Most Read: US CPI, Fed Decision to Guide US Dollar, Setups on EUR/USD, USD/JPY, GBP/USD

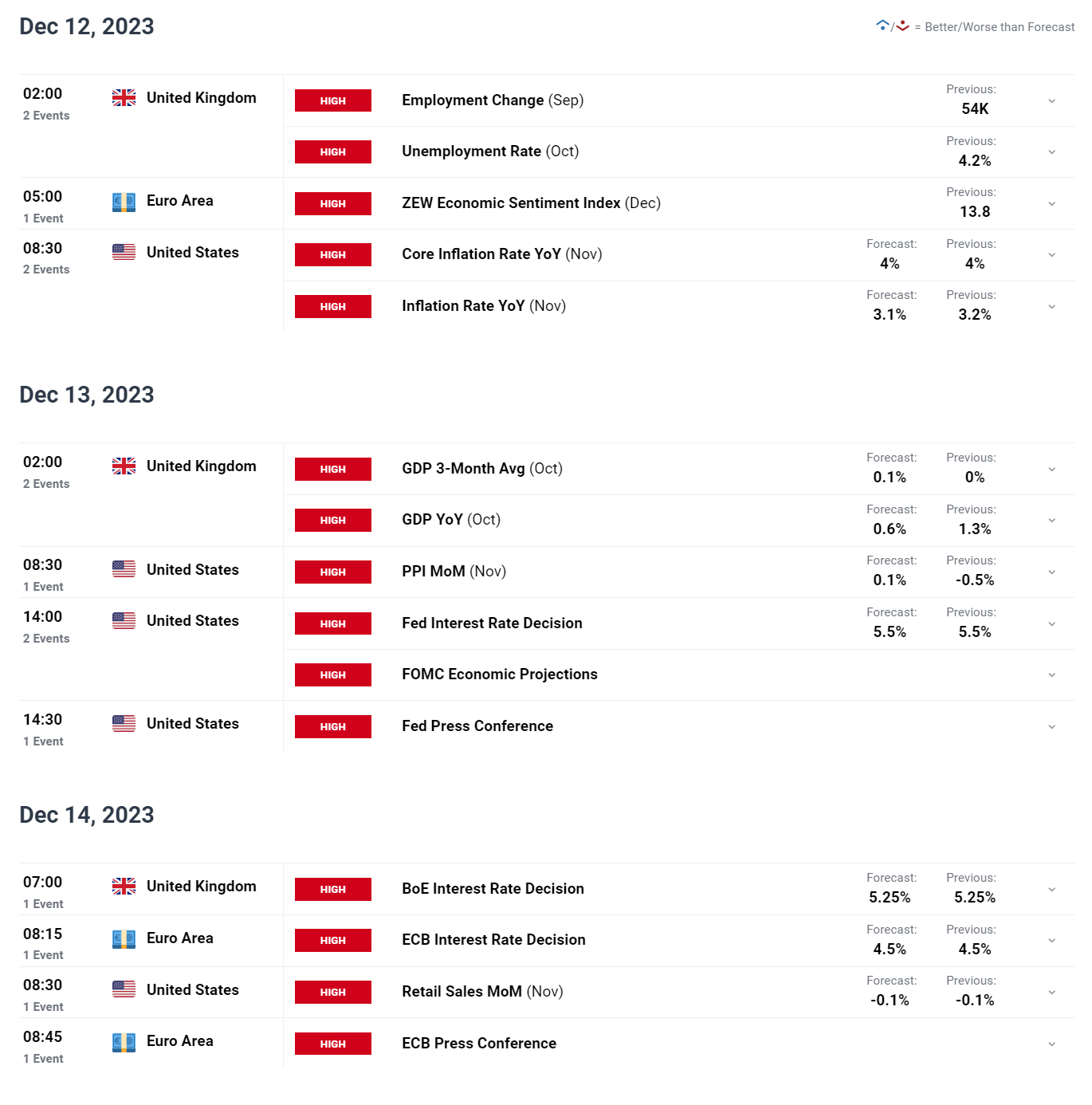

The week ahead is likely to bring elevated market volatility, courtesy of impactful and high-risk events on the economic calendar, including US inflation data, UK GDP figures, and significant monetary policy announcements from the FOMC, the Bank of England and the European Central Bank. Against this backdrop, precious metals, stocks and currency pairs, such as USD/JPY, EUR/USD and GBP/USD could experience large swings, creating interesting trading opportunities.

Traders should keenly monitor the U.S. inflation report to assess the validity of prevailing interest rate expectations for the upcoming year. Although price pressures are projected to continue to cool, progress towards the Fed’s target is likely to be limited, a situation that could reduce the likelihood of the Federal Reserve adopting a more pessimistic stance at its December meeting.

Unsure about gold’s underlying trend? Gain clarity with our latest forecast. Get a free copy of the guide now!

Recommended by Diego Colman

How to Trade Gold

In terms of the central bank announcements, the Fed, ECB and BoE are seen holding their policy settings steady. For this reason, it is vital to pay close attention to their forward guidance and projections.

With growth flagging in both the Eurozone and the UK, there is little appetite for Lagarde or Bailey to be aggressive in their outlook. Powell, however, may have room to be somewhat more hawkish, given the remarkable resilience of the American economy. This may leave the U.S. dollar well positioned to extend its recovery against its major peers, such as the euro, British pound and the Japanese yen, to name a few.

In the event of a US dollar rally resulting from a resurgence in Treasury yields, gold (XAU/USD) and silver (XAG/USD) are likely to suffer. Risk assets could also come under pressure, sending the Nasdaq 100 sharply lower. For a thorough analysis of the forces that may shape financial markets and drive volatility in the coming days, consult DailyFX’s meticulously prepared week-ahead forecasts.

For a complete analysis of the euro’s medium-term outlook, request a copy of our latest forecast!

Recommended by Diego Colman

Get Your Free EUR Forecast

KEY ECONOMIC EVENTS THIS WEEK

Source: DailyFX Economic Calendar

Wondering about the U.S. dollar’s technical and fundamental prospects? Find all the answers you are looking for in our quarterly forecast. Download a free copy of the guide now!

Recommended by Diego Colman

Get Your Free USD Forecast

FUNDAMENTAL AND TECHNICAL FORECASTS

British Pound Outlook: GBP/USD Rattled by NFPs, BoE, ECB, Fed Decisions Ahead

Cable dropped around half-a-point after a slightly stronger-than-expected NFP report hit the screens, but next week is all about three central bank policy decisions.

USD/JPY Weekly Forecast: Markets Peel Back Hopes for BoJ Policy Change

JPY upside may be slowing as NFPs showed a robust US labor market. This week sees the FOMC in action and US inflation to drive volatility.

The ECB projections will hold the key in the week ahead as market participants still price in 125bps of rate cuts in 2024. Can the Central Bank arrest the Euro’s slide?

Gold, Silver & Oil Forecast: Commodities Prepare for a Busy Week

The updated Fed forecast next week can guide the dollar, and by extension, gold prices in the last weeks of 2023 as can the US CPI report. Oil hints at a bullish pullback.

US CPI, Fed Decision to Guide US Dollar, Setups on EUR/USD, USD/JPY, GBP/USD

This article examines the technical outlook for major US dollar FX pairs such as EUR/USD, USD/JPY and GBP/USD, dissecting the critical price thresholds that could come into play this week ahead of US inflation data and the Fed’s decision.

Article Body Written by Diego Colman, Contributing Strategist for DailyFX.com

— Individual Articles Composed by DailyFX Team Members