There was a time when the market was pricing in a high likelihood of a Bank of Canada rate hike tomorrow but after months of strong North American data and sticky inflation, those odds have dwindled.The market currently sees just a 19% chance of a surprise rate cut at...

USDJPY tilts to the downside today, but holds at swing area low. What is needed to BREAK?

The USDJPY pair experienced a downturn, signaling a shift towards a bearish momentum in today's trading session. Despite this decline, the currency pair found some support at a critical swing area near 149.70, which prevented further losses and led to a modest bounce....

NASDAQ index now down 2% on the day

NASDAQ and traded two new session lows away from 100H MAThe NASDAQ index is trading to a new session low of 10982.80. The break lower is taking the price away from its 100-hour moving average at 15922.44 price. The 200-hour moving average at 15764.89 is the next major...

Bitcoin drop extends to 11% in brutal turnaround. Breaks $60,000 to the downside

The new money chasing bitcoin ETFs has just found out that volatility runs both ways.Bitcoin dailyThe easy money on the way up has kicked off some heartburn today. The latest drop was a quick one and took out the $60,000 stops before hitting $59,387 at the low. It's...

US crude oil futures settle at $78.15

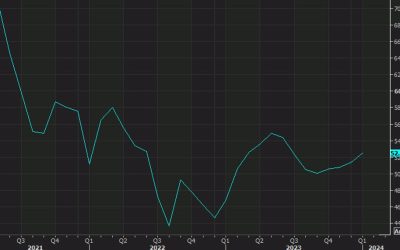

Crude oil futures are settling at $78.15. That is down -59% or -0.75%.The high price today reached $79.49. A low price was at $77.52. The high price on Friday reached $80.85.Looking at the daily chart below, the price settled right at the 38.2% retracement of the move...

Bitcoin falls below $62,000. Outside day now a possibility

Bitcoin bulls should have been popping champagne tonight, but instead a dark cloud has rolled in. This looked like a banner day for crypto as bitcoin edged above the 2021 high of $69,000 but it has turned into a race to take profits.Bitcoin is down more than 8% to...

US equities remain under pressure. Nasdaq decline nears 2%

SPX dailyThe S&P 500 is sitting near the lows of the day, down 52 points to 5079. It's down 1.0% and threatening a three-candle reversal.Worse is the Nasdaq, which is down 1.8%. Early on, it was Tesla and Apple dragging down the index but more recently, it's been...

BofA: What to expect from the ECB and the euro on Thursday?

Bank of America forecasts no significant changes in the European Central Bank guidance during the upcoming meeting, but anticipates a soft indication of forthcoming rate cuts in the press conference. Despite the expectation of dovish-leaning new ECB forecasts, BofA...

Meta stock price rebound after outage, but is a bigger corrections imminent?

Meta shares fell sharply, after the outages on Facebook and Instagram this morning (see post here). The price has bounced back with the current price now down -$5.00 or 1.00%. At the session lows, the price was down as much as -$10.09 (at session lows). Technically...

Bitcoin kissing the all-time high was the kiss of death in today’s trading

Bitcoin touched an all-time high of $69,202 just over two hours ago but the brief moment of exhilaration was met with a wave of pain as sellers used the headline to take profits.The turn is something I warned about earlier. Prices have quickly fallen to $64,000 in a...

European equity close: Some cheering for lower yields, some skepticism

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Nasdaq index is sharply lower today and in the process tests the key 100H MA. What next?

The Nasdaq index is sharply lower today and in the process tested its key 100 hour moving average at 15913.60. Support buyers came in against that technical level and have so far held support. Prices bounced back up toward the 15950 currently.Looking back, the price...

Buyers in the AUDUSD push the pair to swing level and MA resistance at 0.6524. Stay below.

Traders in the AUDUSD have pushed the price of the pair higher in the US session and in the process, tested the swing level starting back in August 2023 near 0.6524, and also it's 100 bar moving out on the 4-hour chart at 0.65238. That level is a resistance target...

Facebook and Instagram are down, tech stocks slump

Tech stocks are at the lows of the day, with the Nasdaq down 1.8% in a broad based selloff led by Tesla (-4.9%) and Apple (-3.0%). Tesla has been struggling with EV demand fears and today was hit by a fire at its Berlin factory that will keep it offline all week....

EURUSD buyers making a break for it… Price moves above the 38.2% retracement

The EURUSD is making a "break for it", and with that has now extended the narrow trading range for the day and also moved above the 38.2% retracement of the move down from the December high to the February low. That level comes in at 1.08640 and will now be a close...

Bitcoin rises to all-time high above $69,000

Bitcoin hourlyA soft US ISM services report led to a round of US dollar selling and improving risk appetite in financial markets. That was the final nudge bitcoin needed to get above $69,000 for the first time ever.The 2021 top briefly broke in a rise to $69,200...

US factory orders for January -3.6% versus -2.9% expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ISM February services index 52.6 vs 53.0 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US February final S&P Global services PMI 52.3 vs 51.3 prelim

Prelim was 51.3Prior was 52.0Composite index 52.5 vs 51.4 prelimPrior composite index 52.0New business inflows have now risen for four straight monthsThe rate of input cost inflation eased again to the slowest since October 2020 Business confidence dropped to the...

US stocks open lower with the NASDAQ index down 1% in early US trading

The major US indices are opening lower with the NASDAQ index is leading the way with the decline near 1%. They moved lower today would be the second consecutive down day after record closes in the NASDAQ and S&P on Friday.A snapshot of the market currently...