Japanese Yen Q1 Recap

The Japanese Yen has had an interesting Q1 to say the least with the Yen starting the quarter looking vulnerable against the Greenback. The US Federal Reserve looked set to continue on an aggressive hiking cycle while the Bank of Japan looked set to continue down its easy monetary policy path.

February turned out to be a difficult month for the Yen as it posted steep losses against the US Dollar. The losses were compounded by the rising odds for a higher peak rate from the US Federal Reserve as US data came in better than expected for the majority of February. Late February was the start of the Yen’s recovery with March seeing the Banking sector woes accelerate the decline in USDJPY as the pair declined some 700-odd pips since February 28.

As we head into Q2 the Yen is basically flat against the Greenback with the early gains made in Q1 effectively wiped out. The question we have to ask is are we going to see a continuation of the Yen’s recent comeback over the coming months? While this article focuses on the JPY technical outlook, Q2 has a host of key fundamentals that could drive the Yens direction – download the full Q2 forecast below:

Recommended by Zain Vawda

Download the newly released Q2 forecast now

Technical Outlook – USD/JPY

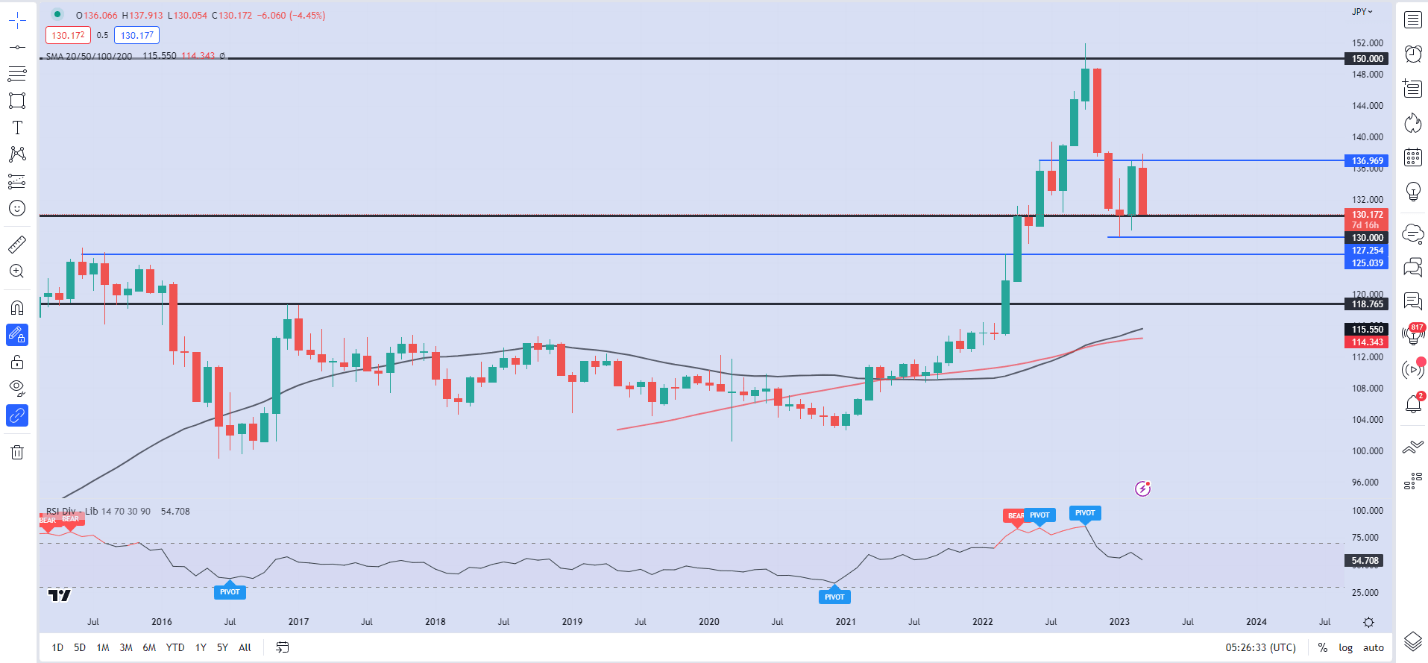

USDJPY Monthly Chart

Source: TradingView, chart prepared by Zain Vawda

USDJPY on the weekly timeframe has been on a steady decline since February 27, with four consecutive weeks of losses. Price is approaching the psychological 130.000 level (at the time of writing) with the monthly candle looking set to close as bearish engulfing candle. A monthly close below the 130.000 handle should lead to further downside for the pair as we haven’t seen a close below since breaking above the psychological 130.00 level in June 2022.

