Most Read: Euro’s Outlook Turns Bearish After ECB Decision, Setups on EUR/USD, EUR/GBP

The euro suffered a major setback this week, primarily against the U.S. dollar, though it also lost some ground against the British pound. The European Central Bank’s dovish stance during its April meeting laid the groundwork for the common currency’s downturn, which was further exacerbated by heightened geopolitical tensions in the Middle East leading into the weekend.

ECB Turns Dovish

At its latest policy meeting, the ECB opted to leave interest rates unchanged but left no doubt about its intention to transition towards a looser position imminently amid increased confidence in the inflation outlook. This guidance prompted traders to ramp up wagers that the institution led by Christine Lagarde would launch its easing campaign at its next monetary policy meeting in June.

Frustrated by trading setbacks? Take charge and elevate your strategy with our guide, “Traits of Successful Traders.” Unlock essential insights to steer clear of frequent pitfalls and costly missteps.

Recommended by Diego Colman

Traits of Successful Traders

Monetary Policy Divergence

The prospect of the ECB moving ahead of the Fed in terms of easing is poised to be detrimental to EUR/USD in the short run. Just a few weeks ago, there were indications that the FOMC could also act in June, but a series of hotter-than-expected U.S. CPI readings and labor market data have derailed this scenario, triggering a hawkish repricing of rate expectations that has been a boon for the U.S. dollar.

Monetary policy divergence could present challenges for the euro against the British pound as well. Although the Bank of England is also seen removing policy restraint in 2024, market pricing suggests that the first cut may not materialize until August. Moreover, traders are only discounting 50 basis points easing from the BoE, whereas they anticipate about 75 basis points in cumulative cuts from the ECB this year.

Geopolitical Tensions on the Rise

Geopolitical tensions in the Middle East are set to keep the euro on tenterhooks in the short term, though any negative impact should be more visible against the U.S. dollar, traditionally considered a safe-haven asset. Concerns about potential retaliatory actions from Iran following an attack on its Syrian embassy by Israel could escalate tensions in the region, unsettling markets and weighing on high-beta currencies.

For a comprehensive analysis of the euro’s medium-term prospects, make sure to download our complimentary Q2 trading forecast today.

Recommended by Diego Colman

Get Your Free EUR Forecast

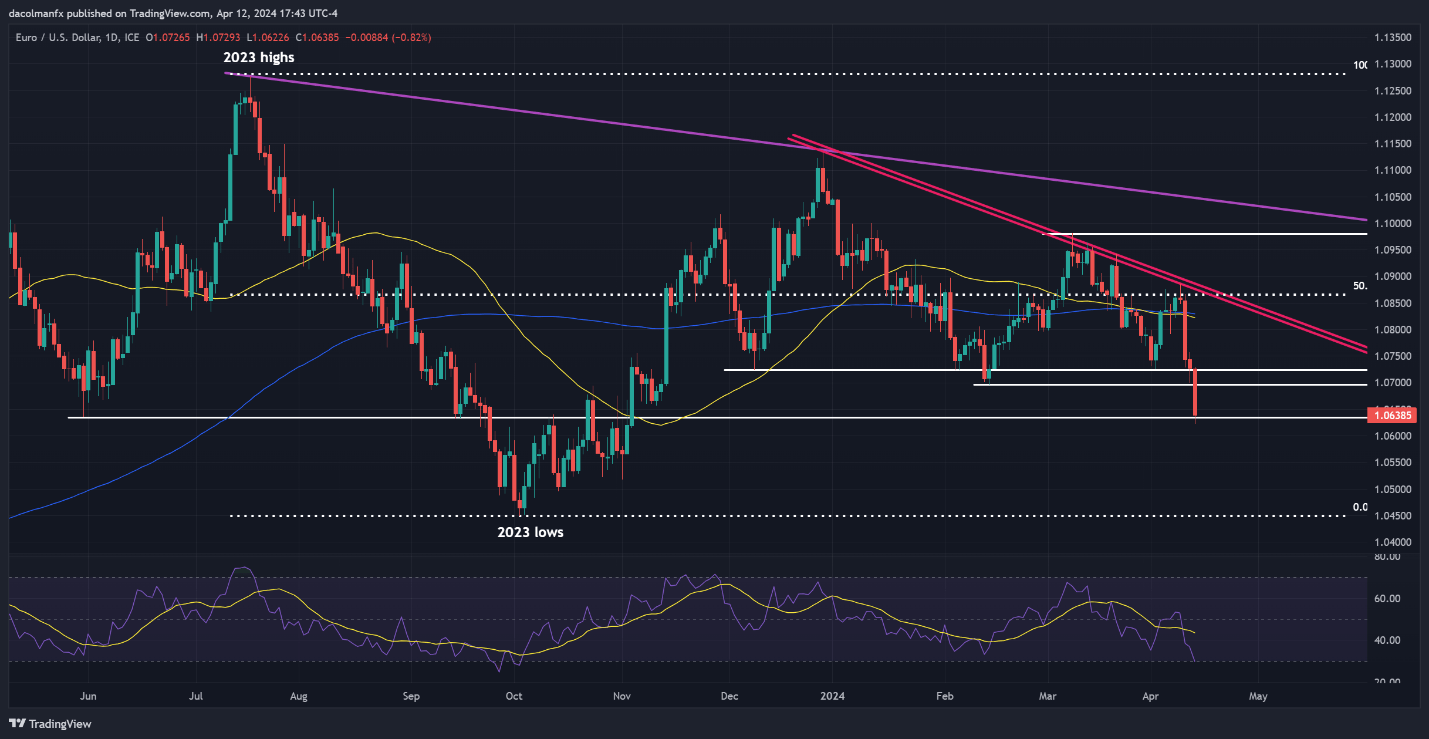

EUR/USD FORECAST – TECHNICAL ANALYSIS

EUR/USD has dropped sharply in recent days, breaching multiple technical floors in the process. The latest leg lower has brought the pair to its lowest point since early November of the previous year, nearing a crucial support at 1.0635. To prevent a deeper downturn, euro bulls will need to staunchly protect this zone; failure to do so may prompt a retreat towards the 2023 lows.

