Economic Indicators & Central Banks:

- The bulls are back in town for now. Wall Street climbed, led by tech and especially the Magnificent 7 — all cohorts rallied, even Tesla which broke a 7-session losing streak even as its earnings news was awaited.

- US: The weaker than expected PMI data from S&P Global was the excuse needed to underpin a short covering rally in Treasuries after the big selloff in April.

- Record US Auction boosted demand! A well bid 2-year sale also added to the gains in Treasuries, while signs of future price pressures saw the long end underperform. Demand petered out into the finish, however, especially with the surge on Wall Street, and yields edged off their lows.

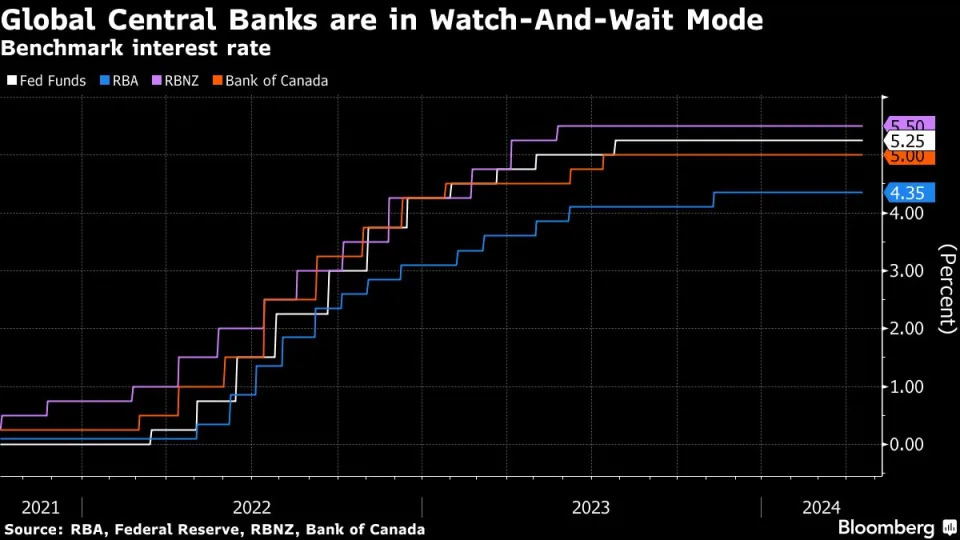

- Australia: The hot inflation print pointed to sticky local price pressures and reinforced the case for the RBA to hold rates at a 12-year high. The CPI rose to 3.6% y/y VS 3.5% estimate, while core CPI rose 4%, also higher than forecast and well above the RBA’s 2-3% target.

- Japan: Strong warning for intervention by officials. The BoJ is widely expected on Friday to leave policy settings & bond purchase amounts unchanged.

- NEW YORK (AP) — The Biden administration has finalized a new rule set to make millions more salaried workers eligible for overtime pay in the US.

Financial Markets Performance:

- The USDIndex slumped, falling to 105.39 largely on profit taking and as haven demand faded.

- USDJPY flirts with 155 after FM Suzuki issued the strongest warning to date on the chance of intervention, saying last week’s meeting with US and South Korean counterparts had laid the groundwork for Tokyo to act against excessive Yen moves.

- AUDUSD up for a 3rd day in a row, to 0.6528 amid a broadly weaker USD but also a strong Aussie post a hot inflation print.

- USOIL steady at $83 ahead of sanctions against Iran and shrinking US Inventories.

- Gold closed slightly lower at $2332, but off yesterday’s $2289 nadir.

Market Trends:

- The NASDAQ increased 1.59%, with the S&P500 up 1.20%, while the Dow rallied 0.69%. Dissipating geopolitical risks also supported.

- EU stock futures are posting gains, after a largely stronger close across Asia. Nikkei and Hang Seng gained more than 2% amid a strengthening tech rally. Australian shares underperformed.

- Tesla Inc. (+13.33% after hours) spiked after its statement for the launch of more affordable vehicles despite a sales miss. The stock halted a 7-day plunge, climbing alongside other members of the group.

- Microsoft Corp., Meta Platforms Inc. and Alphabet Inc. are also due to report earnings this week. Profits for the “Magnificent Seven” group — which also includes Apple Inc., Amazon.com Inc. and Nvidia Corp. — are forecast to rise about 40% in the Q1 a year ago, according to Bloomberg Intelligence data. The group of tech megacaps is crucial to the S&P 500 since the companies carry the heaviest weightings in the benchmark.

- Visa revenue advanced by 17% as Consumer Card spending increased.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.