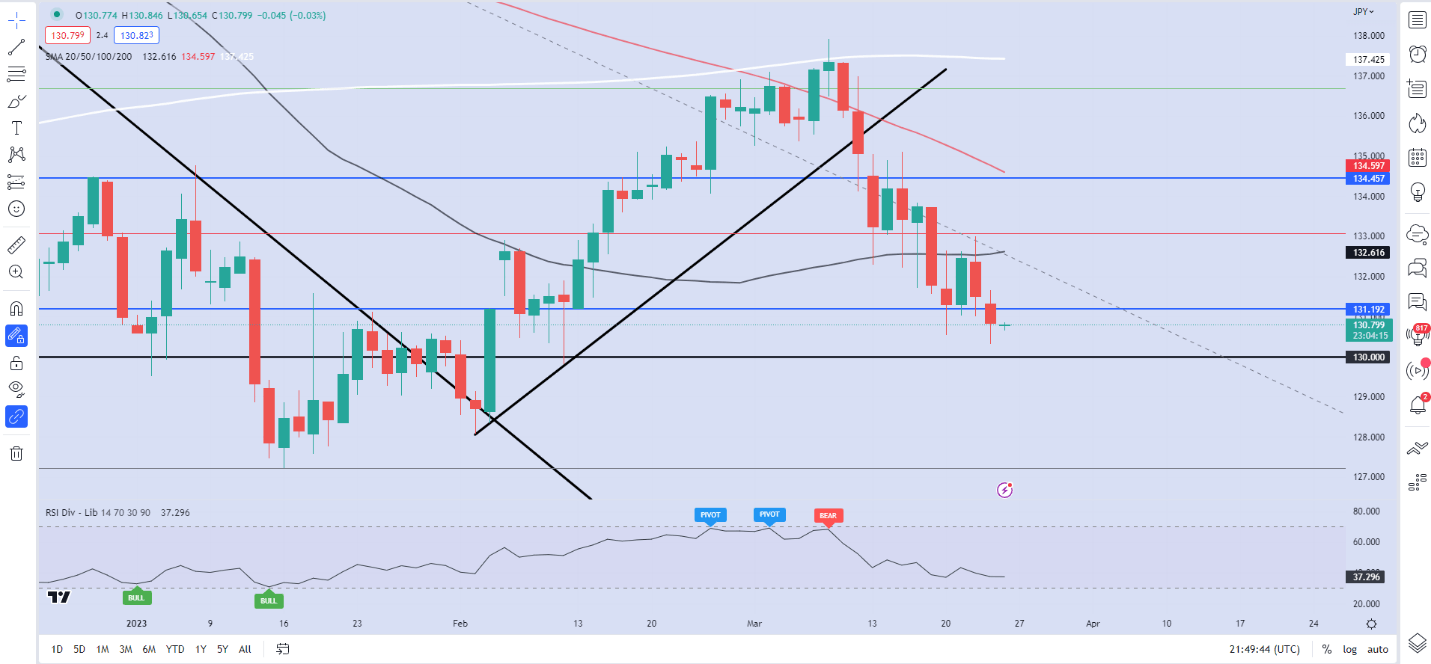

USDJPY Daily Chart

Source: TradingView, chart prepared by Zain Vawda

Price action on the daily timeframe has seen us print a fresh low with retracement now a possibility. Should a pullback materialize immediate resistance rests at 132.600 (50-day MA) with a break higher potentially leading to a retest of the 100-day MA around the 134.600 handle. The YTD high just above 137.000 has held firm so far in 2023 and holds the key to keep the bearish trend intact.

On the downside a break of the psychological level at 130.00 brings the YTD low of 127.250 back into focus. A candle close below this level could see a test of support resting at 125.000 (March 22 swing high).

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter:@zvawda