USD/ZAR PRICE FORECAST:

Recommended by Zain Vawda

Get Your Free USD Forecast

MOST READ: USD/ZAR Rises as SA Reserve Bank (SARB) Pauses After 10 Consecutive Hikes

The South African Reserve Banks (SARB) recent pause in the hiking cycle was no doubt met with cheers by many consumers locally, yet the Central Bank and some economists feared further depreciation for the ZAR may be in the offing. Following an initial selloff however, the ZAR has held firm with USDZAR struggling to reclaim the 18.0000 mark.

US FOMC AND MONETARY POLICY MOVING FORWARD

Looking ahead into next week and USDZAR price action is likely to be driven by USD factors over the short-term. In general data releases from South Africa with the exception of interest rate decisions don’t tend to move the needle on USDZAR all that much.

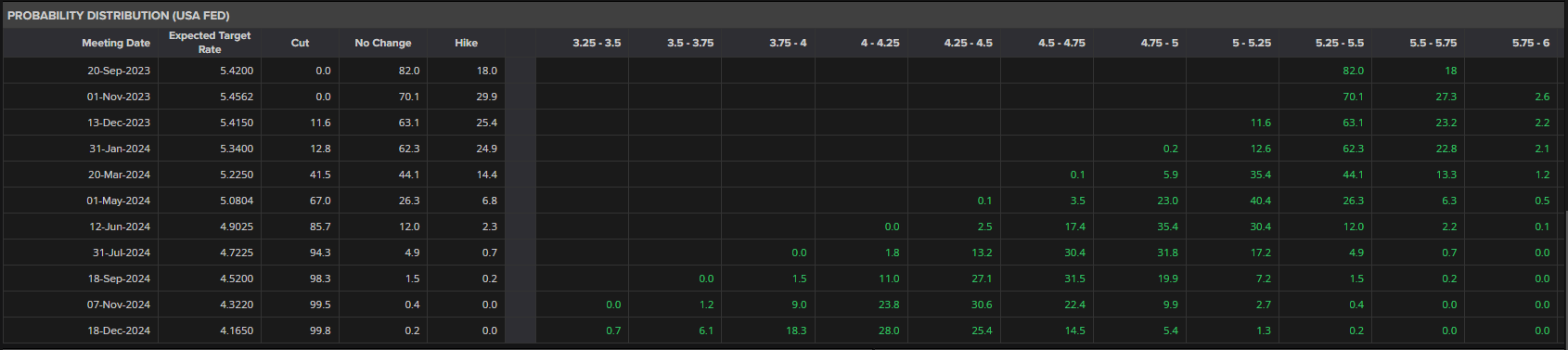

The FOMC meeting this week had many analysts divided as market participants seem to be of the opinion that the Federal Reserve are done hiking rates for 2023, despite Fed Chair Powell leaving the door open for further tightening.

Fed Funds Probability

Source: Refinitiv

Earlier today US Core PCE data came in below estimates and falling 0.5% from the May print of 4.6%. This will obviously be another win for the Federal Reserve as well as market participants hoping the peak rate is in. This obviously follows on from positive Q2 GDP data as well and with the robustness of the labor market talk of a soft landing is likely to accelerate.

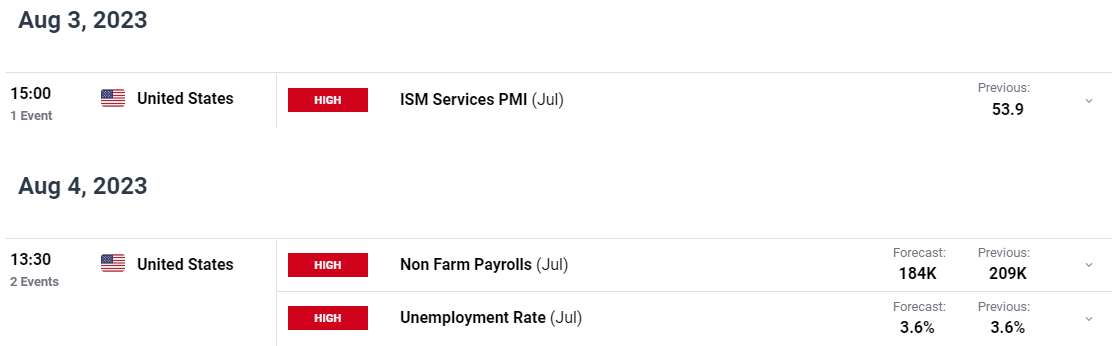

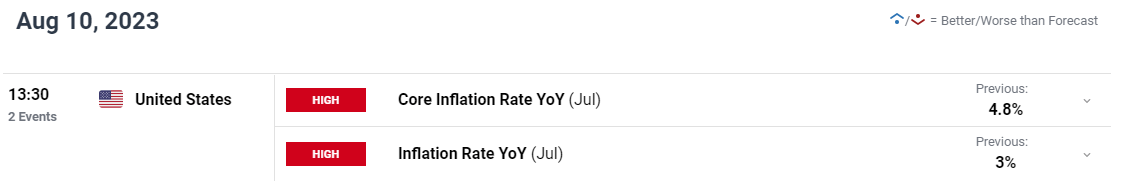

Over the next two weeks US data could hold the key with ISM service PMI followed the NFP jobs report and then of course the latest US inflation numbers on August 10. These events will likely be a key driving force for the US Dollar over the next 2 weeks and could have a huge say in the direction of USDZAR.

