CANADIAN DOLLAR FORECAST:

- USD/CAD slides in response to robust employment survey results from Canada

- Canadian employers added 39,900 jobs last month versus 15,000 expected, signaling economic resilience

- In the upcoming week, the spotlight will be on the August U.S. inflation report

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: Gold Price Outlook Hinges on Key US Inflation Data, XAU/USD on Breakdown Watch

The loonie saw a modest uptick against the U.S. dollar on Friday, boosted by strong employment growth in Canada. In late morning in New York, USD/CAD was down about 0.40% to trade near 1.3626, after briefly flirting with the 1.3700 level in the preceding session.

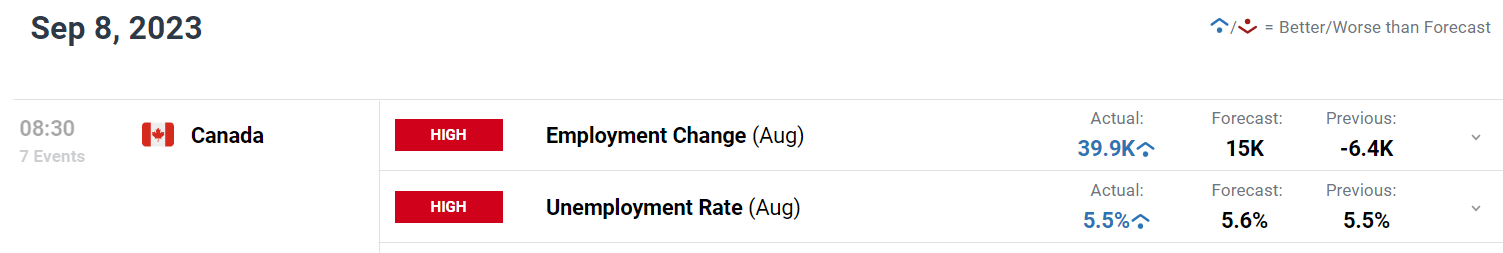

Delving into the specific, the latest jobs survey revealed a remarkable addition of 39,900 payrolls in August, far exceeding the anticipated 15,000, indicating a substantial level of resilience within the country’s economy.

Despite the favorable outcome in today’s data, Canadian short-term yields did not reprice materially higher. This suggests that the report is unlikely to exert a substantial influence on the Bank of Canada’s future decisions.

CANADA’S ECONOMIC DATA AT A GLANCE

Source: DailyFX Economic Calendar

Explore the top trading opportunities identified by the DailyFX Team. Download your guide today!

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

Earlier in the week, BoC kept interest rates steady at 5.0%, but left the door ajar to the possibility of more policy firming in the face of little downward momentum in core inflation. However, traders expressed doubts about this stance, given the central bank’s warning of slower growth on the horizon.

With markets skeptical of Bank of Canada’s ability to deliver additional tightening, the Fed’s normalization cycle will be more relevant for USD/CAD in the near term. While the FOMC has indicated it will “proceed carefully”, the situation could change if U.S. price pressures remain elevated.

We will have more information to assess the broader trend in consumer prices next week when the U.S. Bureau of Labor Statistics releases its latest batch of data, but if inflation results surprise on the upside, interest rate expectations could shift in a hawkish direction, boosting the U.S. dollar across the board.

In terms of estimates, headline CPI is expected to have increased 3.8% y-o-y in August from July’s 3.2%. Meanwhile, the core gauge is seen softening to 4.5% y-o-y from 4.7% previously, a positive but limited improvement for policymakers.

Discover the power of market sentiment. Download the sentiment guide to understand how USD/CAD positioning can influence the pair’s trend!

| Change in | Longs | Shorts | OI |

| Daily | 8% | -11% | -7% |

| Weekly | 20% | 7% | 10% |

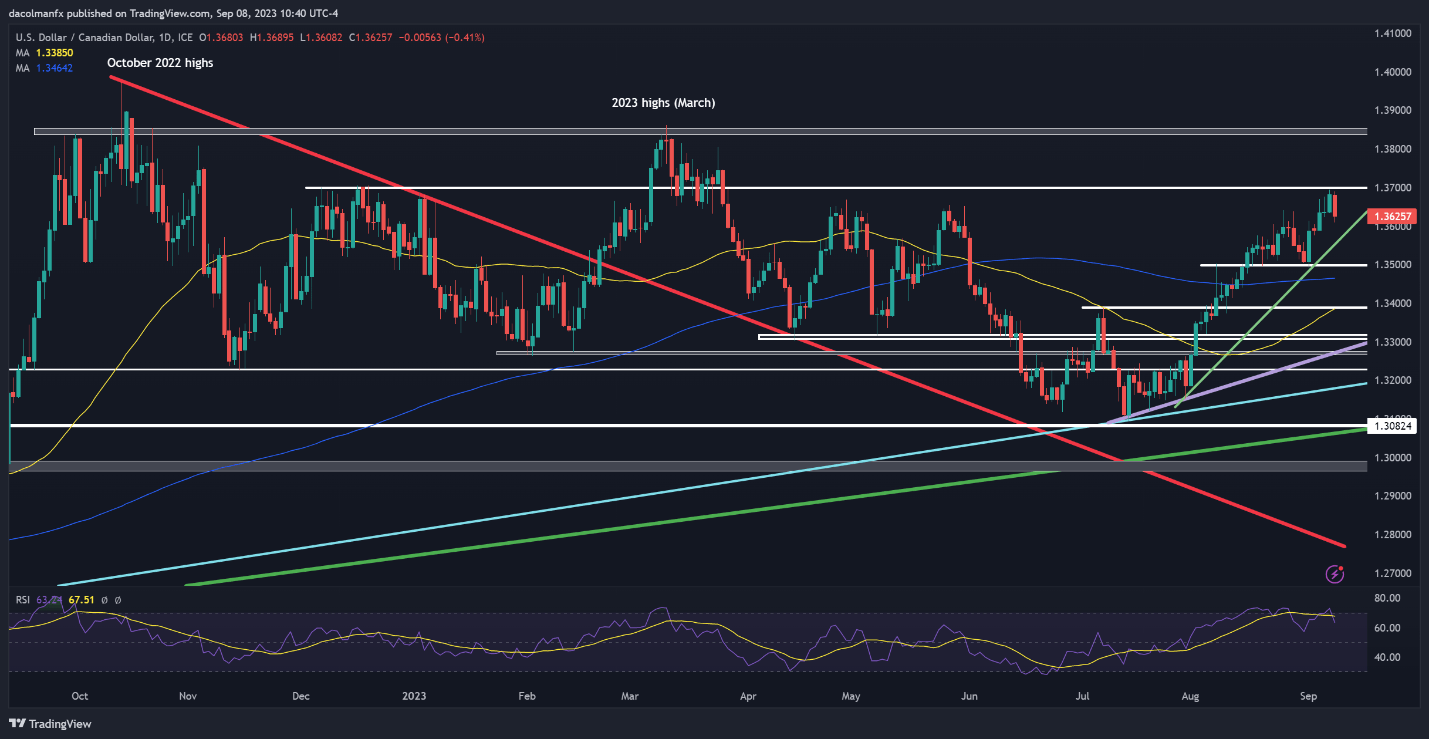

USD/CAD TECHNICAL ANALYSIS

After a strong rally in recent days, the USD/CAD encountered resistance and reversed direction as it approached the 1.3700 technical barrier before the weekend. Despite this setback, the pair remains in a short-term uptrend, indicating the potential for a renewed upward move at any moment.

Looking ahead to a possible rebound, initial resistance looms near the 1.3700 handle but further gains may be in store on a push above this ceiling, with the next upside target located at the 2023 highs in the vicinity of 1.3850.

In the event of bearish price action continuation, support levels are identifiable at 1.3540, followed by 1.3500. Going further down the line, the next significant floor is situated around the 200-day simple moving average.