On the other hand, should selling pressure ease and prices begin to rebound from their current position, initial resistance emerges at 1.0695 and 1.0725 subsequently. Beyond these two thresholds, attention shifts to the 50-day and 200-day simple moving averages in the vicinity of 1.0825. On further strength, the focus will be on 1.0865, the 50% Fib retracement of the 2023 slump.

EUR/USD PRICE ACTION CHART

EUR/USD Chart Created Using TradingView

Interested in learning how retail positioning can offer clues about EUR/GBP’s directional bias? Our sentiment guide contains valuable insights into market psychology as a trend indicator. Get it now!

| Change in | Longs | Shorts | OI |

| Daily | 4% | -24% | -6% |

| Weekly | 17% | -42% | -9% |

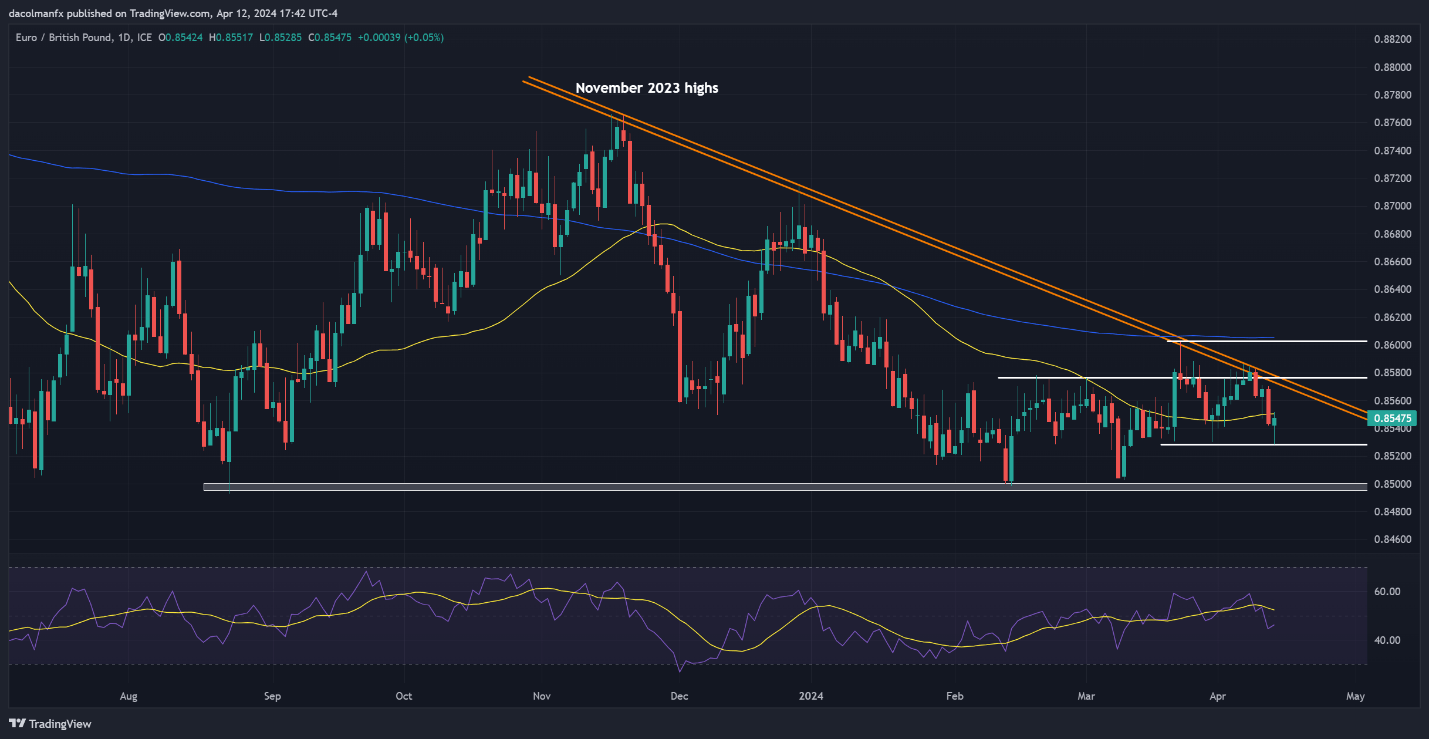

EUR/GBP FORECAST – TECHNICAL ANALYSIS

EUR/GBP dropped moderately this week, but downside momentum faded heading into the weekend as the pair found support at 0.8525 and began to move higher off its weekly lows. If the nascent recovery continues over the next few days, resistance appears at 0.8550 near the 50-day simple moving average. Looking higher, the spotlight will be on trendline resistance at 0.8575, followed by 0.8600.

Alternatively, if bears mount a comeback and EUR/GBP resumes its downward journey, support looms at 0.8525, which represents the late March swing lows. Bulls must strive to maintain prices above this technical area to prevent a breakdown; otherwise, sellers could seize the opportunity to launch a bearish assault on the 2023 lows.