EUR/USD ANALYSIS

- GfK consumer confidence edges higher for January.

- How much further can the euro appreciate against the USD?

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

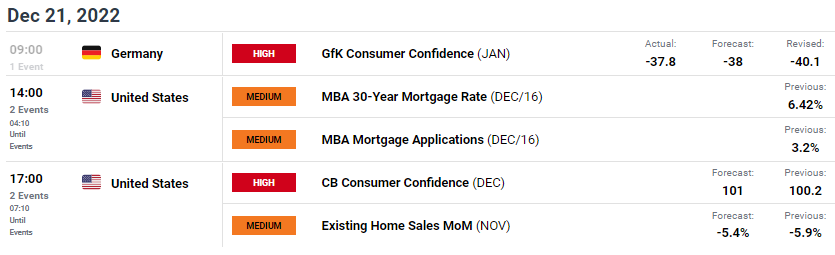

Wednesday morning kicked off with German GfK consumer confidence data (see economic calendar below) for January which beat expectations suggestive of a more upbeat outlook for the third consecutive print. With the dollar trading higher today, EUR/USD has managed to utilize this economic data to keep in the green for now.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Later today the U.S. CB consumer confidence will be in focus but high impact events scheduled for the rest of the year will likely have minimal (lesser) impact on the broader picture after last week’s central bank guidance. This being said, any significant change from expectations could spark some notable price fluctuations but the foundational basis for the euro short-term will be a hawkish European Central Bank (ECB) fixated on reducing inflationary pressures within the eurozone.

EUR/USD ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily EUR/USD chart above has managed to creep above the June 2022 swing high at 1.0615. Traditional seasonality shows that the USD tends to weaken during December which has been the case so far and if this is to continue for the remainder of the month, the 1.0700 psychological will come under consideration. The Relative Strength Index (RSI) has come out of the overbought region and may revert lower this year. Moving into 2023, recessionary fears and declining risk sentiment may take over once more exposing the euro to subsequent downside.

Resistance levels:

- 1.0800

- 1.0774

- 1.0700

Support levels:

- 1.0615

- 1.0500

BEARISH IG CLIENT SENTIMENT

IGCS shows retail traders are currently LONG on EUR/USD, with 6.% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term downside bias.

Contact and followWarrenon Twitter:@WVenketas