Japan finance minister Suzuki:won't comment on forex levelssays it's important for currencies to move in a stable manneris closely watching FX moves with a high sense of urgencymakes no comment when asked about currency intervention.On his "No Comment on Currency...

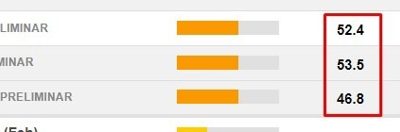

Japan March preliminary PMIs: Manufacturing 48.2 (prior 47.2) Services 54.9 (prior 52.9)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australian February unemployment rate 3.7% (vs. 4.0% expected)

That is a huge drop in the unemployment rate, and a huge number of jobs added.The jobless rate has been assisted by the drop in the participation rate, but I wouldn't go sullying the figures too much. Jobs data are volatile, but this is a great set of headlines. The...

PBOC is expected to set the USD/CNY reference rate at 7.1792 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

Japan’s government issues an emergency earthquake warning

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

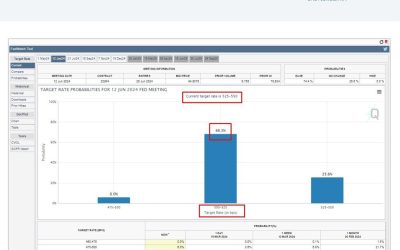

Fed Sticks to Dovish Policy Roadmap; Setups on Gold, EUR/USD, Nasdaq 100

FORECAST - GOLD, EUR/USD, NASDAQ 100The Fed held borrowing costs unchanged and continued to indicate it would deliver three rate cuts this yearThe dovish policy outlook weighed on the U.S. dollar and yields, boosting gold prices and the Nasdaq 100This article examines...

USD extending its losses in Asia morning trade, EUR/USD to a one week high

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

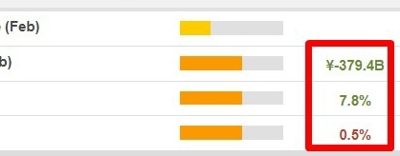

Japan February trade balance -379bn yen (vs. -810bn yen expected)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Hong Kong’s central bank follows the Fed, leaves base rate unchanged at 5.75%, es expected

The Hong Kong Monetary Authority is Hong Kong's central bank.The HKD trades in a band linked to the US dollar prescribed by the HKMA. You can see the limits of the band in the chart below.The Hong Kong Monetary Authority (HKMA) often adjusts its interest rates in line...

Japan Reuters Tankan for March shows solid improvement for Manufacturing and Services

The monthly Reuters Tankan survey, a guide to the Bank of Japan's quarterly tankan survey, due on April 1.Confidence at big Japanese companies rebounded to a three-month high in Marchmanufacturers' sentiment index stood at plus 10 in March, versus minus 1 in the...

Fed ‘insider’ Timiraos says Fed’s outlook has not changed since December: 3 cuts in ’24

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Gold price surging higher in thin trade

Gold was a beneficiary of the FOMC and Powell today, adding to its recent gains. And those have extended.This is a very thin liquidity time of day for pretty much everything, gold included. Which doesn't take away from this surge, not at all. The metal is benefitting...

Goldman Sachs have 3 three takeaways from Powell’s press conference

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australian March preliminary PMIs show manufacturing lower on the month & services higher

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

New Zealand Q4 2023 GDP -0.1% q/q (vs. +0.1% expected)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[충격]건보료 폭탄 맞았다! 2024년 더 깐깐해진 피부양자 탈락기준! “이것”깜빡하면 건보료 더 많이 나와요!]#3.1경제독립tv

https://www.youtube.com/watch?v=ajfdCLSA9tk [충격]건보료 폭탄 맞았다! 2024년 더 깐깐해진 피부양자 탈락기준! "이것"깜빡하면 건보료 더 많이 나와요!]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마...

ICYMI: European Central Bank President Lagarde emphasizes again decisions data dependent

Justin had the headlines from Lagarde:In a nutshell Lagarde was barely wavering on a June rate cut, saying that the data flow ahead means “we will know a bit more by April, and a lot more by June”. Lagarde didn't firmly commit, of course, but went a little soft with...

FOMC June rate cut probability back up to around 70%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Record closes for the Dow, S&P, and NASDAQ indices

US major indices are all closing at record levels as investors cheer the FOMC rate decision and comments from Fed Chair Powell. Although the chair was not overly committed to timing for interest rate cuts, he did reiterate that the high in rates was likely in place....

USD/JPY has recovered half of its FOMC losses … yen doesn’t have a lot going for it

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[충격]건보료 폭탄 맞았다! 2024년 더 깐깐해진 피부양자 탈락기준! “이것”깜빡하면 건보료 더 많이 나와요!]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/03/ecb6a9eab2a9eab1b4ebb3b4eba38c-ed8faded8384-eba79eec9598eb8ba4-2024eb8584-eb8d94-eab990eab990ed95b4eca784-ed94bcebb680ec9691ec9e90-400x250.jpg)