GOLD AND OIL TECHNICAL OUTLOOK:

- Gold prices retreat and probe technical support area near $2,000 as U.S. dollar extends recovery

- Rising U.S. Treasury yields also exert downward pressure on precious metals

- Meanwhile, oil prices sink after failing to break cluster resistance at $82.60/$83.40

Recommended by Diego Colman

Get Your Free Gold Forecast

Most Read: USD/JPY Breaks Major Trendline Resistance as USD/CAD Defies Key Moving Average

GOLD PRICE ANALYSIS

Gold prices (XAU/USD) retreated on Monday, losing ground for the second consecutive trading session and coming within a hair’s breadth of breaking below the psychological $2,000 level, undermined by the solid rally in the U.S. dollar seen in the FX space.

By way of context, the greenback managed to strengthen across the board, supported by rising U.S. Treasury yields, with the 10-year note breaking above its 200-day simple moving average and hitting 3.60%, its highest level in nearly three weeks.

Precious metals, which are priced in U.S. dollars and offer no yield, tend to weaken when the U.S. currency and rates rise, so underperformance is not surprising when these dynamics play out. In any case, gold’s bullish bias remains in place despite Monday’s small pullback.

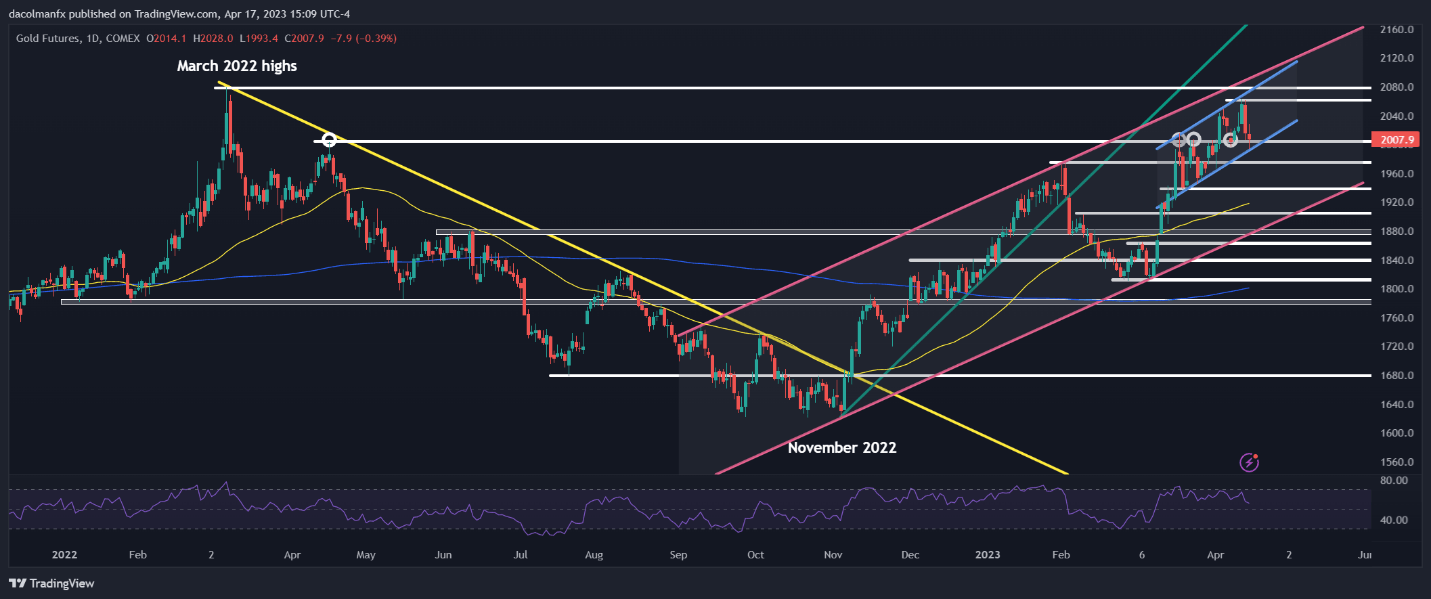

From a price action perspective, XAU/USD has been trading within the confines of an ascending channel since the middle of last month, with bullion testing the lower limit of that pattern near $2,000 on Monday, a region that represents technical support.