For all market-moving economic releases and events, see the DailyFX Calendar

SOUTH AFRICA AND THE RAND MOVING FORWARD

Looking ahead for South Africa and the recent bout of cold temperatures has resulted in an uptick in loadshedding. This obviously could weigh on the ZAR and the SA Reserve Bank outlook moving forward with loadshedding cited as a key area of concern with regard to economic growth prospects for the rest of the year. Eskom having spent a crazy amount over the past three months on diesel supplies in order to lower the stages of loadshedding, however this is not sustainable over the long term as it threatens to further destabilize the power utilities financial position. This could mean as winter draws to a close, higher stages of loadshedding may return on a more permanent basis.

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

FINAL THOUGHTS AND TECHNICAL OUTLOOK

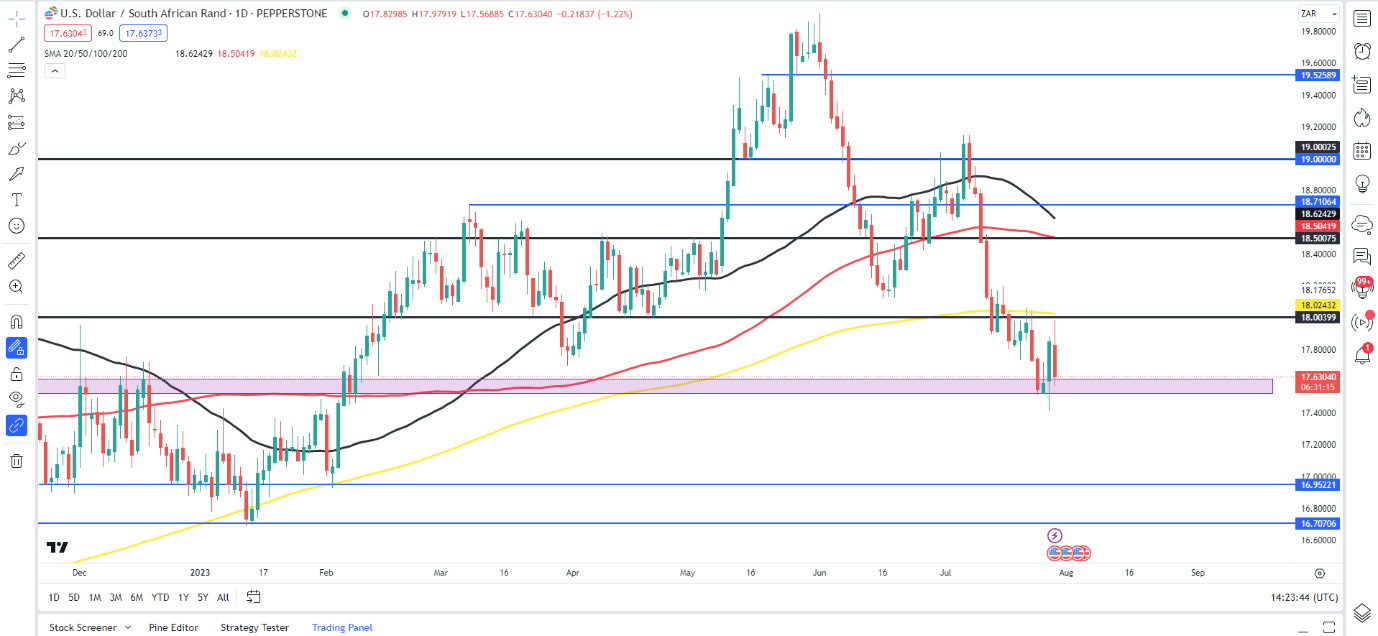

USDZAR from a technical standpoint has always fascinated me as we tend to trend for a sustained period of time. Looking back historically and trends seem to run for 3-4 months at a time before we see a significant change in the overall trend of the pair. This is something which has continued this year with the upside rally beginning on February 2 from the lows around the 16.9200 mark all the way to the 19.9200 mark on June 1.

Since then, we have seen USDZAR staircase its way lower toward the 17.5000 handle which is holding firm at the minute. The range between the 17.5000-18.0000 mark has been holding for the past 2 weeks despite a host of economic event risk for both the ZAR and the USD.

Looking ahead and today’s rejection of the 18.0000 mark once more needs acceptance with a daily candle close below the 17.5000 area (highlighted in pink on the chart) for further downside to gain traction. Such a move would bring the February swing low at 16.9200 into focus before a test of the YTD low around the 16.7000 handle comes into focus. Alternatively, given the speed of the recent selloff we could be in for a short-term retracement particularly if US data remains robust with first area of resistance the 18.0000 mark which lines up with the 200-day MA. A break higher here could bring a retest of 18.5000 into focus which is a key confluence area as we have the 100-day MA resting there as well.

USD/ZAR Daily Chart, July 28, 2023

Source: TradingView, Prepared by Zain Vawda

Introduction to Technical Analysis

Moving Averages

Recommended by Zain Vawda

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda