High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Kažimír: Inflation risks remain tilted to the upside

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

EUR/USD looks to keep the upside going with eyes on German debt brake reform

EUR/USD daily chartDespite a more dour risk mood, the dollar is down in trading today with EUR/USD now seen up 0.2% to 1.0855. The pair is keeping the momentum from last week but buyers are still facing a key test against its 200-week moving average of 1.0865 this...

Crude Oil Futures Analysis with tradeCompass Key Price Levels

Crude Oil Futures (CL) Analysis – tradeCompass for March 10, 2025Current Market Snapshot for Crude Oil Futures:Crude Oil Futures (CL) Price: $67.18Key Thresholds: Bearish Below: $66.88 (Today’s VWAP, Friday’s VAL)Bullish Above: $67.73 (Clearing Friday’s VAH &...

GCC Brokers Accelerates Growth: Deepening MENA Presence & Expanding into SEA

GCC Brokers, a leading forex and CFD broker, is strengthening its position in the Middle East and North Africa (MENA) region while expanding into key Southeast Asian (SEA) markets. With an already well-established presence in MENA, the company is now becoming even...

USDCHF Technical Analysis – The CHF remains supported amid general risk-off

Fundamental OverviewThe USD has come under strong pressure recently as the weaker US data finally triggered a deeper pullback in the greenback from the stretched long positions accumulated in the past two quarters. The market pricing switched pretty fast from...

Eurozone March Sentix investor confidence -2.9 vs -8.4 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Market Outlook for the Week 10th – 14th March

The week starts slowly with fewer scheduled economic events on Monday. Additionally, keep in mind the daylight saving time shift in the U.S. and Canada. On Tuesday, Australia will release the Westpac consumer sentiment, Japan will report household spending y/y, and...

SNB total sight deposits w.e. 7 March CHF 444.1 bn vs CHF 437.4 bn prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

New US-Russia talks reportedly not planned for this week

US and Russia will not be in discussion this week but that doesn't mean the political ball stops rolling. The US and Ukraine are set to engage in talks again, just less than two weeks after the whole debacle involving Trump, Vance, and Zelenskyy in the Oval...

European equities pare opening gains as the risk mood sags

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDJPY Technical Analysis – All eyes on the US CPI

Fundamental OverviewThe USD has come under strong pressure recently as the weaker US data finally triggered a deeper pullback in the greenback from the stretched long positions accumulated in the past two quarters. The market pricing switched pretty fast from...

Germany January trade balance €16.0 billion vs €20.6 billion expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Germany January industrial production +2.0% vs +1.5% m/m expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

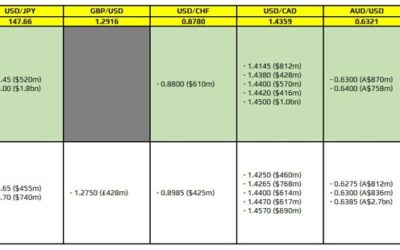

FX option expiries for 10 March 10am New York cut

There aren't any major expiries to take note of on the day. As such, trading sentiment will continue to stick to the key themes from last week. In this instance, risk sentiment will be a key one to watch in the sessions ahead before we get any meaningful US data on...

Bitcoin continues to hold the line at $80,000 for now

In one disappointment to another, the White House crypto summit at the end of last week failed to impress. Everyone was highly anticipating details of the supposed "strategic reserve" that Trump touted. But it wasn't all too convincing as it pertained more to...

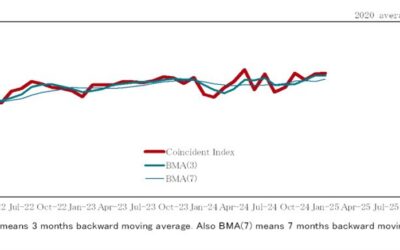

Japan January leading indicator index 108.0 vs 107.9 prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

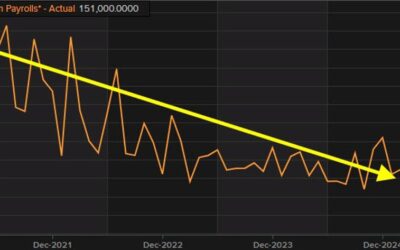

A quieter start to the new week but focus stays on US data

The US jobs report on Friday didn't turn out to be as disappointing as many were hoping for and that kept markets in check overall. The underlying trend is still pointing to added softness in the labour market though. And there's also a slight concern with the...

Michael Saylor proposed that US government acquire 25% of Bitcoin’s total supply by 2035

Michael Saylor, the founder of Strategy, has proposed that the U.S. government acquire 25% of Bitcoin's total supply by 2035 to establish a Strategic Bitcoin Reserve. He suggests that the government systematically purchase 5-25% of Bitcoin’s supply through daily...

ForexLive Asia-Pacific FX news wrap: Yen firmed early, then drifted back some

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...