If bulls manage to defend the $2000 floor and spark a rebound off of that zone, initial resistance lies at $2,060. On further strength, attention shifts to $2,075, followed by $2,095. Conversely, if selling pressure intensifies and support is breached, $1,975 is the first downside focus, followed by $1,940.

| Change in | Longs | Shorts | OI |

| Daily | 11% | 0% | 6% |

| Weekly | 5% | -6% | 0% |

GOLD TECHNICAL CHART

Recommended by Diego Colman

Get Your Free Oil Forecast

OIL PRICE ANALYSIS

Oil prices sank on Monday, falling as much as 2% to $80.50 at some point during the trading session, hit by U.S. dollar strength and recession anxiety. While the U.S. economy has remained resilient over the past year, activity could decelerate sharply later in the year, especially if interest rates continue to rise. This scenario will dampen demand for energy commodities, weighing on fossil fuels.

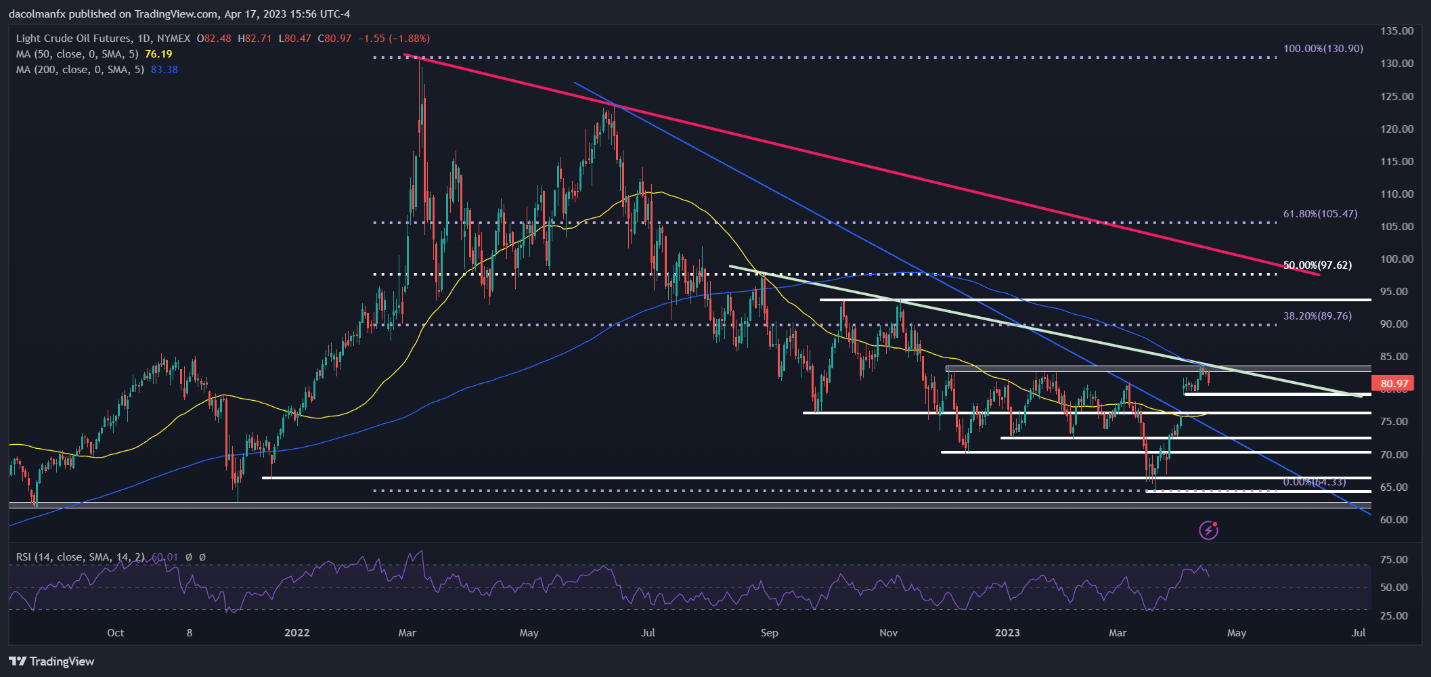

In terms of technical analysis, oil has begun to reverse course after rallying more than 30% from its March lows, a sign that bullish momentum is fading. The daily chart below shows that the recent pullback has taken place after prices failed to clear cluster resistance in the $82.60/$83.40 area, where December 2022 and January 2023 highs align with the 200-day simple moving average.

If losses accelerate in the coming days, initial support rests at $79.00, followed by $76.50, just a touch above the 50-day simple moving average. On the flip side, if bulls regain the upper hand and manage to push prices above $82.60/$83.40, buying interest could regain impetus, setting the stage for a rally toward $89.76, the 38.5 Fib retracement of the March 2022/March 2023 correction.

| Change in | Longs | Shorts | OI |

| Daily | 10% | -6% | 1% |

| Weekly | -7% | 0% | -4% |