High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BoJ To Hike After Economic Growth! The NASDAQ Takes a Nosedive!

The US added 275,000 jobs in February 2024 beating expectations by 80,000. US Average Salary Growth slowed to the lowest growth since March 2022. The US Unemployment Rate rises back to 3.9% after 3 months of no movement. Japanese economists advise the Bank of Japan...

Market Outlook for the Week of 11 – 15 March

This week is expected to be relatively quiet in terms of economic events, although there are some important data releases to keep an eye on. On Monday, there are no notable economic releases, but traders should note that the U.S. and Canada switched to Daylight Saving...

Bitcoin takes another look above $70,000 to start the week

Bitcoin (BTC/USD) daily chart (Coinbase)After a brief dip below $68,000 in earlier in the day, Bitcoin is now racing to fresh record highs above the $70,000 mark. The cryptocurrency took a look at the key level on Friday and over the weekend but buyers held back....

Japan Business Federation head says feeling greater momentum for wage hikes this year

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

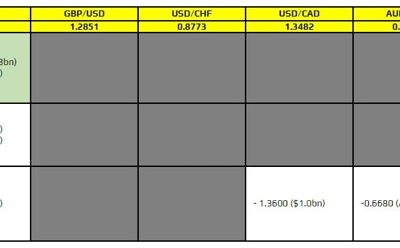

FX option expiries for 11 March 10am New York cut

There are a couple of decent-sized ones for EUR/USD but they are layered across a slight range. As such, the absence of one large expiry in particular is likely to offer little pull to price action on the day. In any case, we are seeing more of a muted tone in markets...

A slower start to the new week beckons in Europe

Major currencies are lightly changed for the most part as we look towards European trading today. The Japanese yen was an early mover, gaining some ground before giving that back as noted here. USD/JPY is now lightly changed near the 147.00 mark, though sellers remain...

China still can’t shake off property market woes

It is being reported by Reuters that Chinese regulators have met with financial institutions and requested large banks to step up support for Vanke. And that includes asking private debt holders to discuss a maturity extension for the developer's debt. For some...

The Japanese yen will stay in focus in trading this week

Yen longs were finally rewarded last week as the currency gained by 2% against the dollar. The BOJ finally got the ball rolling and things are definitely heating up ahead of the policy decision next week. USD/JPY fell to as low as 146.53 earlier but is now trading...

Plenty of big data to watch out for in trading this week

The economic calendar might be a bit of a bore today but don't expect this week to be a quiet one. There are plenty of key risk events to watch out for in the coming days. Here is the list of data releases on the agenda:UK February labour market report (12/03)US...

ForexLive Asia-Pacific FX news wrap: Weekend report the BoJ to abandon YCC next week

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The BOJ meet next week – but this week is an even bigger one for them (wage talk results)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Weak consumption data from Japan – is it enough to hold Bank of Japan action until April?

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Barrick Gold: Would It Benefit From A Gold Rally?

Gold has closed bullish for three consecutive weeks, leaving an ATH at $2195. As of last week, the yellow metal achieved gains over 4.7%. Increased geopolitical tensions, weak US economic data, increased gold holdings by the central banks, fears over bank run,...

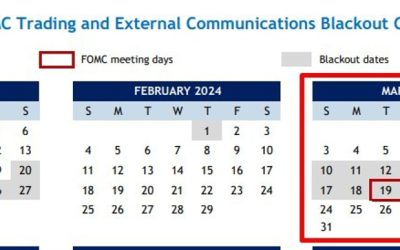

No Fed speakers scheduled today, or the next two weeks! The Blackout period has begun

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

JPY is gaining more ground follow the weekend news

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC sets USD/ CNY reference rate for today at 7.0969 (vs. estimate at 7.1869)

The People's Bank of China set the onshore yuan (CNY) reference rate for the trading session ahead.USD/CNY is the onshore yuan. Its permitted to trade plus or minus 2% from this daily reference rate.CNH is the offshore yuan. USD /CNH has no restrictions on its trading...

China Ambassador to Australia says review into tariffs on Australian wine progressing well

China's review of tariffs it placed on Australian wine is progressing well, Chinese Ambassador Xiao Qian told a conference in Sydney.the background to this is that China slapped Australian products with tariffs in retailation for US moves against China back during the...

Does Elon Musk hate gold up here?

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.1869 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...