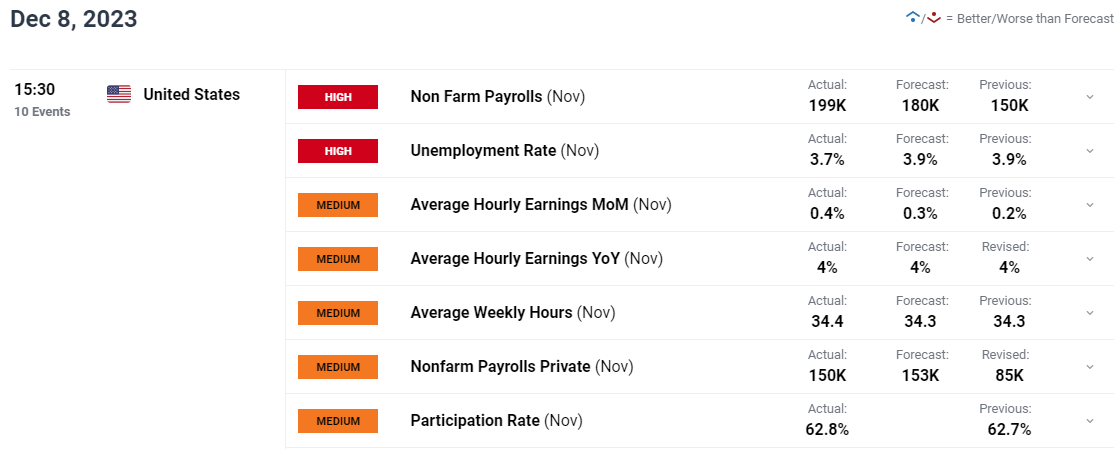

US NFP AND JOBS REPORT KEY POINTS:

- The US Added 199,000 Jobs in June, Slightly Above the Forecasted Figure of 180,000.

- The Unemployment Rate Falls to 3.7%, Remaining within a Range Below the 4% Mark.

- Average Hourly Earnings Came in at 0.4% MoM with the YoY Print Holding Firm at 4.%.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Recommended by Zain Vawda

Introduction to Forex News Trading

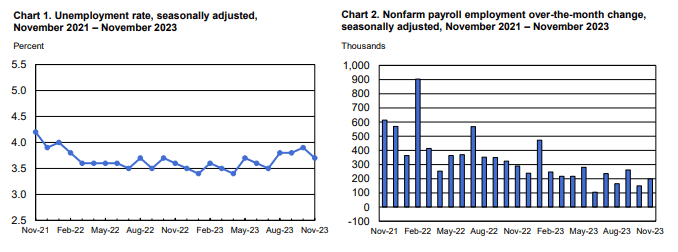

The US added 199,000 jobs in November, and the unemployment rate edged down to 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Employment growth is below the average monthly gain of 240,000 over the prior 12 months but is in line with job growth in recent months. The report is a really mixed ne for the Federal Reserve ahead of next week’s meeting with an increase in hourly earnings and drop in unemployment not ideal for the Central Bank.

Customize and filter live economic data via our DailyFX economic calendar

Job gains occurred in health care and government. Employment also increased in manufacturing, reflecting the return of workers from a strike. Employment in retail trade declined. Employment in manufacturing rose by 28,000, slightly less than expected, as automobile workers returned to work following the resolution of the UAW strike.

In November, average hourly earnings for all employees on private nonfarm payrolls rose by 12 cents, or 0.4 percent, to $34.10. Over the past 12 months, average hourly earnings have increased by 4.0 percent. In November, average hourly earnings of private-sector production and nonsupervisory employees rose by 12 cents, or 0.4 percent, to $29.30.

Source: FinancialJuice

FOMC MEETING AND BEYOND

There have been a lot of positive of late for the US Federal Reserve with the 10Y yield falling back toward the 4%. The economy has shown signs of a slowdown, but the labor market and service sector remain a concern for the Central Bank as market participants crank up the rate cut bets.

Recommended by Zain Vawda

The Fundamentals of Trend Trading

Today’s data although slightly better than estimates is not a game changer by any means. The beat on all three major releases today will definitely give the Fed food for thought as average earnings may keep demand elevated moving forward. It will no doubt be interesting to gauge where the rate cut bets will be once the dust settles from today’s jobs report and ahead of the FOMC Meeting. The question that I am left with is whether Fed Chair Powell may need to tailor his address at the upcoming meeting depending on market expectations.

MARKET REACTION

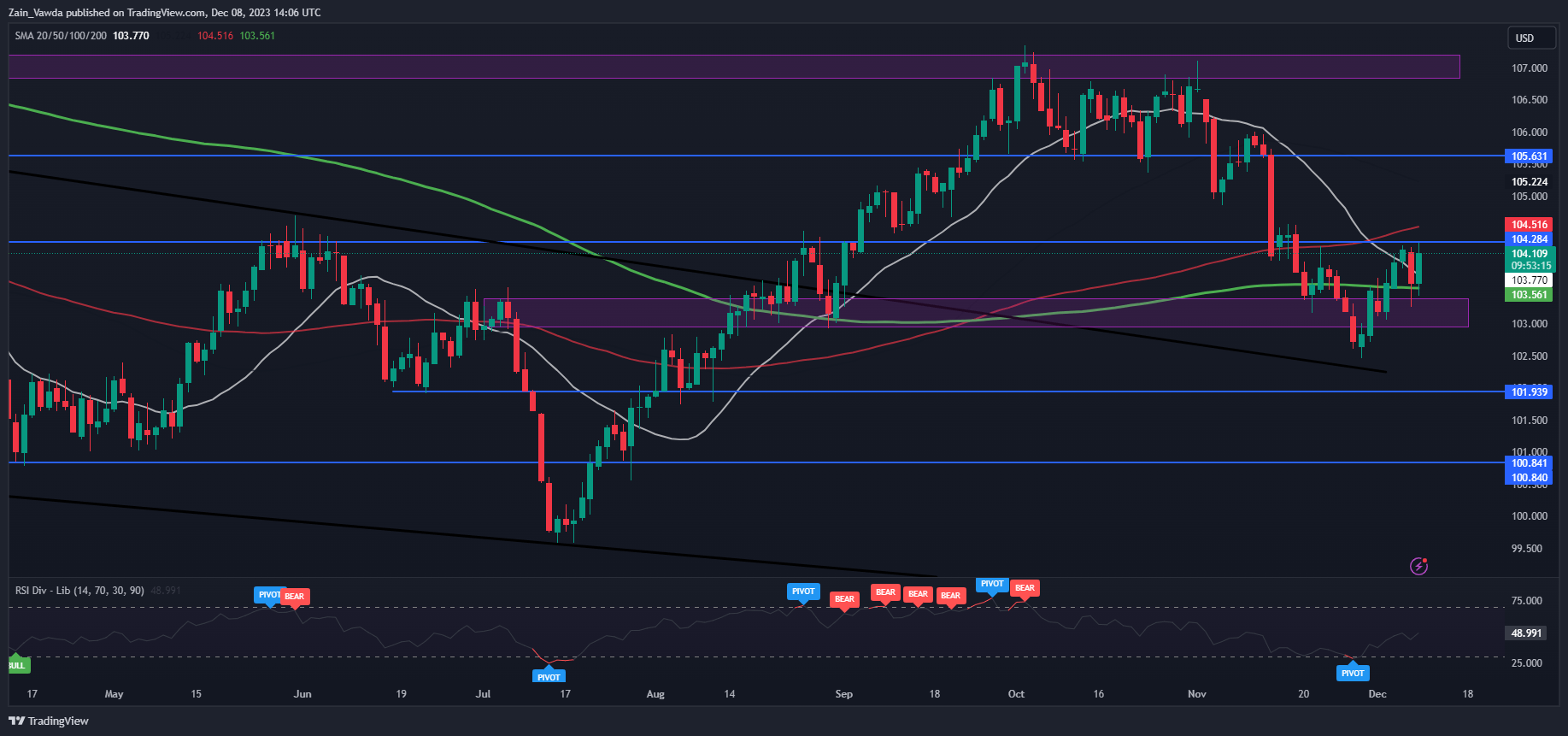

Dollar Index (DXY) Daily Chart

Source: TradingView, prepared by Zain Vawda

Initial reaction on the DXY saw the dollar bounce aggressively before a pullback erased nearly all gains. Since then, we are seeing the DXY inch up ever so slightly as traders have eased their rate cut expectations slightly based on Fed swap pricing.

Key Levels Worth Watching:

Support Areas

- 103.56

- 103.00

- 102.50

Resistance Areas

- 104.28

- 104.51

- 105.00

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda