Dow Jones, S&P 500, Nasdaq 100, Fed, Jerome Powell – Briefing:

- Dow Jones, S&P 500, Nasdaq 100 sink after the Fed rate decision

- Chair Jerome Powell unable to convince markets of no rate cuts

- Another regional bank, PacWest, is in trouble as stocks fell further

Recommended by Daniel Dubrovsky

Get Your Free Equities Forecast

Risk Appetite Deteriorates After the Fed

Wall Street was under pressure on Wednesday as the Dow Jones, S&P 500 and Nasdaq 100 sank after a relatively busy day. All eyes were on the Federal Reserve monetary policy announcement where the central bank delivered a 25-basis point rate hike, as expected. But, as per usual, what mattered was the messaging and signaling coming from Chair Jerome Powell and company.

During the usual press conference, Mr. Powell made a couple of notable remarks. For one thing, he mentioned that bank conditions have ‘broadly improved’ since early March when Silicon Valley Bank (SVB), a regional lender, collapsed. Meanwhile, he downplayed market expectations of easing. He said that the committee’s outlook does not support rate cuts.

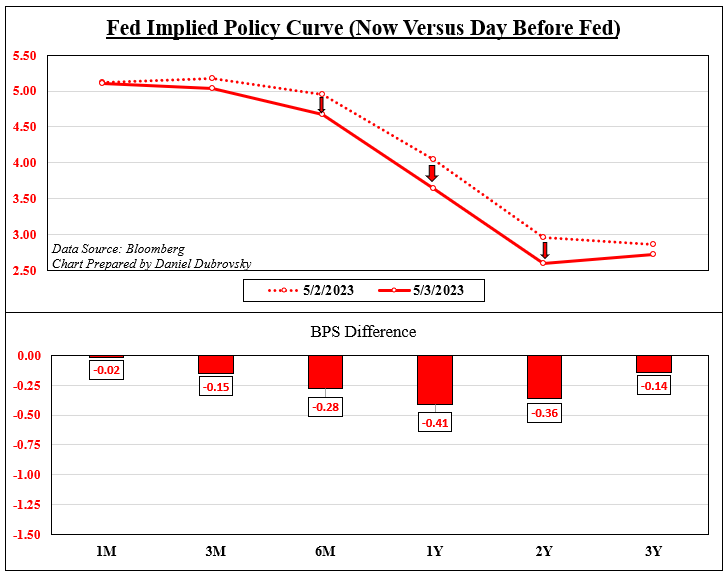

Did the markets believe the central bank? Absolutely not. You can see this in the chart below. For the 6-month outlook, markets have added at least one more 25BPS cut by year-end compared to yesterday. Almost 2 cuts were priced into the 12-month horizon. If you measure it from where interest rates are currently, at least 3 rate cuts are priced in by December.

This is worrying. Such a near-term pivot would likely be a reaction to an increasingly worsening economic outlook. Still, the labor market remains tight. Albeit a key gauge has been heading in the wrong direction. There are now about 1.64 jobs per unemployed person in the US, down from a peak of around two in 2021. Still, historically the 1.64 reading remains elevated. It has fallen to the lowest since 2021.

Soon after Powell’s press conference, another regional bank, PacWest, saw its share price sink 34% after reports crossed the wires that it was weighing strategic options, including a sale. This sent S&P 500 futures plunging in after-hours trade. As such, Thursday’s Asia-Pacific trading session could look a bit ugly, placing indices like Australia’s ASX 200 and Hong Kong’s Hang Seng Index at risk.

The Evolving Fed Rate Cut Outlook

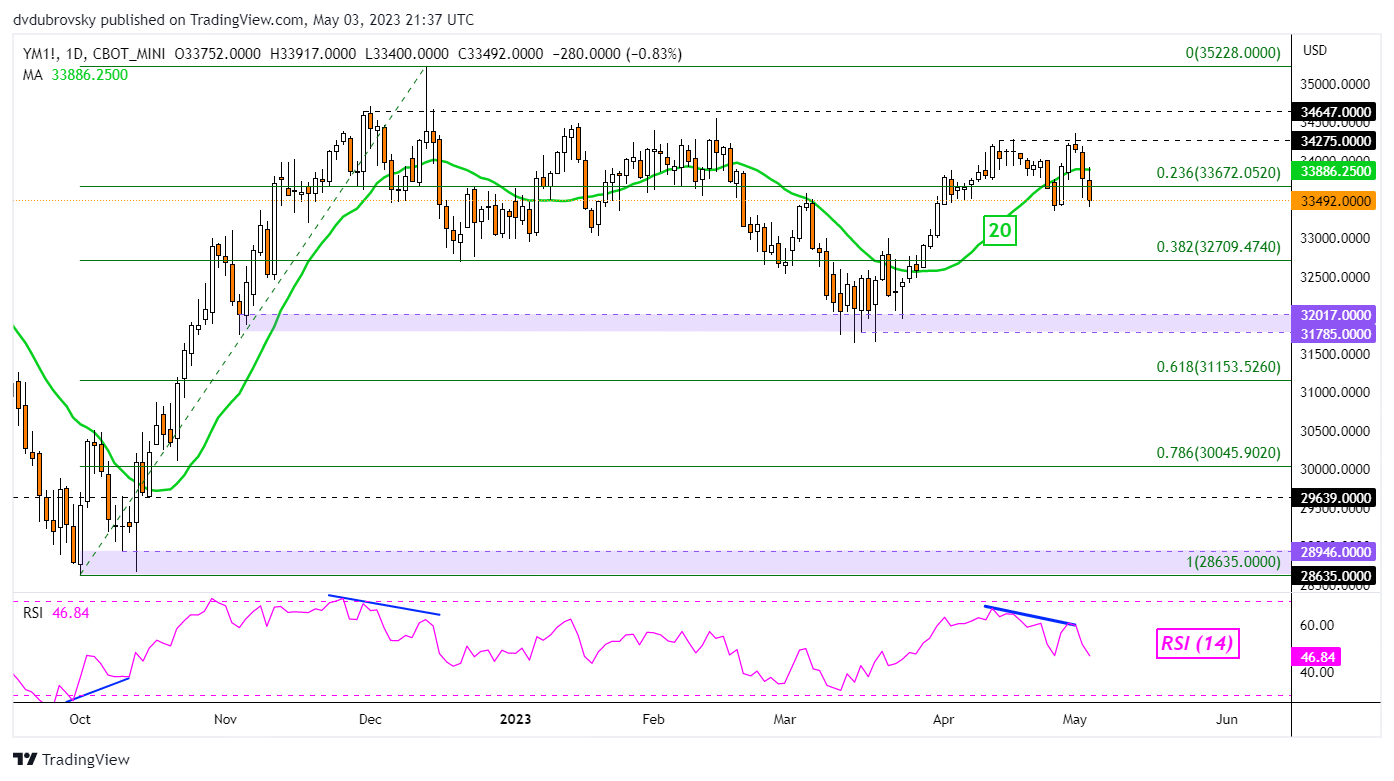

Dow Jones Technical Analysis

On the daily chart, Dow Jones futures have confirmed a breakout under the 20-day Simple Moving Average (SMA) once again. But, the index remains above the April 26th close. As such, the immediate technical outlook arguably remains neutral. Further losses expose the 38.2% Fibonacci retracement level at 32709. Otherwise, key resistance is around 34275.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Dow Jones Futures Daily Chart

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com