EUR/USD Price, Chart, and Analysis

- German Ifo data suggest that the economic outlook is improving

- The ECB – market impasse over interest rates continues.

Recommended by Nick Cawley

Download our new Q1 Forecast

Most Read: EURUSD Latest – The Bullish Trend Remains in Place as the ECB Talks Tough

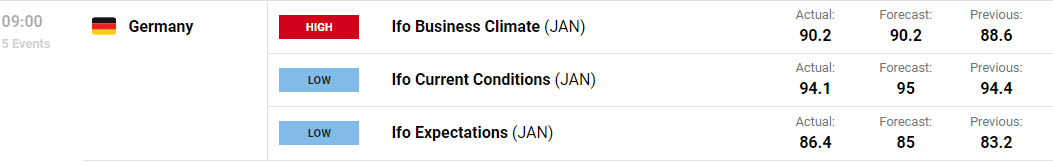

The German economy is starting the new year with more conviction, according to the latest Ifo report. The business climate and expectations readings both moved higher compared to December’s report, while current conditions were marginally lower.

‘Sentiment in the German economy has brightened. The Ifo business climate index rose to 90.2 points in January, up from 88.6 points in December. This is due to considerably less pessimistic expectations. Companies were, however, somewhat less satisfied with the current situation. The German economy is starting the new year with more confidence’.

For all market-moving economic releases and events, see the DailyFX Calendar

The latest official outlook for the German economy is also more optimistic with the government now seeing growth of 0.2% this year compared to a prior forecast of a 0.4% contraction. The growth outlook for next year however was downgraded from 2.3% to 1.8%.

Recommended by Nick Cawley

Introduction to Forex News Trading

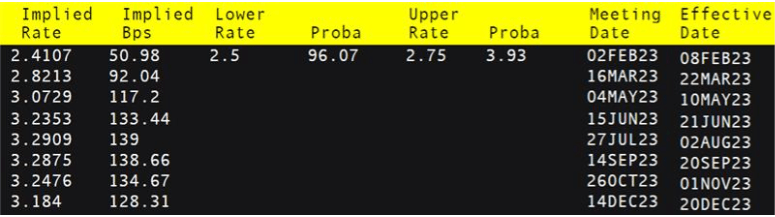

Markets are currently expecting the ECB to hike interest rates by 50 basis points next week and hike by the same amount at the March policy meeting. This is in line with the central bank’s forecast. However things start to diverge from Q2 onwards with the ECB saying recently that they are looking at multiple 50bp increases, and no cuts, this year, while the market sees a much lower path of rate hikes with a potential cut at the end of Q4. This difference of opinion between the central bank and the market – similar to the situation the US Federal Reserve is facing – needs to be resolved quickly before the growing shift in opinion between ECB members starts to impact the market. A central bank needs its policymakers to be singing from the same song sheet, or at least humming the same tune.

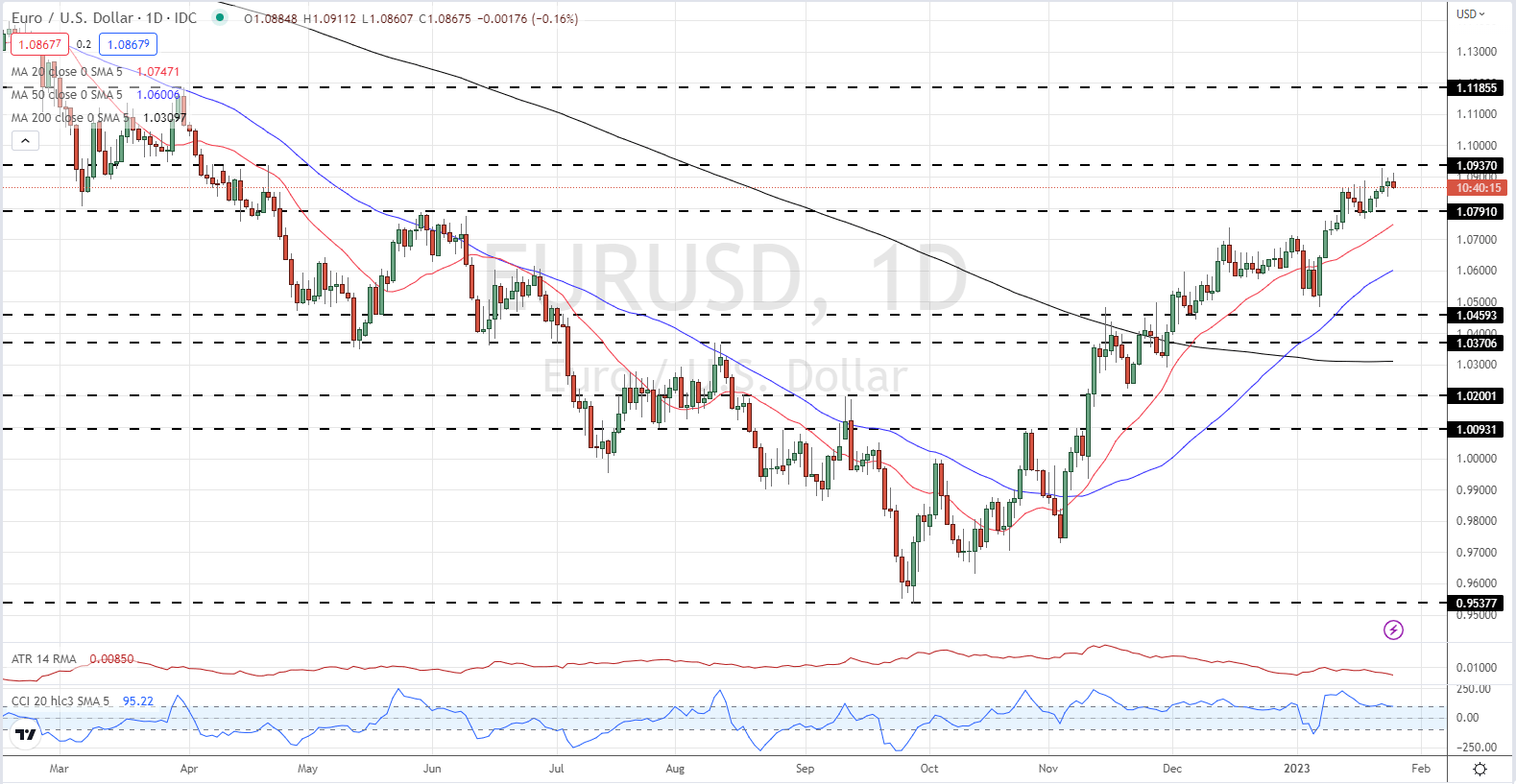

The Euro remains relatively strong against the US dollar and will likely stay that way as the interest rate differential between the two widens in the coming months if the ECB is to be believed. EUR/USD remains supported all the way down to 1.0770 while Monday’s 1.0927 multi-month high remains within reach. A confirmed break of this level leaves room for the pair to move back to the end-of-March high at 1.1185.

EUR/USD Daily Price Chart – January 25, 2023

Charts via TradingView

| Change in | Longs | Shorts | OI |

| Daily | -4% | -3% | -3% |

| Weekly | 20% | -1% | 7% |

Retail Traders Trim Longs and Add to Shorts

Retail trader data show 32.78% of traders are net-long with the ratio of traders short to long at 2.05 to 1.The number of traders net-long is 16.44% lower than yesterday and 19.00% lower from last week, while the number of traders net-short is 9.35% higher than yesterday and 16.57% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.