US stocks have come under pressure at the end of Q3 2023 as the Fed made their stance clear on interest rates remaining higher for longer. Such an environment is likely to weigh on risk assets like equities but from a technical point of view there are still a few hurdles that need to be overcome if stocks are to selloff from here. Major levels of support are well defined and should they hold, markets may exhibit choppy price action into new year with a slight downward drift.

This report deals with the technical aspects of major US indices. For the comprehensive US indices forecast, including fundamental considerations, download our complete guide for Q4:

Recommended by Richard Snow

Get Your Free Equities Forecast

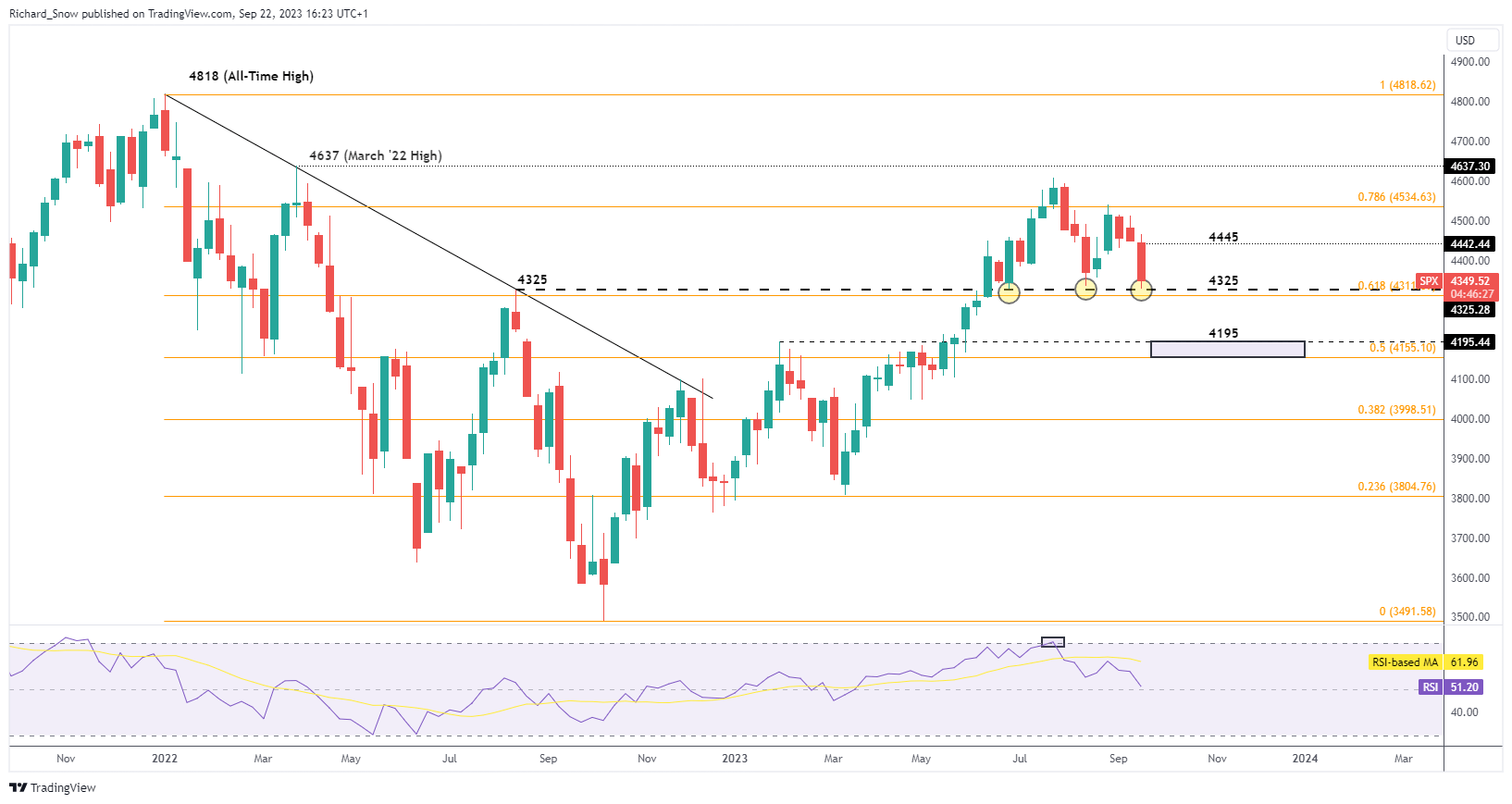

S&P 500: Significant Support Comes Under Heavy Pressure

The S&P 500 index posted one of the largest pullbacks of this longer-term uptrend, bringing into question if prices are simply cooling off from a strong period of gains or is this a sign of an eventual reversal?

