layer-1 Curated Blockchain ecosystem, announces its recent listing on Bitfinex, a premier digital asset trading platform, after recently migrating to the Ethereum Network from Fantom. This...

US December new homre sales 664K vs 645K expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Lagarde major comments during press conference bucketed by topic. EURUSD lower.

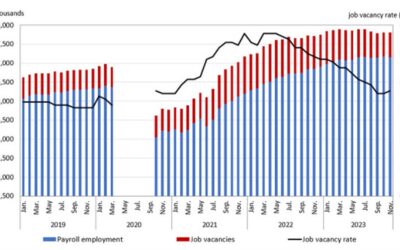

ECBs Christine Lagarde's comments can be grouped into several key topics:Economic Outlook and Recovery Indicators:PMI a small signal that recovery conditions are coming into place.Some surveys point to growth further ahead.Incoming data signal weakness in near...

US stocks move higher. NASDAQ and S&P index up for the sixth consecutive day

The major US stock indices are opening higher on the day with the NASDAQ index leading the way. The NASDAQ and S&P are working on their sixth consecutive day to the upside. Over that period, the S&P has closed at record levels for four days in a row. Today...

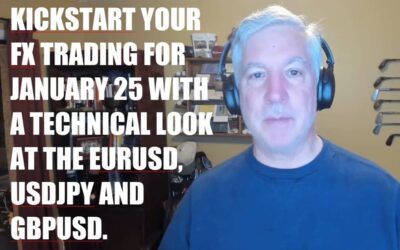

Kickstart your FX trading for January 25 with a technical look at EURUSD, USDJPY & GBPUSD

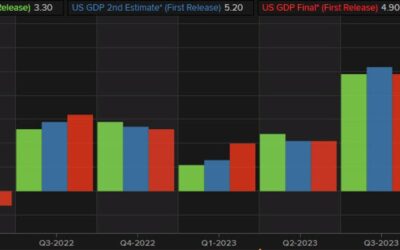

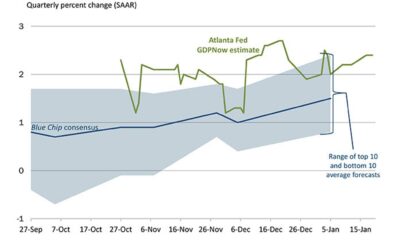

In the kickstart video, I take a look at three other major currency pairs from a technical perspective - the EURUSD, USDJPY and GBPUSD. There was a slew of economic data in the US highlighted by the Advanced GDP for the 4th quarter which showed strong growth and tame...

GBP/USD Outlook: US GDP and Fed Decisions Take Centre Stage

Key Highlights · UK PMIs Lift Sterling: Recent robust UK PMI data has provided a boost to the GBP, reflecting resilience in the services sector.· Retail Sales Concerns: Unexpectedly sharp declines in UK retail sales have injected caution into market sentiment.· US...

Lagarde Q&A: The consensus was that it was premature to discuss rate cuts

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Lagarde opening statement: Risks to economic data remain tilted to the downside

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Watch and listen live: Lagarde’s press conference

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Canada November weekly earnings +4.1% y/y vs +3.9% prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US wholesale inventories advanced for December 0.4% versus -0.4% last month

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

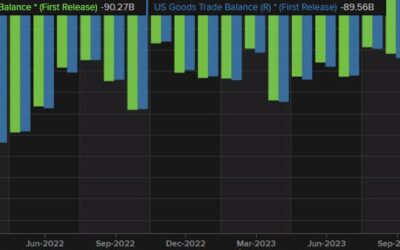

US December advance goods trade balance -88.46 billion vs -89.33 billion prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US durable goods for December 0.0% versus 1.1% estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

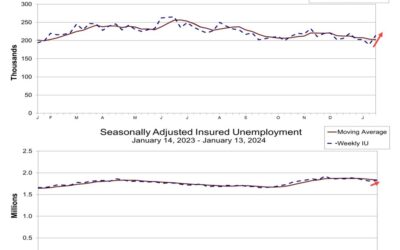

US initial jobless claims 214K vs 200K estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US Q4 advance GDP +3.3% vs +2.0% expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The first look at fourth quarter US GDP coming up next

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB leaves key interest rates unchanged in January monetary policy meeting

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...