USD/JPY TECHNICAL ANALYSIS

The U.S. dollar rallied at the start of the week, bolstered by surging U.S. Treasury yields following the release of the U.S. ISM manufacturing report, which showed a jump in the employment and prices paid components of the survey. In this context, USD/JPY advanced more than 0.8% to ~137.40 in afternoon trading, reaching its best level since early March.

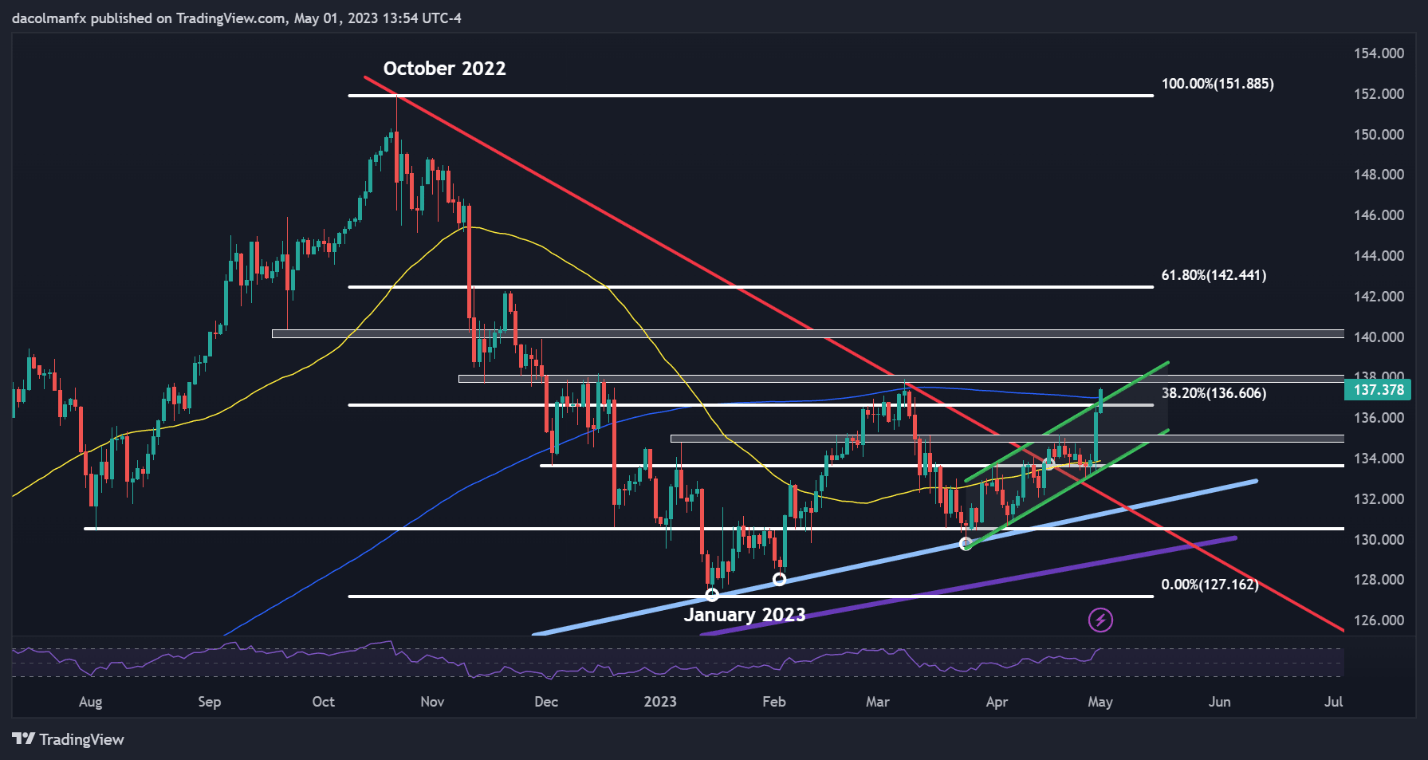

USD/JPY’s technical outlook has turned more constructive after the exchange rate breached confluence resistance located at 136.60 on Monday, an area where the upper bound of a short-term rising channel aligns with the 200-day simple moving average and the 38.2% Fibonacci retracement of the October 2022/January 2023 selloff.

If pair holds above 136.60, bulls could become emboldened to launch an attack on the 2023 highs just a touch below the psychological 138.00 level. Successfully piloting above this hurdle could put into play the 140.00 region. In the event of a setback, initial support rests at 136.60, but if prices dip below this floor, a retest of 135.00 cannot be ruled out.

Recommended by Diego Colman

Get Your Free JPY Forecast

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Using TradingView

S&P 500 FUTURES TECHNICAL ANALYSIS

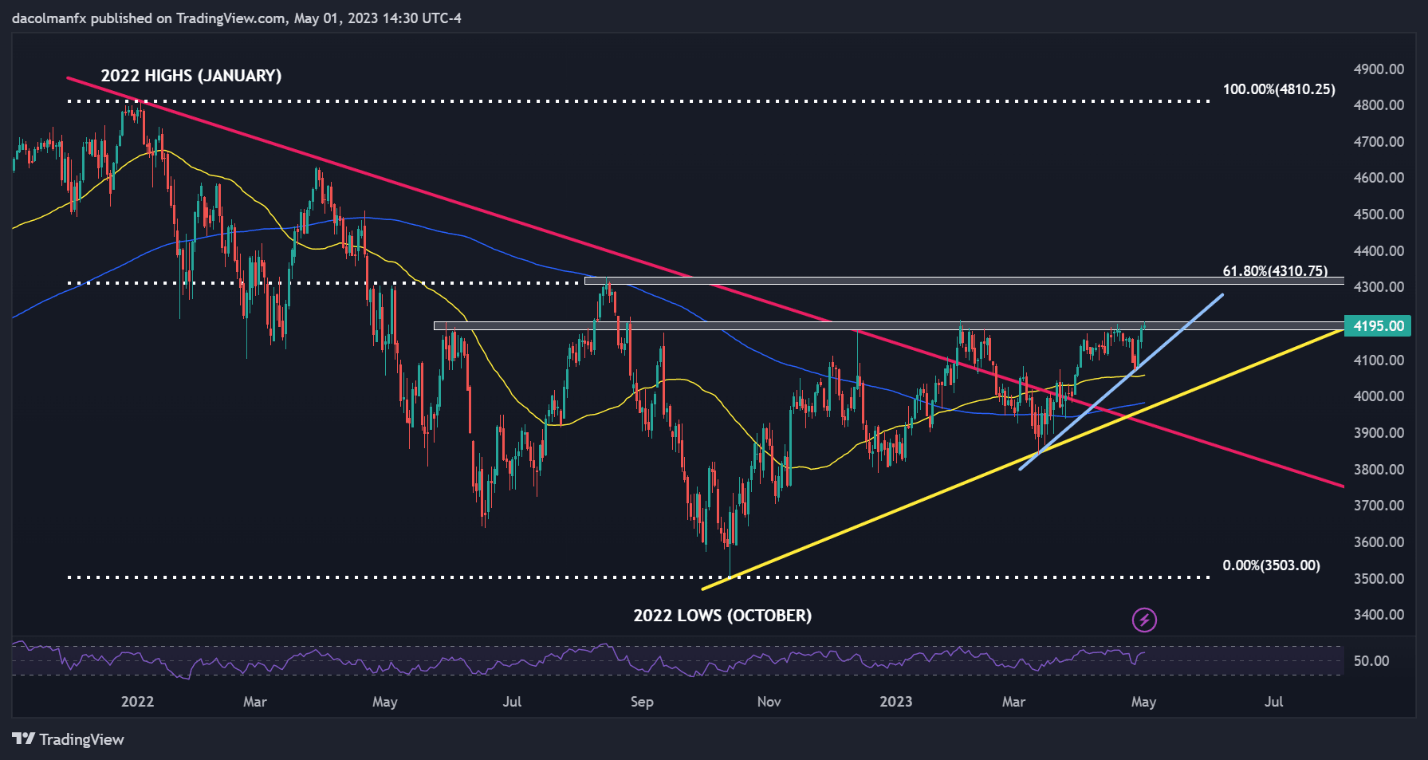

The S&P 500 fell early last week, but encountered support at a rising trendline extended off the March lows. From those levels, the index has made a solid comeback, with prices now testing major resistance near 4,200, where the bears have repeatedly overpowered the bulls since June of last year, repelling the index lower on nearly every test.

If history is a guide, technical resistance at 4,200 may curb the pace of recent gains and extinguish positive impetus again, paving the way for a moderate pullback in the coming days. If the bearish scenario plays out, we could see a retrenchment toward dynamic support at 4,125 soon ahead of a possible retest of the 50-day simple moving average at 4,060.

On the other hand, if the bulls manage to get the S&P 500 decisively above the 4,200 barrier, upward momentum could gather pace, attracting new buyers into the market and creating the right conditions for a rally toward 4,310. This resistance corresponds to the 61.8% Fibonacci retracement of the 2022 selloff and last year’s August high.

Recommended by Diego Colman

Get Your Free Equities Forecast