Crude Oil, OPEC+, WTI, US Dollar, IRAN – US DEAL, China – Talking Points

- Crude oil saw notable intraday volatility but ended near where it started overnight

- A deal between the US and Iran could see more production to compensate for OPEC+ cuts

- The US and Chinese economies might hold the key for WTI direction

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Crude oil continued its bumpy ride this week going into the Friday session after news reports of a potential US – Iran deal to free up supply for the global market overnight.

The Israeli news outlet Haaretz cited Israeli defence officials as saying that progress had been made toward a deal that will allow Iranian oil back onto the open market in exchange for Tehran to cease the process of high-level enrichment of uranium.

It is being reported that the deal may lead to a million barrels per day being added to supply. The news comes hot on the heels of the announcement last weekend that Saudi Arabia will cut its output by the same amount starting on July 1st.

The OPEC+ meeting last Sunday created a tick-up in price and volatility to start the week, but crude then fell back within the range.

Recommended by Daniel McCarthy

How to Trade Oil

While the overnight news saw a notable dip lower, the price quickly recovered with the US Dollar tumbling in the aftermath of an unexpected bump up in US initial jobless claims. They printed at 261k for the week ended June 3rd against forecasts of 235k.

Treasury yields slipped lower across the curve with the larger losses seen in the back end of the curve. The benchmark 10-year note dropped around 10 basis points to settle near 3.72% going into the Friday session.

The 2s 10s yield spread remains near record inversion at around -0.80%. This remains an ominous sign for the global economic outlook. Such inversions have historically been a precursor to a slowdown in economic activity.

It remains to be seen if this is to eventuate but the concern for the demand for oil is front of mind for traders with China also unable to kick-start its economy after re-opening from pandemic restrictions.

Unlike many Western countries that are trying frantically to rein in uncomfortably high inflation, China’s CPI printed at 0.2% year-on-year to the end of May today. Additionally, PPI was -4.3% for the same period.

The lack of price pressures in the world’s second-largest economy might continue to undermine crude.

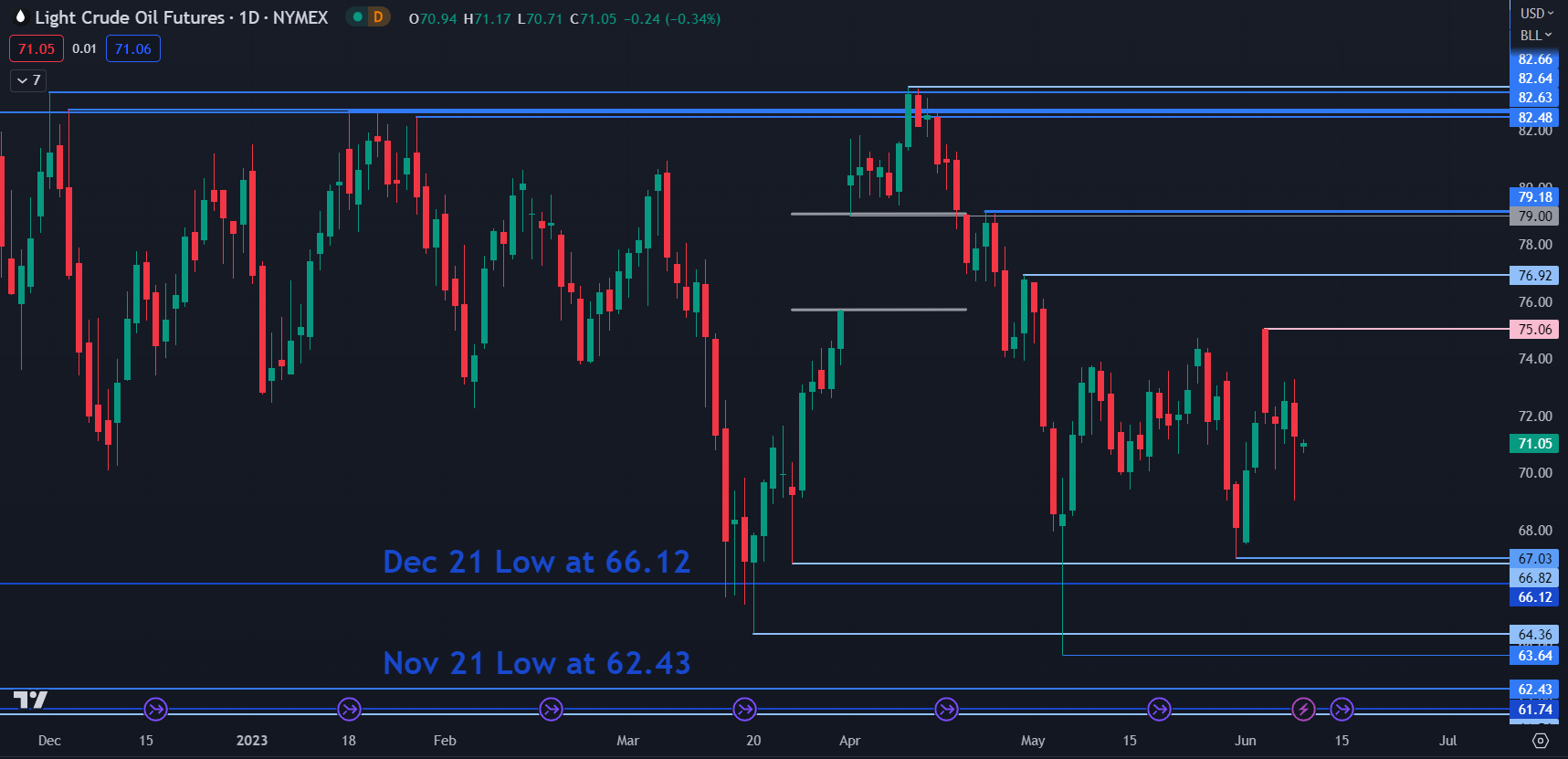

WTI CRUDE OIL TRAPPED IN THE RANGE FOR NOW

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter