USD/JPY ANALYSIS & TALKING POINTS

- Japan looks to US for guidance.

- US inflation may result in Japanese involvement.

- Bearish divergence suggestive of downside to come.

Recommended by Warren Venketas

Get Your Free JPY Forecast

JAPANESE YEN FUNDAMENTAL BACKDROP

The Japanese Yen has yet to make any real upside impact on the US dollar this week as USD/JPY remains elevated. Despite warnings from the Japanese Finance Minister Shunichi Suzuki that intervention is a possibility should the JPY deteriorate even further (around the 150 mark), markets are seemingly unphased until action is taken. It is important to note that Japanese exported will be comfortable with the weaker currency to stoke demand for local goods and services.

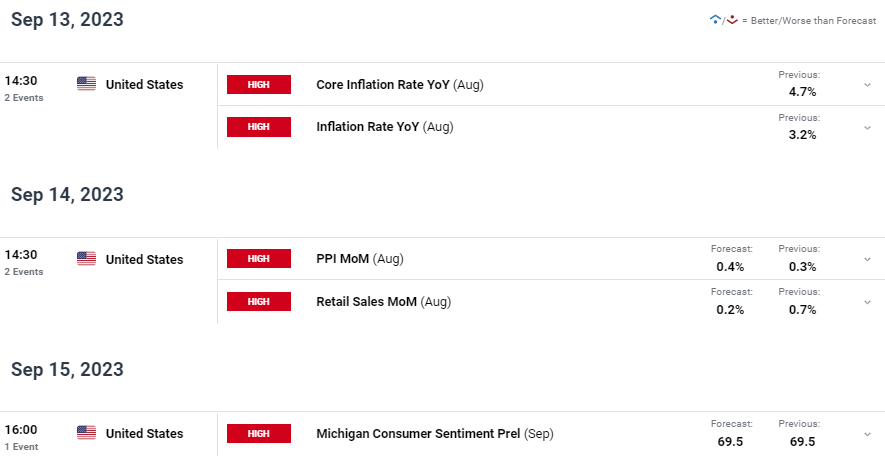

The week ahead looks to be US dominated (see economic calendar below) with particular focus on US CPI. Both core and headline inflation has been trending downwards but at a slower place than the Fed would like, and still far from the 2% target level. An upside surprise would really weigh negatively on the Japanese Yen and increase the pressure on the Bank of Japan (BOJ) to get involved.

JPY ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

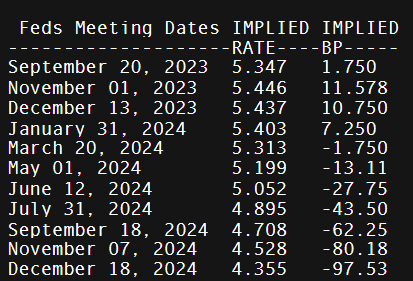

Money market pricing (refer to table below) for the Federal Reserve looks to be skewed towards a rate pause in September thereafter, the potential for another hike depending on upcoming data which makes next week’s US CPI extremely pertinent.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

IMPLIED FED FUNDS FUTURES

Source: Refinitiv

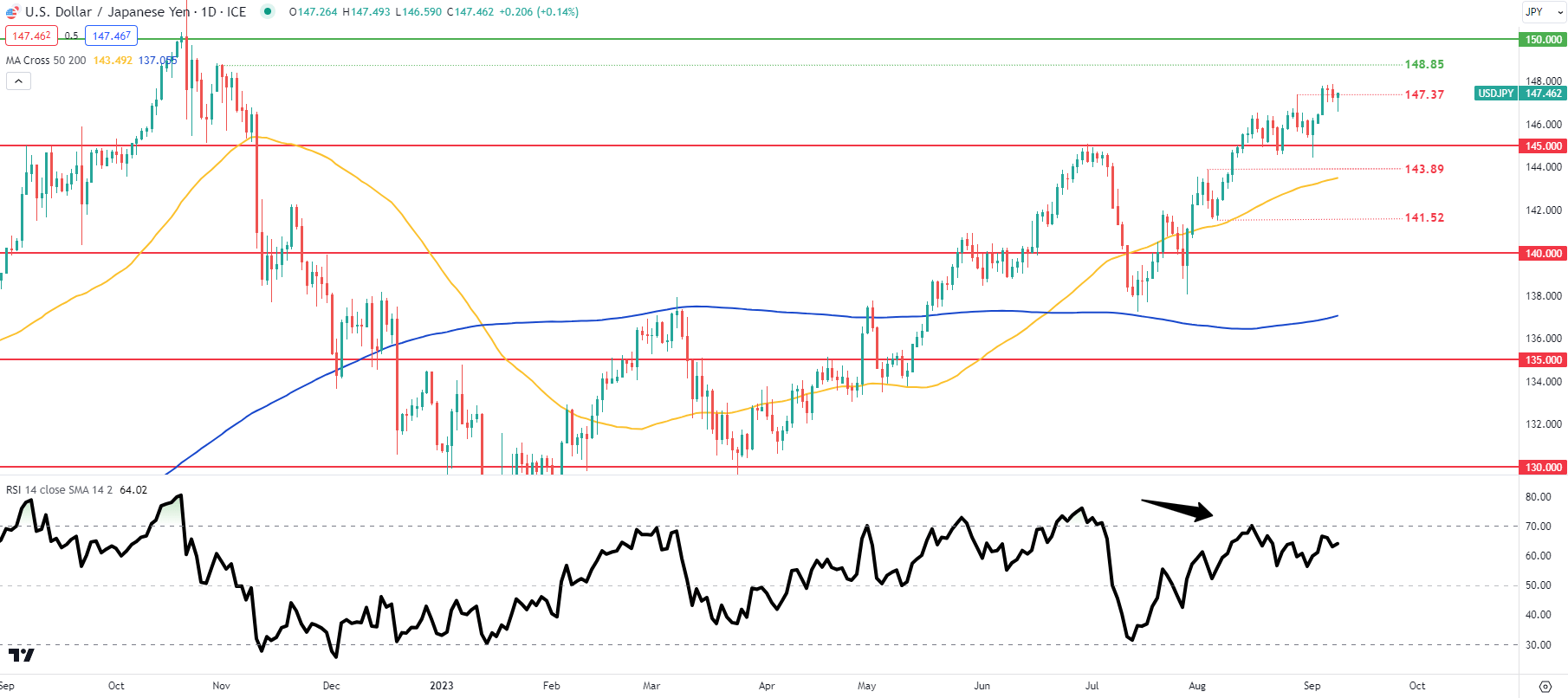

USD/JPY TECHNICAL ANALYSIS

USD/JPY DAILY CHART

Chart prepared by Warren Venketas, IG

Daily USD/JPY price action alongside its developing bearish/negative divergence signal (black arrow), points to slowing bullish momentum and the possibility for a turnaround in favor of JPY strength. Fundamental factors are likely to be the catalysts driving this move lower and the warnings from Japanese officials should not be taken lightly.

Key resistance levels:

- 150.00

- 148.85

Key support levels:

- 147.37

- 145.00

IG CLIENT SENTIMENT: BEARISH

IGCS shows retail traders are currently net SHORT on USD/JPY, with 75% of traders currently holding short positions (as of this writing).

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas