Stock heatmap by FinViz.com Mon, 10 Mar 2025 14:46:07 GMTTechnology Hit Hard: Semiconductors and Software Stocks Slump, Healthcare Shows ResilienceToday's US stock market has been a tumultuous landscape, painted predominantly in shades of red, as technology stocks,...

Bitcoin touches below $80,000

Bitcoin dailyThe US strategic bitcoin reserve announcement wasn't the catalyst that bitcoin bulls hoped it would be. Instead, it's created a flurry of 'sell the fact' trades that have it threatening the lowest levels since the election.Bitcoin is currently trading...

Not a good start to the US stock market. NASDAQ index now down 500 points

S&P below 200 day MAThe S&P 500 traded below its 200-day moving average on both Thursday and Friday but managed to close above it on both occasions. However, today's session opened with a gap back below this key level, which currently stands at 5735.00. The...

US February employment trends 108.56 vs 108.35 prior

Prior was 108.35 (revised to 109.45)This is a composite index so it doesn't tell us any data we don't already know but it's a useful broad view.“The ETI fell in February to its lowest level since October,” said Mitchell Barnes, Economist at The Conference Board....

USDCHF trades lower in up and down price action

USDCHF technicalsThe USDCHF is trading lower in response to declining yields, though price action has remained choppy throughout the session. The pair initially dropped to 0.87575, a level that aligns with the December 8 low at 0.8758, providing temporary support. So...

PU Prime Expands Deposit Bonus Promotion to Copy Trading Accounts

PU Prime, a globally recognized CFD broker, has announced an update to its Deposit Bonus Promotion. Previously available only for standard trading accounts, this popular bonus is now extended to Copy Trading accounts, enabling traders to enhance their trading...

Elevate Your Trading Knowledge with HFM’s Extensive Webinars

HFM, a leading global online trading broker under the HFM Group, continues to support traders worldwide with enhanced educational webinars—a series of weekly educational and interactive webinars designed to teach and empower traders across the globe. These educational...

Tesla shares down 4% premarket as UBS slashes deliveries forecast

UBS has slashed its price target on Tesla to $225 from $290 while maintaining their "Sell" rating following weaker-than-expected signs on Q1 deliveries.The bank now sees Q1 2025 deliveries at 367K units from a previous 437K after Tesla's disappointing Q4 2024...

ECB’s Nagel unveils a 12-point vision for German reform

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDCAD moves higher to start the NA session

USDCAD technicalsThe USDCAD saw a modest decline at the start of the new trading week following Mark Carney’s victory in Canada’s Liberal Party leadership race, setting him up to replace Justin Trudeau as prime minister. Carney, a former central bank chief of both...

US stock futures point to an ugly start to the week

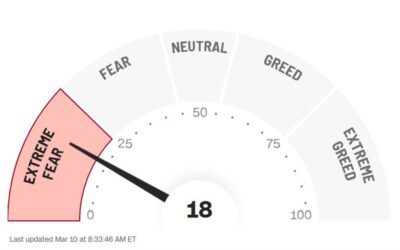

S&P 500 futures are down 76 points, or 1.3% in yet-another Monday massacre. Nasdaq futures are down 1.6% with some of the memes/momentum stocks looking particularly ugly.CNN's Fear and Greed index is at 18 at the moment, which is 'extreme fear'. To be far, it was...

Carney expected to be welcomed with a Bank of Canada rate cut

Mark CarneyFormer Bank of Canad and Bank of England Governor Mark Carney was selected a leader of the Canadian Liberal party yesterday in a landslide vote. That means he will soon take over for Prime Minister Justin Trudeau.Carney hinted at what will happen as he...

Hassett: Trade policy uncertainty will be resolved in early April

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The USD is lower to start new trading week. What key level are in play to start the week.

The USD is lower vs the major currency pairs with the greeback moving the most vs the JPY (-0.74%), the NZD (-0.49%), AUD (-0.30% and the CHF (-0.28%). The dollar is modestly lower vs the EUR (-0.16%), and unchanged vs the GBP and CAD. Over the weekend, Pres. Trump...

[테슬라+비트코인 역대급 저점 통과중! 끝나면 이렇게 된다! 머스크, 트럼프의 숨겨진 큰 그림]#3.1경제독립tv

https://www.youtube.com/watch?v=nEM_ViaeX1s [테슬라+비트코인 역대급 저점 통과중! 끝나면 이렇게 된다! 머스크, 트럼프의 숨겨진 큰 그림]#3.1경제독립tv *본 채널은 투자에 대한 조언을 드리지만, 투자는 전적으로 본인의 판단하에 진행하고, 투자에 대한 책임도 전적으로 본인에게 있다는 점을 명심하셔야 합니다 [3년뒤 10억부자 3.1경제독립tv필독 추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요!...

ForexLive European FX news wrap: Euro bounces around on German news, risk slumps yet again

Headlines:Markets:JPY leads, USD and CAD lag on the dayEuropean equities lower; S&P 500 futures down 1.1%US 10-year yields down 5.8 bps to 4.247%Gold down 0.5% to $2,896.93WTI crude up 0.5% to $67.41Bitcoin up 2.4% to $82,629It's a modest start to the new week...

AUDUSD Technical Analysis – We are back at the key resistance zone

Fundamental OverviewThe USD has come under strong pressure recently as the weaker US data finally triggered a deeper pullback in the greenback from the stretched long positions accumulated in the past two quarters. The market pricing switched pretty fast from...

Germany’s Greens co-leader says the goal is to come to an agreement

The Greens' co-leader Felix Banaszak is now out saying that they will prepare their own legislative proposal for security and defense. Adding that "the goal is to come to an agreement". I mean, you wouldn't expect them to outright cave to Merz's camp so this could be...

Germany’s Greens party official calls for members not to vote for bill on spending plans

Katharina Droege is the co-chair of the Greens and she is calling for her members not to back Merz's spending plans in her latest remarks today. She says that "if the CDU and SPD want our backing, they must show that investment goes towards the climate and...

USDCAD Technical Analysis – The Loonie remains at the mercy of tariffs headlines

Fundamental OverviewThe USD has come under strong pressure recently as the weaker US data finally triggered a deeper pullback in the greenback from the stretched long positions accumulated in the past two quarters. The market pricing switched pretty fast from...

![[테슬라+비트코인 역대급 저점 통과중! 끝나면 이렇게 된다! 머스크, 트럼프의 숨겨진 큰 그림]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2025/03/ed858cec8aaceb9dbcebb984ed8ab8ecbd94ec9db8-ec97adeb8c80eab889-eca080eca090-ed86b5eab3bceca491-eb819deb8298eba9b4-ec9db4eba087eab28c-400x250.jpg)