The best way to approach that is by assessing the confluence zone of support around the August 2022 high of 4,325 and the 61.8% Fibonacci retracement of the 2022 major decline at 4,311. This zone, and more specifically the 4,325 level, has proved too much of a challenge for price action during previous run ins. The RSI has recovered form overbought levels but could fall short once more. In that event, prices may look to consolidate around 4,325 and 4,600.

However, a break and close below the zone may suggest that further selling is possible, in which case the zone between 4,195 and the 50% Fib level (4,155) comes into focus.

S&P 500 Weekly Chart

Source: TradingView, Prepared by Richard Snow

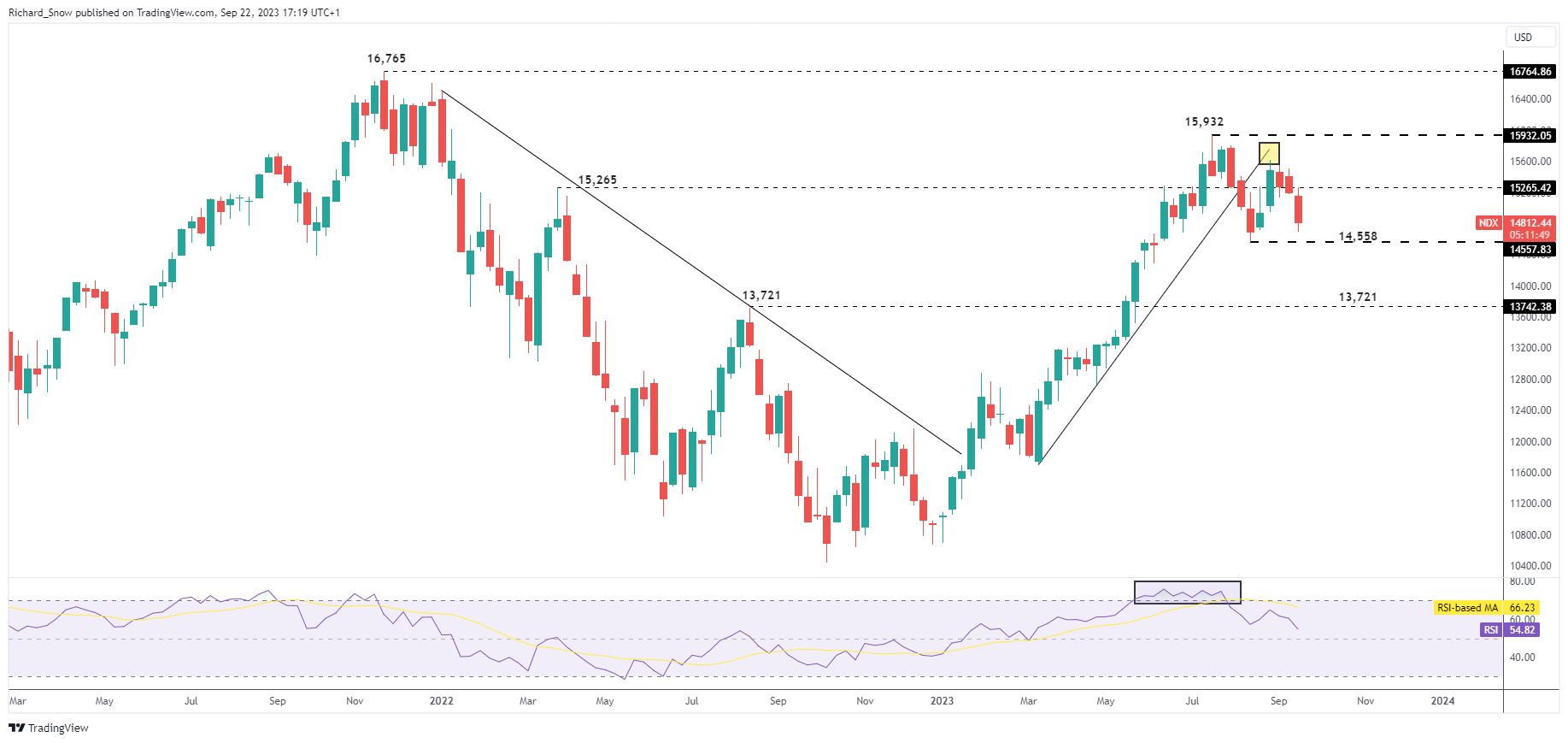

Nasdaq 100: Tech Stocks Hold Their Ground Above Prior Swing Low

The rise in tech stocks since March gained traction at a ferocious pace, resulting in a very steep trendline which broke down in Q3. This is where the Nasdaq finds itself after failing to retest the trendline, this time as resistance, threatening to head lower still.

Price action heading into the end of the third quarter accumulated multiple weekly declines on the way to support at 14,558 which is yet to really be tested at the time of writing. With the hiking potentially having come to an end, markets now gear up for months of elevated borrowing costs which weigh not only on consumers but also on valuations. A such, extended selling and a weekly close below 14,558 opens up 13,721.

Bulls may not wish to give up that easily, potentially defending support at 14,558 – resulting in choppier price action. A sideways channel between 15,932 and 14,558 may ensue, potentially favouring the lower band of the sideways channel until bears make another attempt at that bearish breakout.

Nasdaq Weekly Chart

Source: TradingView, Prepared by Richard Snow

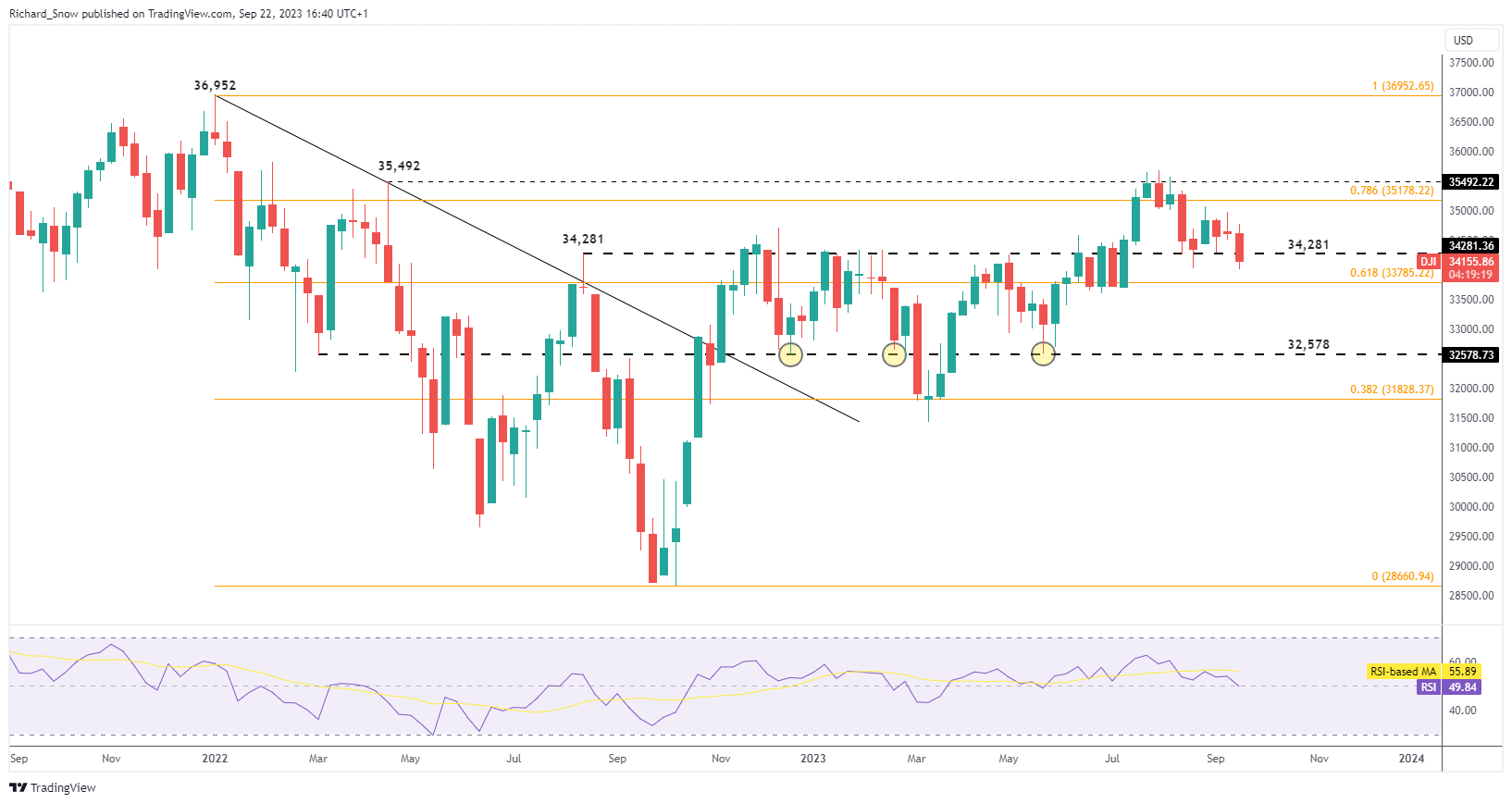

Dow Jones: Downside Vulnerability Appears More Pronounced

The Dow Jones index appears the most susceptible to an extended selloff by virtue of its technical posture. Firstly, it was the slowest of the three indices to register price appreciation, evidenced by a way more gradual slope. Secondly, recent price action reveals a better-defined downward direction than its peers, currently testing the August swing low.

As such, a close below the prior swing low and the 61.8% Fib level (33,785) brings 32,578 into the fray – a level that provided support on numerous occasions this year.

Dow Jones Weekly Chart

Source: TradingView, Prepared by Richard Snow

Q4 serves up new opportunities. Find out which major markets DailyFX analysts have identified as ones to watch as we round off the year:

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast