US Dollar, DXY Index, USD, Debt Ceiling, Volatility, VIX, MOVE, OVX, GVZ – Talking points

- The US Dollar has shored up some support as debt ceiling talks continue

- Treasury yields have been climbing and may underpin USD amid uncertainty

- While volatilities are in check, for now, event risk might be building that could hit DXY

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The US Dollar found firmer footing going into Wednesday despite US debt talks appearing to have stalled on Tuesday.

The T-Bill market is displaying some nervousness around the so-called X-date identified by Treasury Janet Yellen to be June 1st. She has said that on that day Treasury may not be able to meet all its financial commitments.

The spread between the Bills maturing on May 30th and June 6th would normally trade within a few basis points of each other. There are currently around 400 basis points spread difference between these US Government short-term debt notes.

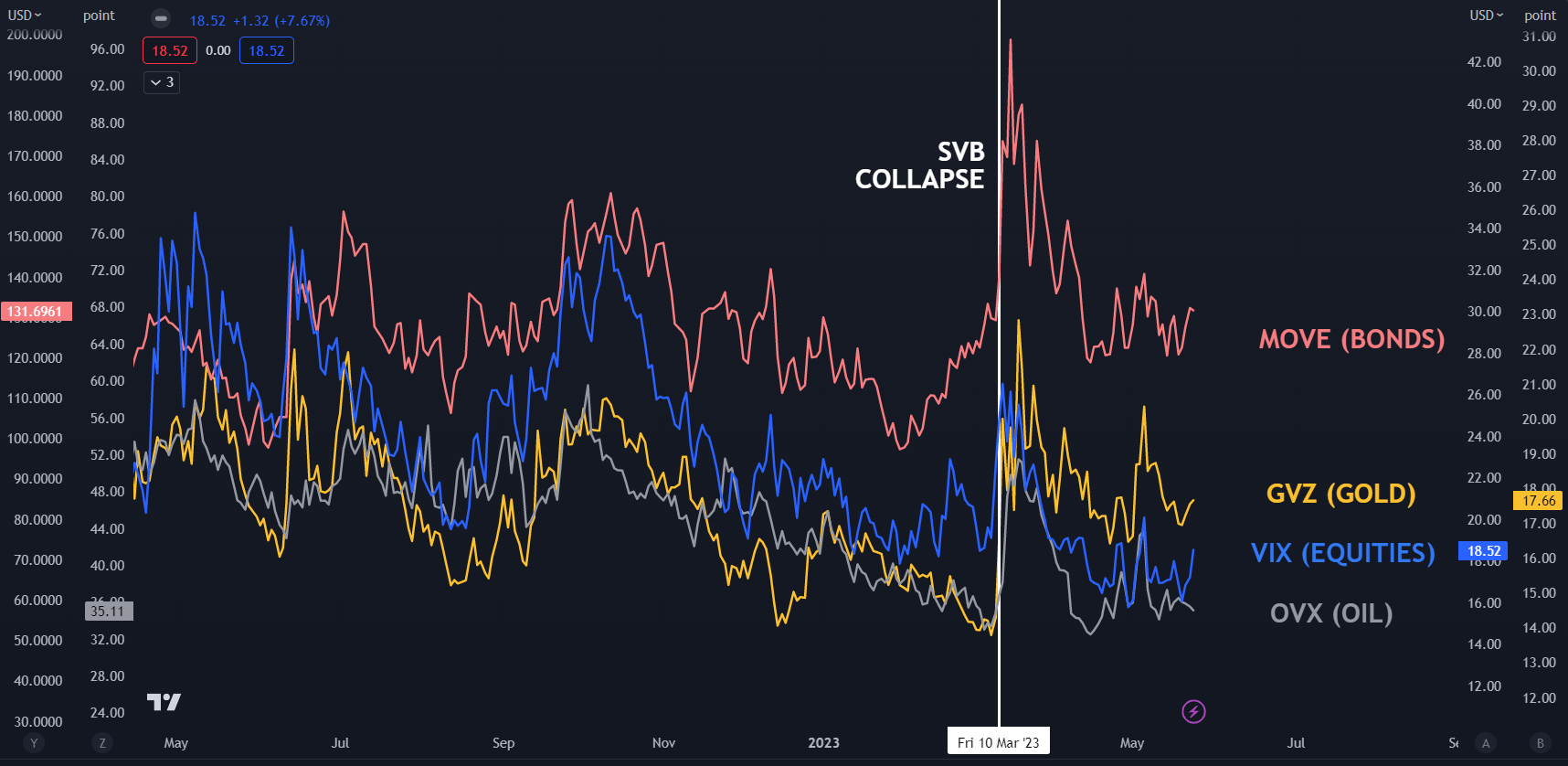

Conversely, broader markets don’t appear to be too concerned with volatility gauges across US equities, bonds, gold and oil remaining somewhat subdued as illustrated below. Not surprisingly, bond volatility might be slightly elevated compared to other markets but overall, currently benign compared to recent events.

CROSS MARKET VOLATILITY INDICES – VIX, MOVE, OVX, GVZ

The collapse of Silicon Valley Bank Financial (SVB) evidently caused more anxiety in financial markets as reflected by the spike in volatility at the time.

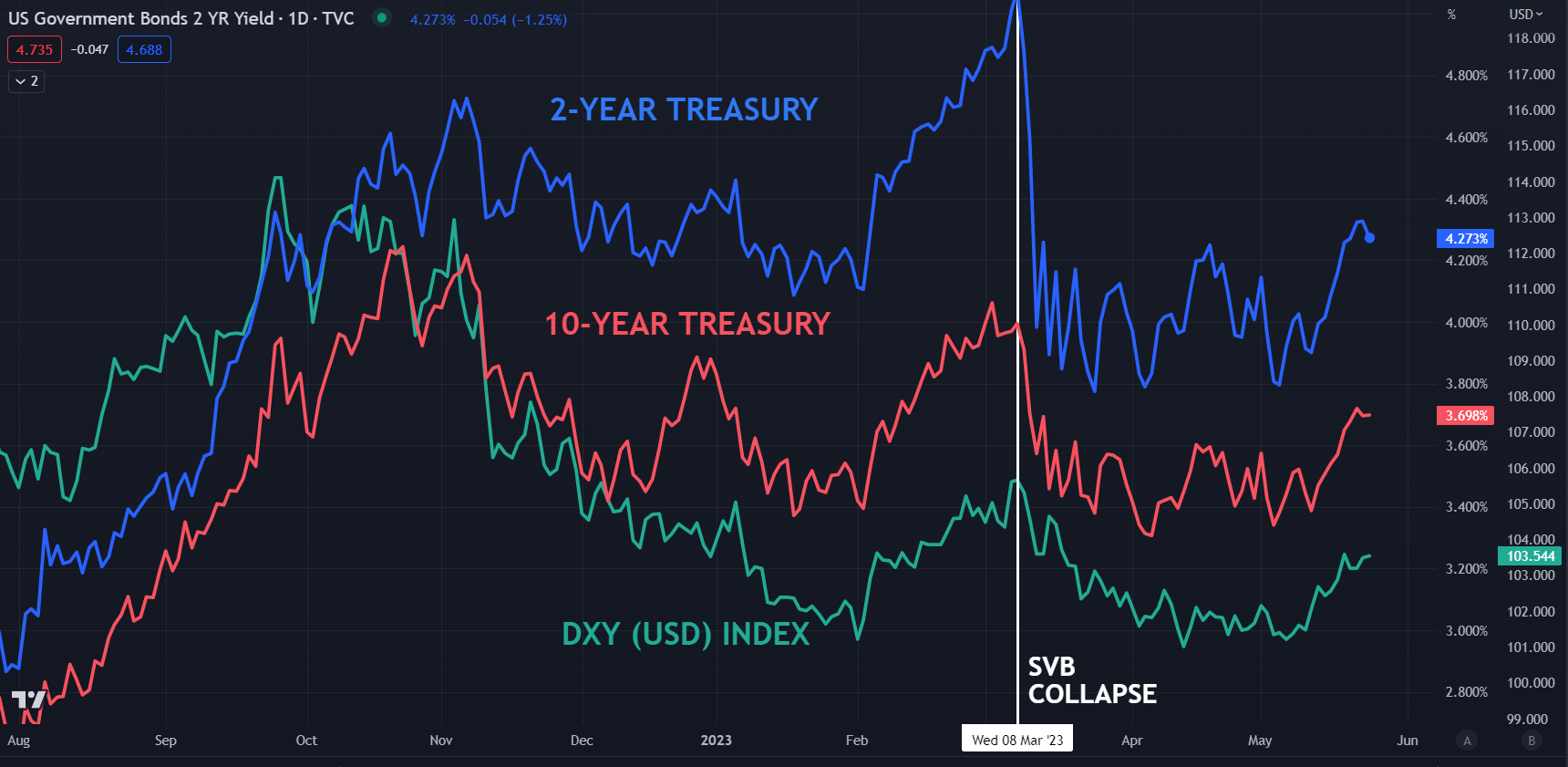

Treasury yields have been steady so far this week although they eased just slightly early Wednesday. Overall, they have recovered from the lows seen earlier this month across the curve and all tenors are now at their highest levels since the collapse of SVB.

The benchmark 2-year bond reached over 4.40% yesterday before easing after having traded at 3.66% earlier this month. Similarly, the 10-year note eclipsed 3.76% after touching 3.30% a few weeks ago.

The correlation between the DXY (USD) index and Treasury yield seems apparent in the chart below.

Looking at the chart above and below, the price movements around the SVB collapse and the growing concern surrounding the US debt ceiling appear to present patterns.

In times of crisis and uncertainty, correlations in financial markets tend to go toward 1 and -1 as the need to cover risk seems to outweigh the need to add risk.

For the US Dollar, a default on US debt could be a cataclysmic event that might see inter-market correlations break down.

Historically, USD has mostly been seen as a haven in times of chaos. If the US is the centre of financial market mayhem, these relationships may come under questioning.

Recommended by Daniel McCarthy

How to Trade FX with Your Stock Trading Strategy

US DOLLAR (DXY), US 2- AND 10-YEAR YIELDS

Recommended by Daniel McCarthy

The Fundamentals of Range Trading

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter